Steven Gassenberger is a Policy Analyst with Reason Foundation's Pension Integrity Project.

Prior to joining Reason, Gassenberger worked as a consumer advocacy manager for Xerox Corporation specializing in financial consumer regulation and compliance. He also worked as a senior associate for Stateside Associates, where he developed state-level management strategies for a variety of policy areas. Prior to that, held positions at the National Breast Cancer Coalition and the International Fund for Agricultural Development.

At Reason, Gassenberger has contributed to in-depth analysis of the Arkansas TRS, Florida FRS, Louisiana LASERS, Louisiana TRSL, Mississippi PERS, Montana MPERS, Montana TRS, New Mexico ERB, New Mexico PERA, North Dakota PERS, Texas ERS, and Texas TRS pension systems.

Gassenberger has also presented testimony in Montana, Nebraska, and Texas during state pension reform efforts.

His work has been published in The Wall Street Journal and Business Observer.

Gassenberger recently shared the stage at the Pelican Institute’s Solutions Summit 2.0 with Louisiana State Senator Barrow Peacock, Michigan State Senator Phil Pavlov, and Jonathan Williams, Chief Economist at The American Legislative Exchange Council in discussing “Fostering a Sustainable System for Louisiana.”

Gassenberger graduated from the University of New Orleans with a BA in international relations and received a MA in public policy from Tel Aviv University.

-

Pension Plan Investments in Alternative Assets Pose Serious Risk to Taxpayers and Members

Alternative investments are the most challenging investments to value because they require assumptions about complex future cash flows and valuation multiples from future sales.

-

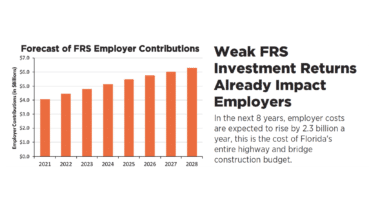

Florida Retirement Cost Increases Highlight the Need for Pension Reform

Florida legislators will have to address an additional $2.3 billion in FRS costs in the next eight years.

-

Testimony: Legislation in Montana Would Use Marijuana Tax Revenue to Pay for Pensions

Dedicating marijuana tax revenues to pay down long-term pension debts can help improve a state’s financial position.

-

Testimony: Texas Employee Pension System Considers Funding Change

Over $4.46 billion of ERS's pension debt can be attributed to the way the state systematically underfunds its public employee pension system.

-

Testimony: Texas Pensions Would Benefit from Increased Transparency

A Private Equity Portfolio Performance report would make public specific information regarding the private equity holdings of TRS for third-party monitoring and evaluation.

-

Montana Public Employee Retirement System (MPERS) Pension Solvency Analysis

The Montana Public Employee Retirement System public pension plan is only 74 percent funded.

-

Testimony: Nebraska Taxpayers, Employees and Retirees Would Benefit From Pension Stress Testing

Stress testing can help stakeholders better understand the potential financial risks facing pension systems.

-

Legislation in Nebraska Would Use Stress Testing to Assess Municipal Pension Sustainability

Stress testing would be a significant first step in identifying and addressing the challenges facing locally-run pension plans in Nebraska.

-

North Dakota Public Employees Retirement System Pension Solvency Analysis

The public pension plan has only 68 percent of the assets needed to fully fund the system in the long-term.

-

Contribution Increases Could Help New Mexico’s Teacher Pension Plan, But More Changes Are Necessary

Recently proposed changes would improve the pension plan's funded status, but still fall far short of helping the plan reach full funding.

-

Some State Pension Plans Try to Downplay Poor Investment Returns

The only standard that matters to plan members and taxpayers is whether the public pension system is meeting its expected investment returns.

-

New Mexico Educational Retirement Board Pension Solvency Analysis

New Mexico's Educational Retirement Board has $7.9 billion in unfunded pension liabilities.

-

Louisiana State Employees’ Retirement System (LASERS) Pension Solvency Analysis

The Louisiana State Employees' Retirement System has only 64 percent of the assets needed to fully fund the pension system.

-

Teachers’ Retirement System of Louisiana Pension Solvency Analysis

The latest, official numbers reveal that the Teachers’ Retirement System of Louisiana now has over $10 billion in unfunded pension liabilities.

-

Teacher Retirement System of Texas Solvency Analysis

Investment returns failing to meet unrealistic expectations have been the largest contributor to the public pension plan's unfunded liabilities, adding over $30 billion in debt since 2001.