In the past few weeks, several state public pension plans have published headline-grabbing news of high investment returns. Colorado’s Public Employee Retirement Association, for example, posted an impressive 17.4 percent return for its latest fiscal year. Unfortunately, the pension plan still has $31 billion in debt and only has 63 cents for every dollar needed to pay for future benefits already promised to workers.

A single year, or even several years, of above-average investment returns would be welcome news for public pension plans. But, a year or two of great returns will not resuscitate the public pension plans at risk of financial insolvency. Public pension plans with growing debt are in need of structural reforms that protect taxpayers, employees and retirees. A key component of these reforms is setting realistic assumptions about future investment returns.

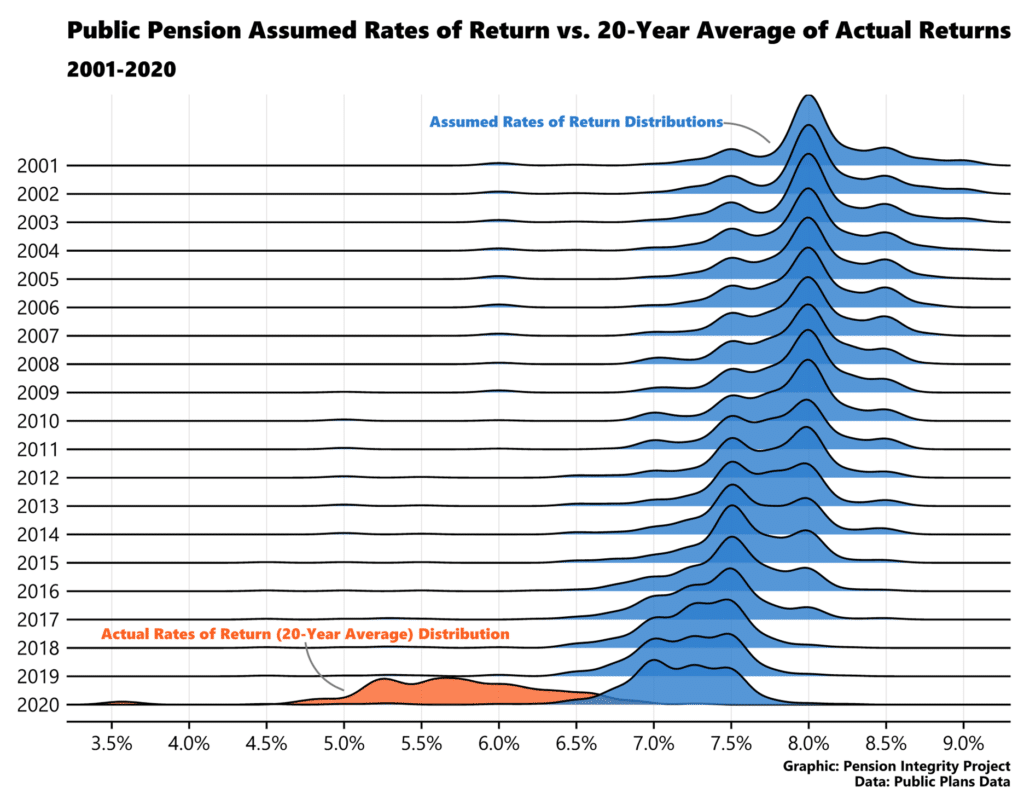

For the last 20 years, state and local pension plans’ assumed rates of return have been far too optimistic. The distributions of average (geometric mean) assumed investment returns and actual returns from 2001 to 2020 demonstrate this. The figure below shows the distribution of the average assumed investment return rate versus actual investment returns for 200 of the largest state and local pension plans in the United States. The median assumed rate of return over the last 20 years was 7.7 percent per year, the median actual rate of investment return for these public pension plans was 5.7 percent.

This two percent difference helps to explain the nearly 30 percent drop in the average pension plan funded ratio over the same period. In recent years, many pension plans lowered their assumed rates of return. As visualized below, the distribution of state and local pension plan assumed rates of return (blue) are moving closer to the distribution for the 20-year average (orange).

Although progress has been made there is still a significant gap between the assumptions for investment returns and actual returns from the last two decades. For public pension plans, falling short of investment return expectation, even by a small percentage, can add millions to billions in pension debt over time.

In short, state and local governments are betting that the next few decades will not be like the last two. Policymakers should continue to lower overly optimistic assumed rates of return. By doing so, they can reduce the risk of future growth in unfunded pension liabilities, protecting taxpayers and government workers.

Stay in Touch with Our Pension Experts

Reason Foundation’s Pension Integrity Project has helped policymakers in states like Arizona, Colorado, Michigan, and Montana implement substantive pension reforms. Our monthly newsletter highlights the latest actuarial analysis and policy insights from our team.