Truong Bui is the director of data strategy and analytics at Reason Foundation and a managing director of its Pension Integrity Project.

Bui primarily works on the pension team's data and quantitative work and has contributed to numerous policy studies and data visualizations.

Prior to joining Reason, Bui was a financial analyst for Thien Viet Securities, a local investment bank in Vietnam, where he specialized in business valuation and investment memo preparation.

Bui graduated from RMIT University Vietnam with a bachelor's degree in commerce and received a Masters of Business Administration, with an emphasis in finance, from the Drucker School of Management at Claremont Graduate University.

Bui is based in Los Angeles.

-

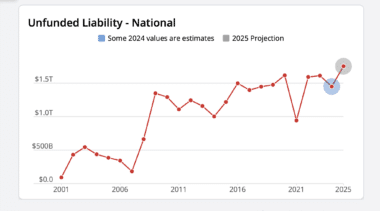

Report: State and local pension plans have $1.48 trillion in debt

State pension systems have $1.29 trillion in unfunded liabilities, and local governments have $187 billion.

-

Best practices in cash balance plan design

A transition to a cash balance structure offers an opportunity to reset actuarial assumptions, enforce strict funding discipline, and improve stakeholder transparency.

-

With additional plans reporting, total unfunded public pension liabilities in the U.S. grow to $1.61 trillion

Information added to the Annual Pension Solvency and Performance Report finds the median funded ratio across public pension plans decreased marginally to 75.8%.

-

Mississippi adopts hybrid retirement design in major pension reform

A sustainable new “hybrid” retirement design has been adopted, but major funding and design issues remain for 2026.

-

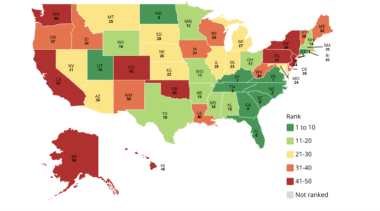

28th Annual Highway Report: Executive summary of findings and state rankings

The Annual Highway Report examines every state's road pavement and bridge conditions, traffic fatalities, congestion delays, spending per mile, administrative costs, and more.

-

Annual pension solvency and performance report

At the end of the 2023 fiscal year, the nation's public pension systems had $1.59 trillion in total unfunded liabilities.

-

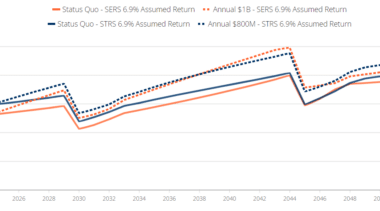

How Connecticut pensions can save $7 billion in interest costs over the next 30 years

The Connecticut Pensions Dashboard explores various economic scenarios that could impact the state's public pension debt.

-

The case for Connecticut’s fiscal guardrails

The “fiscal guardrails” have saved Connecticut more than $170 million and could save $7 billion over the next 25 years.

-

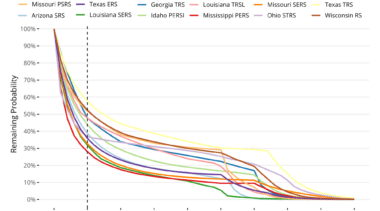

Most public employees leave jobs before they vest in pension systems

An examination of 12 public pension plans finds 62% of public workers leave before vesting in their pensions.

-

For most workers, the value of Alaska’s defined contribution plan surpasses that of a traditional pension

The following tool created by the Pension Integrity Project displays the year-by-year accrual of retirement benefits for a wide variety of Alaska workers in different fields and starting at different ages.

-

Dallas should not bet on pension obligation bonds to save pension system

The Dallas Police and Fire Pension System has $3 billion in unfunded liabilities. But pension obligation bonds do not refinance pension debt, they leverage it.

-

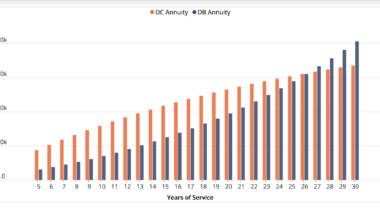

Comparing Alaska’s defined benefit and defined contribution retirement plans

Most of Alaska’s public employees would be better served in the existing defined contribution plan.

-

Arizona passes prefunding program for state retirement system

The Arizona State Retirement System is now one of the few statewide pension systems that has a dedicated contribution prefunding program.

-

Best practices for pension debt amortization

Amortization policy is at the core of the successful elimination of pension debt.

-

The impact of cash flow on public pensions

This policy brief uses the Montana Public Employee Retirement System (PERS) as a case study to illustrate the principles and importance of conducting a cash flow analysis of public pension plans.

-

Examining the populations best served by defined benefit and defined contribution plans

The claim that a defined benefit plan is more efficient than a defined contribution plan, purely on a basis of cost, overlooks a larger and more meaningful perspective regarding benefit distribution.