Steven Gassenberger is a policy analyst with Reason Foundation's Pension Integrity Project.

Prior to joining Reason Foundation, Gassenberger worked as a consumer advocacy manager for Xerox Corporation, specializing in financial consumer regulation and compliance. He also worked as a senior associate for Stateside Associates, where he developed state-level management strategies for a variety of policy areas. Prior to that, Gassenberger held positions at the National Breast Cancer Coalition and the International Fund for Agricultural Development.

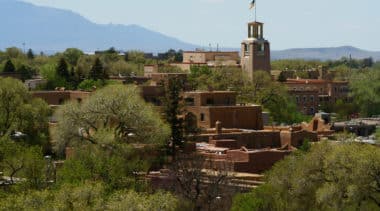

At Reason, Gassenberger has contributed to in-depth analysis of the Arkansas TRS, Florida FRS, Louisiana LASERS, Louisiana TRSL, Mississippi PERS, Montana MPERS, Montana TRS, New Mexico ERB, New Mexico PERA, North Dakota PERS, Texas ERS, and Texas TRS pension systems.

Gassenberger has also presented testimony in Montana, Nebraska, and Texas during state pension reform efforts.

His work has been published in The Wall Street Journal and Business Observer.

Gassenberger recently shared the stage at the Pelican Institute’s Solutions Summit 2.0 with Louisiana State Senator Barrow Peacock, Michigan State Senator Phil Pavlov, and Jonathan Williams, Chief Economist at The American Legislative Exchange Council in discussing “Fostering a Sustainable System for Louisiana.”

Gassenberger graduated from the University of New Orleans with a BA in international relations and received an MA in public policy from Tel Aviv University.

-

Committee Staff Report on Teacher Retirement System of Texas Recommends Increasing Investment Transparency

The Sunset Commission staff recommendations are a positive step towards a more sustainable retirement system for current and future Texas public servants and taxpayers.

-

Arkansas Teacher Retirement System Pension Solvency Analysis

Investment returns failing to meet unrealistic expectations has been the single largest contributor to unfunded liability growth, adding $1.9 billion in debt to ATRS since 2000.

-

New Mexico Enacts Bipartisan Pension Reform to Improve PERA Solvency

Senate Bill 72 was a necessary and crucial first step towards improving the financial health of PERA and ensuring the sustainable delivery of public employee retirement benefits for state and local workers

-

PERA’s Redesigned COLA Provides Retirees Inflation Protection and Improved Sustainability

Senate Bill 72 aligns the New Mexico Public Employees Retirement Association’s benefit adjustments with other fully-funded state pension plans and provides robust protections for retirees against inflation.

-

Proposed New Mexico PERA Board Restructuring Would Improve Expertise, Balance Representation Long-Term

The proposed legislation offers the promise of improving the experience and oversight capabilities of the Public Employees Retirement Association's governing board.

-

Redesigning Cost of Living Adjustments Would Improve PERA Sustainability

The Public Employees Retirement Association Pension Solvency Task Force projects PERA currently has only a 38 percent chance of reaching full funding by 2043.

-

Why PERA Being Only 71 Percent Funded Is Not Enough

The New Mexico Public Employees Retirement Association has at least $6.1 billion in pension debt and potentially more if its current actuarial assumptions are too aggressive, which is likely.

-

Why New Mexico Needs to Reform the Public Employees Retirement Association Now

The proposed reforms would be a meaningful step toward strengthening PERA while putting as little stress on members and taxpayers as possible.

-

PAYGO Is the Most Costly Way to Fund a Public Retirement System and Would Be Bad for New Mexico

Pensions are meant to be prefunded so that current taxpayers and current public employees share the costs of those workers’ benefits.

-

Proposed PERA Reform an Important Step Toward Pension Solvency in New Mexico

New bill would address the Public Employees Retirement Association's systemic issues by improving funding policy and adopting a more sustainable benefit adjustment mechanism.

-

Credit Rating Upgrade Doesn’t Clear Arizona of its Pension Problems

The state has $27 billion in unfunded pension liabilities today in its four major pension plans.

-

More Pension Debt Revealed As Florida Lowers Assumed Rate of Return to More Realistic Levels

Missing the mark on investment return assumptions has added $17 billion to the Florida Retirement System's unfunded liability over the past decade.

-

Slight Improvement, But Same Story: Louisiana Teachers’ Pensions Are Still in Trouble

Long-term investment losses have systematically starved TRSL of the revenue it needs to keep the retirement system on track to full funding.

-

The Teachers Retirement System of Texas Is Increasingly Relying on Risky Investments

TRS, an already-unhealthy pension plan with $46 billion in unfunded liabilities, needs to lower the rate of return it expects to generate from investments.

-

Public Pension Plan Designs Are the Problem, Not Pensions Themselves

If you build a pension system with risk management in mind, you can avoid the common pitfalls that have led to the over $1 trillion in U.S. public pension debt.

-

Continuing Reform: Challenges Persist With the Florida Retirement System (FRS)

The retirement benefits ultimately received by members of both plans within FRS will come at an ever-increasing cost to taxpayers and other public services if needed technical adjustments to both plans go neglected.

-

Assessing the Financial Sustainability of Montana’s Largest Public Pension Systems

Despite investment markets showing historic gains, Montana’s public pension systems are experiencing an increase in unfunded liabilities and are likely to continue on their path to insolvency if needed technical adjustments aren't made.

-

Teachers’ Retirement System of Louisiana (TRSL) Pension Solvency Analysis

Investment returns failing to meet unrealistic expectations has been the largest contributor to the unfunded liability growth, adding $4.2 billion to the unfunded liability since 2000.