Mariana F. Trujillo is a policy analyst with Reason Foundation's Pension Integrity Project.

Trujillo studies economics at George Mason University, where she served as president of the Economics Society. Prior to joining Reason, she worked in Treasury Market Risk at JP Morgan, the Mercatus Center, and the Cato Institute.

She is a Brazilian-American deeply passionate about liberty, its assumptions, and fascinating tensions.

-

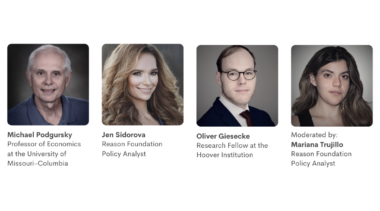

Webinar: How pensions impact the recruitment and retention of public employees

In this webinar, pension experts discuss the modern challenges of recruiting and retaining talent in the public sector, focusing on the role public pensions.

-

How the US Treasury shaped a new era of Swiss monetary policy

The United States Department of the Treasury classified Switzerland as a currency manipulator during the COVID-19 pandemic.

-

Mississippi’s low pension contributions cause S&P Global to downgrade its credit outlook

With unfunded pension liabilities doubling and pension contributions failing to keep up with public employee benefit increases, S&P lowers Mississippi's state credit rating outlook.

-

Public pension reforms aren’t impacting public employee turnover rates

Turnover rates seem to have little to do with retirement plan structure and more to do with employee compensation and the changing reality of American labor markets.

-

West Virginia improved teacher retirement funding through increased spending, not better plan design

West Virginia simply started dedicating enough money to pay for the public pension promises it was making.

-

How high interest rates impact public pension systems

Higher interest rates and pension systems' investment strategies risks burdening workers and taxpayers with even larger unfunded liabilities.

-

Dallas should not bet on pension obligation bonds to save pension system

The Dallas Police and Fire Pension System has $3 billion in unfunded liabilities. But pension obligation bonds do not refinance pension debt, they leverage it.

-

The way Michigan’s pension reform tackles public pension debt is a model for other states

Rather than simply paying off public pension debt, Michigan created a mechanism to push local pension systems toward solvency.

-

Why public pension systems invest in private equity, even when they shouldn’t

Public pension funds are under pressure to reduce the accumulating debt as much as possible and present an actual rate of return that matches estimates.