Truong Bui is the director of data strategy and analytics at Reason Foundation and a managing director of its Pension Integrity Project.

Bui primarily works on the pension team's data and quantitative work and has contributed to numerous policy studies and data visualizations.

Prior to joining Reason, Bui was a financial analyst for Thien Viet Securities, a local investment bank in Vietnam, where he specialized in business valuation and investment memo preparation.

Bui graduated from RMIT University Vietnam with a bachelor's degree in commerce and received a Masters of Business Administration, with an emphasis in finance, from the Drucker School of Management at Claremont Graduate University.

Bui is based in Los Angeles.

-

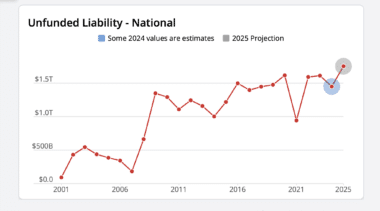

Report: State and local pension plans have $1.48 trillion in debt

State pension systems have $1.29 trillion in unfunded liabilities, and local governments have $187 billion.

-

Best practices in cash balance plan design

A transition to a cash balance structure offers an opportunity to reset actuarial assumptions, enforce strict funding discipline, and improve stakeholder transparency.

-

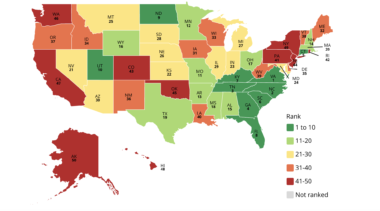

28th Annual Highway Report: Executive summary of findings and state rankings

The Annual Highway Report examines every state's road pavement and bridge conditions, traffic fatalities, congestion delays, spending per mile, administrative costs, and more.

-

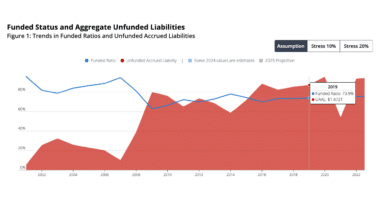

Annual pension solvency and performance report

At the end of the 2023 fiscal year, the nation's public pension systems had $1.59 trillion in total unfunded liabilities.

-

The case for Connecticut’s fiscal guardrails

The “fiscal guardrails” have saved Connecticut more than $170 million and could save $7 billion over the next 25 years.

-

Best practices for pension debt amortization

Amortization policy is at the core of the successful elimination of pension debt.

-

The impact of cash flow on public pensions

This policy brief uses the Montana Public Employee Retirement System (PERS) as a case study to illustrate the principles and importance of conducting a cash flow analysis of public pension plans.

-

Analysis of South Carolina Senate Bill 176

Senate Bill 176 would provide new hires a secure and attractive retirement plan that better protects the state's taxpayers.

-

New Mexico Educational Retirement Board Pension Solvency Analysis

New Mexico's Educational Retirement Board has $7.9 billion in unfunded pension liabilities.

-

The “New Normal” In Public Pension Investment Returns

The primary culprit of growing pension debt has been the across-the-board investment underperformance of pension assets relative to plans’ own return targets.

-

North Carolina Teachers’ and State Employees’ Retirement System: A Pension Solvency Analysis

Better risk management and more realistic plan assumptions can help ensure the state delivers the promised retirement benefits to its employees.

-

Assessing the Financial Sustainability of Montana’s Largest Public Pension Systems

Despite investment markets showing historic gains, Montana’s public pension systems are experiencing an increase in unfunded liabilities and are likely to continue on their path to insolvency if needed technical adjustments aren't made.

-

A 2018 Evaluation of LAUSD’s Fiscal Outlook: Revisiting the Findings of the 2015 Independent Financial Review Panel

Los Angeles Unified School District is unique in California and the nation because the size of its projected budget deficits and overall debt dwarfs most other urban school districts.

-

Did Pension Reform Improve the Sustainability of Pension Plans?

Evidence from a Counterfactual Analysis of Michigan and Alaska

-

Best Practices for Setting Public Sector Pension Fund Discount Rates

The main objective should be for pension plans to shift toward having discount rates reflect the risks of liabilities—not the potential performance of assets.