-

Vision Zero and Complete Streets: Do they make roads safer?

In the wake of rising traffic fatalities, municipalities have been looking for a comprehensive solution to reduce or eliminate traffic fatalities.

-

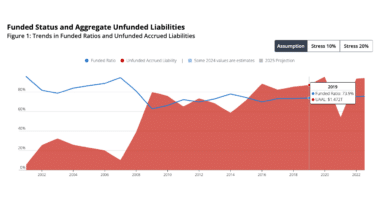

Annual pension solvency and performance report

At the end of the 2023 fiscal year, the nation's public pension systems had $1.59 trillion in total unfunded liabilities.

-

Working paper: Best practices in optional defined contribution plans

With the proliferation of unfunded pension liabilities among U.S. governments, optional defined contribution plans can serve as valuable risk mitigation solutions.

-

The case for Connecticut’s fiscal guardrails

The “fiscal guardrails” have saved Connecticut more than $170 million and could save $7 billion over the next 25 years.

-

A framework for federal and state hemp-derived cannabinoid regulation

The growing popularity of hemp-derived products has stimulated significant legislative attention in recent years, with over 90 regulatory proposals introduced in state legislatures in 2024 alone.

-

Georgia’s teacher pension system needs reforms to address current debt, future risks

The pension plan is still $27.7 billion short on the assets needed to pay for retirement promises made to teachers.

-

Transparent K-12 open enrollment data matters to parents, policymakers and taxpayers

A total of 16 states have strong statewide cross-district open enrollment laws, while 13 states have strong statewide within-district open enrollment laws.

-

The cost of state hold harmless policies in K-12 education

With widespread public school enrollment losses in the wake of the COVID-19 pandemic, the financial costs of some hold harmless policies have increased exponentially.

-

Reforming environmental litigation

There is growing bipartisan support that the NEPA process, as it has evolved since the legislation’s enactment in 1970, has gone too far, placing obstacles and delays in the way of needed energy and transportation infrastructure projects.

-

State taxpayers’ share of MPSERS debt would increase under various proposals

The first 20.96% of each year’s unfunded accrued liability contribution is currently paid by local school districts, and any amount required above that is paid by the state.

-

Michigan requires greater transparency to support public trust in law enforcement

Michigan House Bill 5749 would clarify that law enforcement disciplinary records are not exempted from public records requests.

-

Is private equity a public financial hazard?

Private equity funds lack clear return and risk metrics, making it hard to assess performance before investments are redeemed, often a decade or more after the initial investment.

-

Delaying Mississippi PERS reform will increase cost to taxpayers

PERS faces a $25.5 billion shortfall largely due to unfunded benefit increases, investment underperformance, and insufficient employer contributions.

-

Getting cannabis legalization right in Hawaii

Hawaii may be poised to become the 25th state to legalize the recreational use of cannabis for adults aged 21 and over.

-

How to modernize and properly fund the inland waterway system

There's an $800 million backlog of current inland waterway system projects and another $6 billion worth of projects planned, but not yet started.

-

Ibogaine treatment for opioid use disorder

Policymakers should consider ibogaine as a potential alternative treatment for opioid use disorder.

-

Regulated psilocybin access in Arizona would help treat mental health conditions

Arizona Senate Bill 1570 would create a regulated and limited program to access psilocybin.

-

The effects of cash bail on crime and court appearances

Research suggests that curtailing the use of monetary release conditions among low-risk defendants would not result in dramatic drops in court attendance or increased risk of reoffending.