Truong Bui is the director of data strategy and analytics at Reason Foundation and a managing director of its Pension Integrity Project.

Bui primarily works on the pension team's data and quantitative work and has contributed to numerous policy studies and data visualizations.

Prior to joining Reason, Bui was a financial analyst for Thien Viet Securities, a local investment bank in Vietnam, where he specialized in business valuation and investment memo preparation.

Bui graduated from RMIT University Vietnam with a bachelor's degree in commerce and received a Masters of Business Administration, with an emphasis in finance, from the Drucker School of Management at Claremont Graduate University.

Bui is based in Los Angeles.

-

Unfunded public pension liabilities are forecast to rise to $1.3 trillion in 2022

The 2022 Public Pension Forecaster finds aggregate unfunded liabilities will jump back over $1 trillion if 2022 investment results end up at or below 0%.

-

Alaska pension bill would bring major financial risk and unfunded liability growth

House Bill 55 would commit Alaska to unpredictable long-term costs for public safety workers' pensions so it is crucial to consider the costs over decades, not just a few years.

-

Modeling how public pension investments may perform over the next 30 years

This tool runs a simulation of the investment performance of a hypothetical public pension portfolio over 30 years.

-

Horizon survey predicts bleak future for public pension investment returns

Major survey by Horizon Actuarial Services says the short- and long-term investment outlook for public pension plans is getting worse.

-

Public Pension Plans Need to Put a Year of Good Investment Returns In Perspective

A year or two of great returns will not resuscitate the public pension plans at risk of financial insolvency.

-

Analysis of South Carolina Senate Bill 176

Senate Bill 176 would provide new hires a secure and attractive retirement plan that better protects the state's taxpayers.

-

New Mexico Educational Retirement Board Pension Solvency Analysis

New Mexico's Educational Retirement Board has $7.9 billion in unfunded pension liabilities.

-

Examining How Much Money That Pension Debt Takes Away From Michigan’s Classrooms Each Year

In 2018, Detroit Public Schools spent $2,202 per student on MPSERS debt, which equals nearly 27 percent of the district's per pupil foundation grant from the state.

-

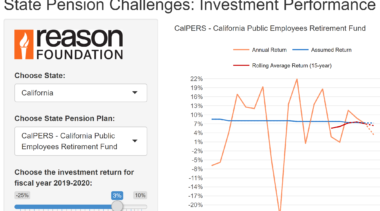

Public Pension Investment Performance Has Historically Fallen Short of Return Assumptions

Declining interest rates and market volatility over the last three decades have made it harder for public pension plan investment performance to match assumed rates of return - and plans have been slow to lower their assumptions.

-

Colorado Considers Reducing Pension Contributions in Response to Budget Concerns

If pension contribution policies are adjusted it would result in the addition of significant long-term costs and a public pension plan that is no longer en route to full funding.

-

Public Pension Plans Weren’t Meeting Investment Expectations Long Before the Coronavirus

A reliance on overly optimistic assumed rates of investment returns was driving the increases in public pension debt before the recent economic downturn.

-

Failing to Meet Investment Expectations Drives the Teachers’ Retirement System of Louisiana Debt

Investment underperformance has accounted for over 50 percent of the $6.3 billion worth of unfunded liabilities plaguing TRSL.

-

The “New Normal” In Public Pension Investment Returns

The primary culprit of growing pension debt has been the across-the-board investment underperformance of pension assets relative to plans’ own return targets.

-

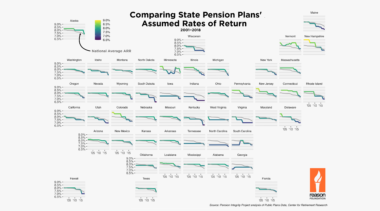

Map: Comparing State Pension Plans’ Assumed Rates of Return

This visualization shows how states have been gradually adjusting their assumed rates of return down to more realistic levels.

-

New Mexico Enacts Bipartisan Pension Reform to Improve PERA Solvency

Senate Bill 72 was a necessary and crucial first step towards improving the financial health of PERA and ensuring the sustainable delivery of public employee retirement benefits for state and local workers

-

North Carolina Teachers’ and State Employees’ Retirement System: A Pension Solvency Analysis

Better risk management and more realistic plan assumptions can help ensure the state delivers the promised retirement benefits to its employees.

-

PAYGO Is the Most Costly Way to Fund a Public Retirement System and Would Be Bad for New Mexico

Pensions are meant to be prefunded so that current taxpayers and current public employees share the costs of those workers’ benefits.

-

Assessing the Financial Sustainability of Montana’s Largest Public Pension Systems

Despite investment markets showing historic gains, Montana’s public pension systems are experiencing an increase in unfunded liabilities and are likely to continue on their path to insolvency if needed technical adjustments aren't made.