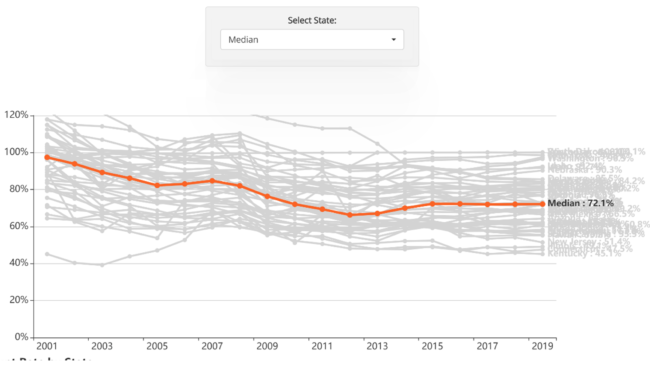

Twenty years ago, state pension plans were nearly 100 percent funded, on average. Today, the average state pension plan funded ratio stands at roughly 72 percent.

Funded ratios are used to display the dollars a pension plan has saved compared to the amount the plan will need to fulfill pension promises already made to public workers and retirees.

The interactive tool below shows each state’s public pension funded ratio and how it compares to the aggregated national funded ratio (total assets compared to liabilities for all plans run by each state) from 2001 to 2019. For example, California’s funded ratio is currently 71.6 percent, which means the state has roughly 71 cents saved for every dollar of pension benefits it owes.

This analysis reveals that most state pension plans saw significant drops in funding in the early and late 2000s, followed by a minor rally during the largest bull market run-up in our nation’s history. In the last five years, the average seems to have leveled at around 72 percent. Initial analysis of 2020 data shows that state aggregated funded ratios remain roughly unchanged from 2019 at 72 percent.

There are many reasons funded ratios have declined and stagnated. The largest of these are investment returns coming in below plan expectations and insufficient annual contributions.

Another factor that should be considered when comparing pension funding between states is how they have adjusted their discount rates, which is how plans calculate the present value of promised benefits. A discount rate is highly influential on a plan’s funded ratio and if the rate is too high—meaning it reflects an unrealistic expectation on long-term investment returns—it will hide the true extent of the state’s public pension liabilities.

As some public pension plans have prudently adjusted their discount rates down to realistic levels, they have also revealed the true cost of fully funding their public pension systems. This affects funded ratios by revealing a higher pension liability. The second chart of this tool shows the change in each state’s discount rate between 2001 and 2019.

Stay in Touch with Our Pension Experts

Reason Foundation’s Pension Integrity Project has helped policymakers in states like Arizona, Colorado, Michigan, and Montana implement substantive pension reforms. Our monthly newsletter highlights the latest actuarial analysis and policy insights from our team.