-

K-12 Education Spending Spotlight: An in-depth look at school finance data and trends

Reason Foundation’s new K-12 Education Spending Spotlight provides critical insight into key school finance trends across the country.

-

Best practices for cost-of-living adjustment designs in public pension systems

Striking the proper balance between cost, risk, and benefits in a way that works for both employees and employers.

-

Frequently asked questions on student-centered funding

Student-centered funding puts student needs as the focus of education funding decisions.

-

Converting high occupancy vehicle lanes to high occupancy toll lanes or express toll lanes

This brief examines why and how high-occupancy vehicle lanes are converted, how much the conversions cost, and how high-occupancy toll and express toll lanes have performed.

-

How Washington state can transition from the gas tax to road usage charges

This brief suggests a policy framework for developing a road usage charge program in Washington and an implementation order that builds on systems already in place on the state’s major highways.

-

Replacing Michigan’s gas tax with mileage-based user fees

A transition from per-gallon fuel taxes to a mileage-based user fee system should be considered as a strategy to ensure adequate road funding for Michigan’s future.

-

The impact of California’s cannabis taxes on participation within the legal market

This analysis develops an empirical model to estimate the degree to which California’s tax regime affects participation within its commercial cannabis market, and how participation may change through different approaches to taxation.

-

Frequently asked questions about the FDA’s ban on menthol cigarettes

Here are some of the common questions about banning menthol cigarettes, the supposed evidence in support of a menthol cigarette ban, and a ban's possible consequences on public health and minority communities.

-

Working Paper: How shifting to a defined contribution retirement plan impacted teacher retention in Alaska

Using individual-level data for all Alaska teachers in the Teacher Retirement System before and after the retirement benefit change, we assess the effects of pension reform on teacher mobility out of employment with the Alaska K-12 system.

-

Rating states on telehealth best practices

This toolkit aims to help policymakers move towards quality-oriented, affordable, and innovative health systems by ensuring that their state telehealth laws remove barriers that prevent access to care.

-

Examining the causes of induced demand and the future of highway expansion

The most effective method for reducing induced demand is to implement pricing on highways.

-

K-12 funding in Tennessee: A student-centered approach

By adopting a student-centered funding model, Tennessee would replace the state's outdated education finance system that lacks transparency and local control.

-

Ranking how each state’s transportation funding system aligns with the users-pay/users-benefit principle

With direct users-pay funding sources, those who use the highways are the people paying for them.

-

Modernizing Florida retirement: Analyzing recent reform concepts

Comprehensive reform to the Florida Retirement System could protect taxpayers and offer employees a secure retirement.

-

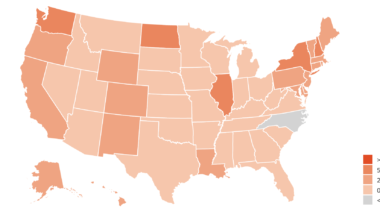

Annual Highway Report: Ranking each state’s highway conditions and cost-effectiveness

The Annual Highway Report examines every state's pavement and bridge conditions, traffic fatalities, congestion delays, spending per mile, administrative costs, and more.

-

Frequently asked questions about the States Reform Act, a proposed marijuana bill

Rep. Nancy Mace (R-SC) unveiled the States Reform Act, a proposal to remove marijuana from the auspices of the federal Controlled Substances Act.

-

What Kratom and delta-8 THC illustrate about substance regulation and criminalization

Substances like delta-8 and kratom are new entrants into what has become an “underground” market for “legal” buzzes and highs.