With the 11th hour passage of Senate Bill 12, an effort to put the state teachers’ pension on better fiscal footing, the Texas Legislature created the conditions needed to issue Texas teachers a long overdue cost of living payment, but fell short of addressing the systemic reforms needed to make such benefit increases more consistent for retirees.

After originally being introduced in the Senate as a boost in annual funding of the Teacher Retirement System of Texas (TRS) through increased employer and employee contributions, including a so-called “13th check”—in essence, an additional one-time benefit—worth up to $500, the House amended the bill so only the state would increase contributions. The House version also provided a larger 13th check of up to $2,400, again funded by the state. After conference committee revisions, the final version gradually increased both teacher (7.7% to 8.25%) and state (6.8% to 8.25%) contributions from 2020 to 2024, and capped the 13th check at $2,000. Already cash-strapped local school districts not participating in Social Security will also see their additional payments go up from 1.5% to 2% by 2025.

Why these exact rates and timetables? Because, with just the right combination of assumptions and contribution rates, the legislation would meet the legal threshold for issuing a cost of living adjustment for which TRS retirees have waited over a decade. Technically, the increase in TRS funding is projected by plan actuaries to pay off all pension debts within 30 years. Getting that debt payment timeline down to 30 years frees up the legislature to provide the one-time $2,000 13th check to current retirees.

The legislature’s efforts this session highlights the importance of maintaining the funding of TRS so it meets the state’s definition of “actuarily sound”—on schedule to pay off all pension debts within 30 years. If TRS debt payments exceed the prescribed 30 years, the state is prohibited from issuing additional benefits to retirees, including COLAs. Despite addressing one major issue pulling TRS into insolvency—insufficient contributions—several more systemic issues within TRS require action by legislators to ensure taxpayer funds are used effectively and public servant retirements are secure.

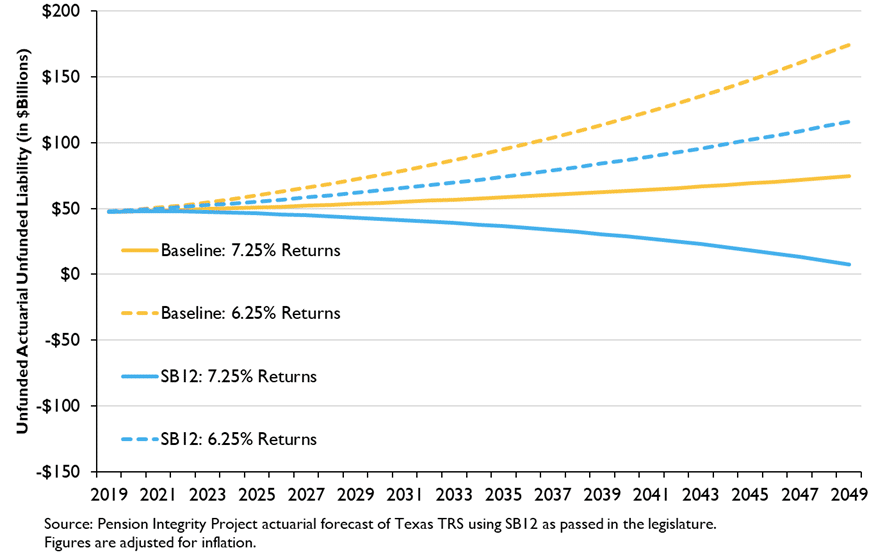

The Pension Integrity Project at Reason Foundation analyzed SB12 before passage, taking a deep look into the historic and forecasted indicators of TRS, and found that although the changes adopted in the recently passed reform may steer the system today back to the path to full funding within 30 years, the long-term success of these changes very much depends on investment results. Figure 1 shows that, while SB12 directs TRS onto a path of reduced long-term pension debts, returns below expectations could still result in ever-rising unfunded liabilities.

Figure 1: Sensitivity of TRS Unfunded Liabilities Before and After SB12

Returning to assess SB 12 as passed last week, basic forecasting using the Pension Integrity Project’s financial models indicates just a single year of returns slightly below expectations will result in an amortization period above the 30-year target – once again triggering the prohibition of future COLAs.

Table 1 shows how even with the changes made by SB12 the funding period increases as returns fall short of expectations. A return of 7% in 2020—just 0.25% below the expected 7.25%—would be enough to extend the system’s debt payment schedule to 32 years, in which case retirees would miss out on a COLA in year one of the reform. This demonstrates just how precarious future COLAs will be for retirees, even after increased funding into TRS.

Table 1: How One Year of Returns Affect the TRS Funding Period

| 2020 Investment Returns

(post-SB12) |

Forecasted Funding Period (Years) |

| 7.25% | 30 |

| 7% | 32 |

| 6.5% | 33 |

| 6% | 34 |

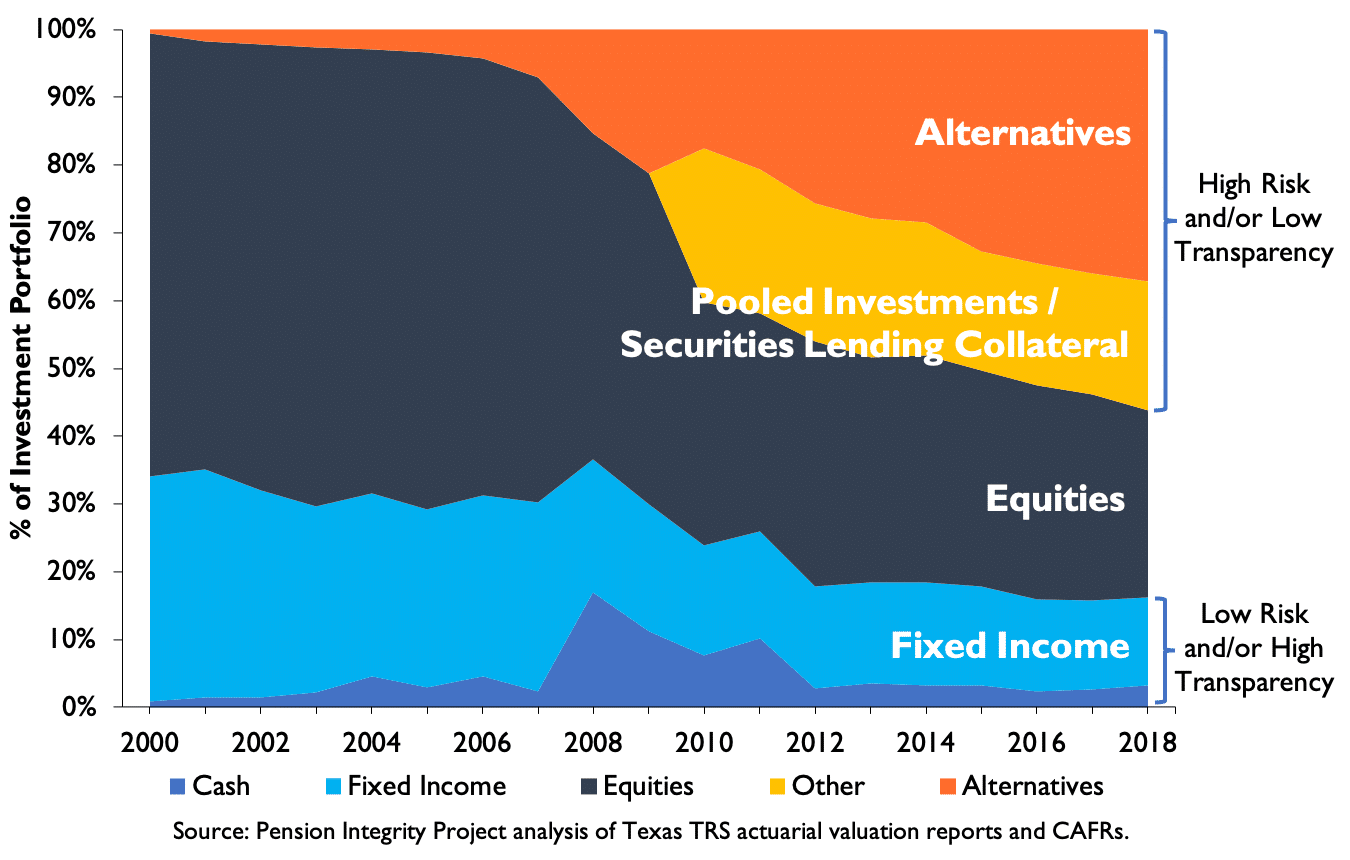

A long-term analysis of TRS investments illustrates that precariousness by showing how the engine driving investment growth has changed over time and the results of that change. Figure 1 shows the types of investments driving the growth of TRS investments when the plan was fully funded two decades ago compared to the assets driving investment growth today. With the expansion of high-risk assets to keep up with high return assumptions in the current market, the upside may be bigger but the taxpayer money on the table is at greater risk, and at a higher cost.

Figure 2: Texas TRS Asset Allocation (2000-2018)

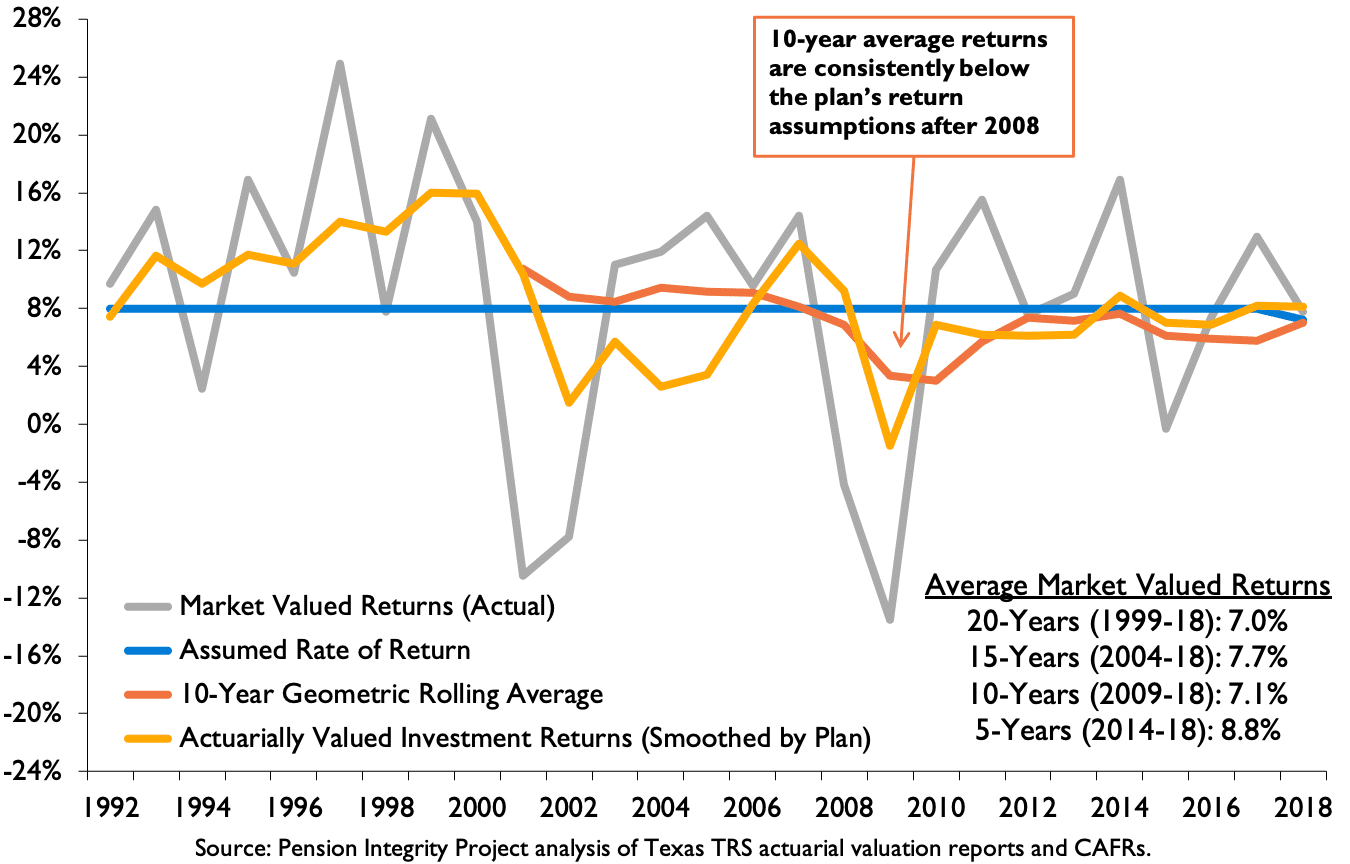

TRS investment volatility should be deeply disconcerting to every policymaker, taxpayer, and teacher in Texas. Investment experts indicate that markets are now experiencing a “new normal”, in which long-term returns won’t reach the levels they did in previous decades. A historic analysis of TRS returns shows that the system has a difficult time achieving not only the 8% expectation from the past, but also the 7.25% benchmark they expect to achieve going forward (see Figure 2). Despite some experts suggesting the system will revert to its historic average beyond 15 years, this, along with the expectations of other investment experts, suggests that there is a good chance returns will fall below current TRS expectations in the long-term.

Figure 3: Texas TRS Investment Returns 1992-2018

All of this lends credence to the Pension Integrity Project’s initial evaluation of SB12, that the increased contributions, while an important first step, are not a comprehensive solution to the problems TRS faces.

To be clear, this session’s efforts to make TRS “actuarially sound” began and ended with meeting the requirements to issue retirees a long-awaited cost of living adjustment. Meeting those requirements was a good first step to building a more fiscally solvent retirement system for Texas teachers, and it demonstrates how addressing issues plaguing one of the largest state expenses can be mutually beneficial to both public servants and taxpayers.

But there’s more work to do, given the lingering risks facing TRS. Legislators should continue to seek out solutions for other issues not addressed in SB12 such as paying off the system’s pension debt quicker, or adopting automatic adjustment policies such as those recently implemented in Colorado and Fort Worth to avoid future underpayments into the system. Texas stakeholders and lawmakers would be wise to use the momentum of this recent success to build more effective, affordable and sustainable retirement solutions for all public servants.

Stay in Touch with Our Pension Experts

Reason Foundation’s Pension Integrity Project has helped policymakers in states like Arizona, Colorado, Michigan, and Montana implement substantive pension reforms. Our monthly newsletter highlights the latest actuarial analysis and policy insights from our team.