The Nebraska legislature is currently considering a bill aimed at helping to identify systemic challenges that are driving the growth of unfunded liabilities affecting municipal pension systems across the state.

The proposed legislative bill (LB) —LB 586 by State Sen. Robert Clements—would use private-sector financial stress testing methods to help policymakers, retirees and stakeholders understand the financial risk and long-term sustainability of retirement plans serving municipal workers.

For years, Reason Foundation’s Pension Integrity Project has suggested that public pension systems use stress testing to assess their ability to maintain plan solvency during normal market fluctuations as well as unforeseen “Black Swan” economic events, like last decade’s Great Recession and the more recent COVID-19 pandemic and recession.

Understanding a pension plan’s stress points provides an opportunity for the pension system’s managers to implement preventive measures that either limit the impact of the discovered risks or avoid the risks entirely.

One of the most widely recognized risk factors pension plans must navigate is volatility in short- and long-term investment returns. Traditionally, reports from public pension plan consultants give long-term forecasts assuming a year-to-year outcome that exactly matches their assumed long-term investment return assumptions. But—as the last two decades would attest—expecting increasingly volatile market returns to match assumptions each year is not an accurate portrayal of the volatility of global investment markets.

Instead of only showing a scenario of what the plan’s funding would look like if it met its assumed rate of return each year, stress testing explores a range of realistic market scenarios to more comprehensively demonstrate what could happen to the pension plan’s funding over the next few decades. This allows policymakers to see not only where the system’s financial health is today, or where it is expected to be in 30 years, but how the system would be impacted in times of unforeseen economic volatility.

Nebraska’s LB 586 requires a description of each municipal pension system’s assumed rate of return and how each pension board determined that rate. This metric is important because if a public pension plan’s investment performance falls short of that rate, debt is created. The decision-making process around this important assumption should be more transparent.

Similarly, showing the impact various market return scenarios would have on assets, liabilities, and required contributions over long periods of time, can provide a quantitative view of the appropriateness of such an important assumption.

Additionally, LB 586 requires qualifying cities’ pension boards to report:

- An explanation of how various market return scenarios impact system assets, liabilities, and required governmental contributions.

- A 30-year forecast of standard projection measurements (assets, liabilities, contributions, payroll, etc.) assuming each year’s market results are the same as the system’s assumptions, as well as annual returns that are 200 and 400 basis points below a system’s assumed investment return.

- Additional forecasts related to potential municipal budget constraints may limit a city’s ability to maintain its current funding policy.

- A market “stress test” forecast report that applies a specific sequence of investment return—a one-year 20 percent investment loss followed by 20 years of earnings at a rate 2% below the system’s assumed rate.

- A sensitivity analysis (e.g., “if Factor A changes, how much does Factor B move”) related to a system’s discount rate.

- A detailed report outlining the system’s method of paying down accrued unfunded pension liabilities over time.

Although some scenarios required under the proposed legislation are often described as black swan-types of events that are hard to predict, they spotlight the relationship between traditional public pension plan metrics and the resources required to sustain such systems over long periods of time. Stringent accounting and financial disclosure requirements have increased the amount of attention given to these types of assessments that explore the outcomes that can result from possible deviations from assumptions.

North Carolina, Virginia, Hawaii, Washington, and several other states have recently adopted similar pension stress testing requirements. Requiring routine risk assessments will hopefully, over time, prompt much more active discussions related to pension risk management in those states.

Recently, the risk-assessment policy adopted by the Colorado Public Employees’ Retirement Association (PERA), for example, helped identify funding weaknesses and mobilized a robust group of stakeholders dedicated to long-term solvency and resiliency of the state’s public pension system. This mobilization ultimately resulted in Colorado passing comprehensive, bipartisan, and lasting pension reform in 2018.

Colorado’s particular required risk assessment draws lines in the sand where stakeholder consensus dictates acceptable or concerning levels of risk and takes the form of simple “signal light” report. This evaluation looks at how investment returns, population growth, mortality, and other actuarial assumptions impact the system’s efforts to achieve and maintain full funding. The simplified signal light reporting system gives policymakers and stakeholders the ability to assess the likelihood that future changes to the plan will be needed.

Requiring routine stress testing of Nebraska’s public pension systems would unlock the ability to apply uniformed metrics to what is currently a real, but largely unmeasured, problem for taxpayers, retirees and local governments. This bill would allow policymakers to rely on real and concrete accounting that clearly defines the challenges facing each pension system in clear, comparable, and dispassionate metrics.

In the interest of taxpayers and the public workers depending on these pension systems, the reporting established by this bill would be a significant first step in identifying and addressing the challenges facing locally-run pension plans.

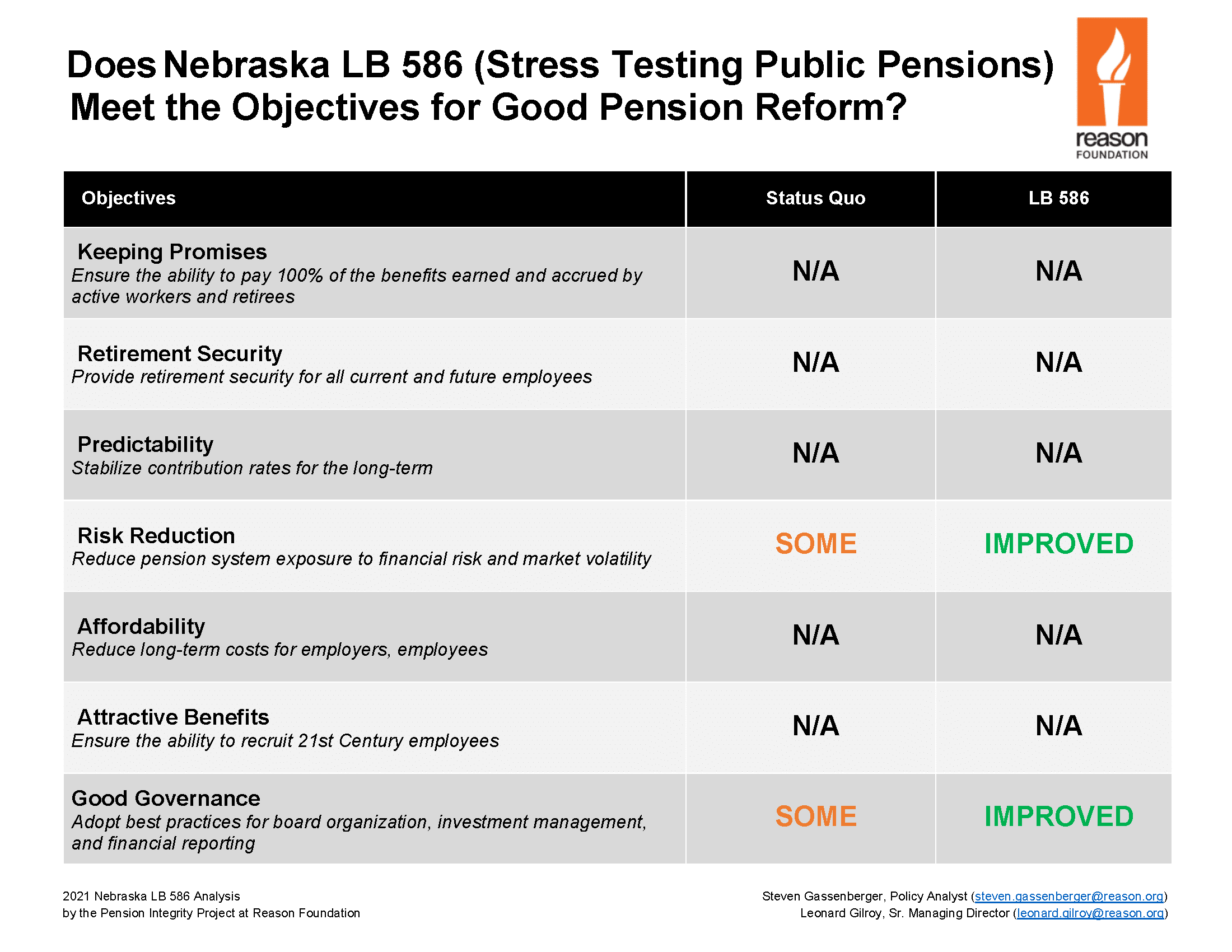

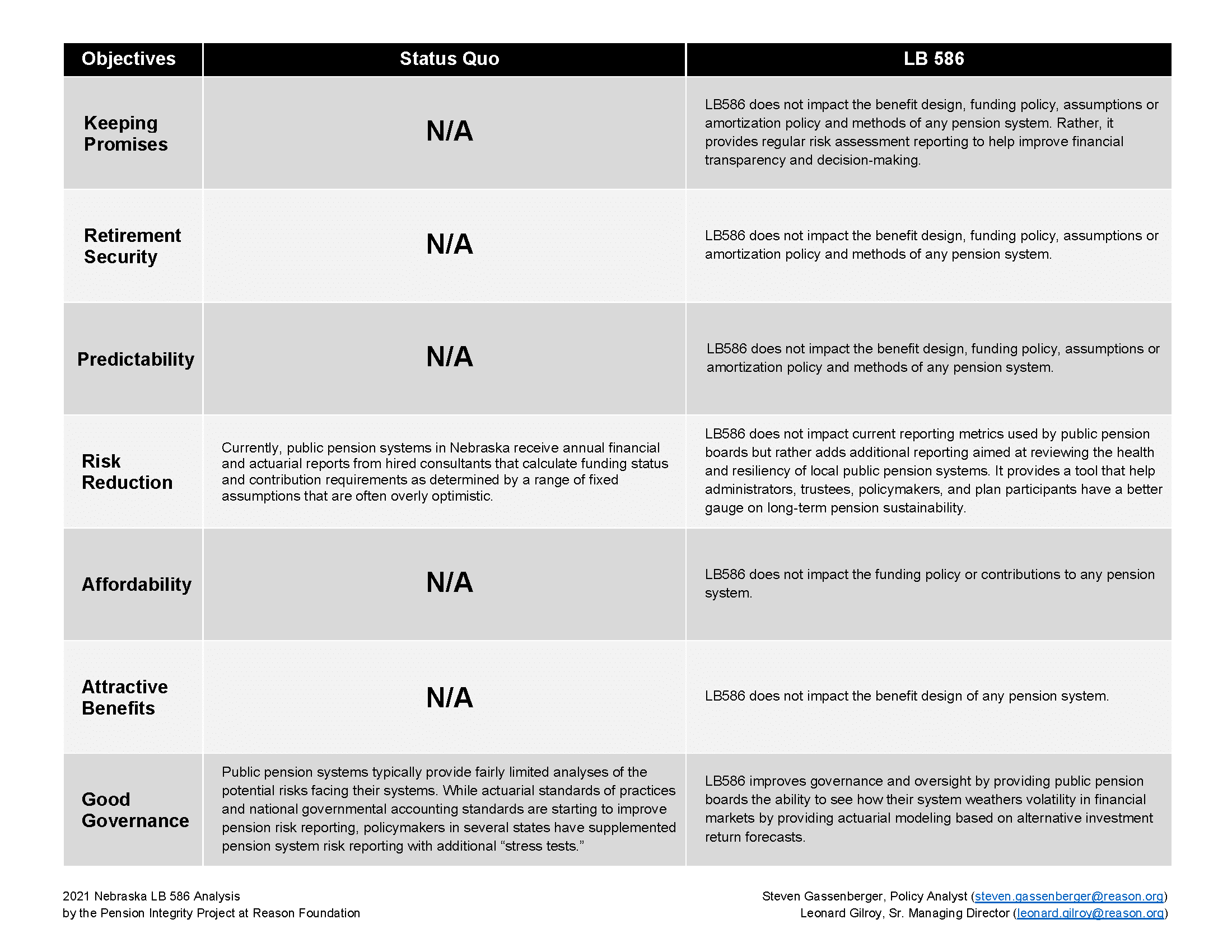

The chart below details which important measures of comprehensive public pension reform that Nebraska’s LB 586 includes.

Stay in Touch with Our Pension Experts

Reason Foundation’s Pension Integrity Project has helped policymakers in states like Arizona, Colorado, Michigan, and Montana implement substantive pension reforms. Our monthly newsletter highlights the latest actuarial analysis and policy insights from our team.