Zachary Christensen is a managing director of Reason Foundation's Pension Integrity Project.

Christensen’s work with Reason's Pension Integrity Project aims to promote solvent, sustainable retirement systems that provide retirement security for government workers while reducing long-term costs for taxpayers and employees. Zachary and his team provide education, reform policy options, and actuarial analysis for policymakers and stakeholders to help them design practical and viable reform proposals.

The Pension Integrity Project has provided technical assistance to several successful pension reform efforts in recent years, including in Michigan, Colorado, Arizona, South Carolina, Texas, and other states tackling persistent pension solvency challenges.

Christensen has contributed to in-depth solvency analysis of the Arizona PSPRS, Arkansas TRS, Louisiana TRSL, Texas ERS, and Texas TRS pension plans.

Christensen's work has been published in the Los Angeles Daily News, Orange County Register, NJ.com, Colorado Politics, and many other publications. He has also been featured in the Carolina Journal and the Michigan Capitol Confidential. His research has been published by the Hoover Institution, The Platte Institute, Texas Public Policy Foundation, and Rio Grande Foundation.

Prior to joining Reason Foundation, Christensen was a pension finance analyst at Stanford University’s Hoover Institution, where he worked on widely-cited research on the funding status and accounting methods for public sector retirement systems.

Christensen holds an M.S. in Public Policy from Pepperdine University and a B.S. in Political Science from Brigham Young University.

-

California’s state and local pension plans have over $265 billion in debt

California’s public pension plans are taking on more risk than other pension systems while generating relatively poor investment return results.

-

Florida must stay the course to pay for promised pension benefits

Florida’s retirement system for public workers is estimated to be 17 years away from eliminating expensive pension debt.

-

Ohio lawmakers consider bill to promote an independent childhood

Senate Bill 277 would assure parents that they can let their children engage in safe, reasonable activities without mandated adult supervision.

-

How government workforce reductions can impact public pension debt

Public pension plans need to lower their payroll growth assumptions or transition to a method that is less sensitive to payroll fluctuations.

-

With additional plans reporting, total unfunded public pension liabilities in the U.S. grow to $1.61 trillion

Information added to the Annual Pension Solvency and Performance Report finds the median funded ratio across public pension plans decreased marginally to 75.8%.

-

New Georgia, Florida, and Missouri laws protect parents who teach their children independence

These laws ensure that parents can confidently grant reasonable levels of independence to their kids without fearing government intervention.

-

California bills would increase taxpayers’ costs and public pension debt

California’s state-run pension plans already had $285 billion in unfunded liabilities at the end of 2023.

-

Changing North Carolina’s investment strategy would bring significant risks to taxpayers, public pensions

North Carolina taxpayers are obligated to pay for constitutionally-protected public pensions if the state's investments don't meet expectations.

-

Mississippi adopts hybrid retirement design in major pension reform

A sustainable new “hybrid” retirement design has been adopted, but major funding and design issues remain for 2026.

-

A chance for reasonable childhood independence in Georgia

A new Georgia bill will protect parents from overzealous law enforcement and child protective services intervention while promoting childhood independence.

-

Webinar: Best practices in optional defined contribution plans for public workers

For those looking to implement or improve an optional defined contribution plan to go alongside an existing pension, several key policy decisions are important.

-

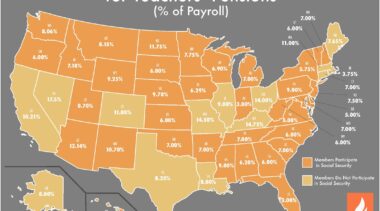

How much teachers contribute to their retirement benefits in each state

Most states require teachers to pay between 5% and 12% of their pay, with the employer paying what remains to cover the benefit and pension system's debt.

-

Is private equity a public financial hazard?

Private equity funds lack clear return and risk metrics, making it hard to assess performance before investments are redeemed, often a decade or more after the initial investment.

-

Ohio teachers’ pension reforms should not be at the expense of taxpayers

Long-shot investment strategies that mask the risk to Ohio taxpayers are not the path toward improving teacher benefits.

-

For most workers, the value of Alaska’s defined contribution plan surpasses that of a traditional pension

The following tool created by the Pension Integrity Project displays the year-by-year accrual of retirement benefits for a wide variety of Alaska workers in different fields and starting at different ages.

-

Ohio’s teacher retirement reforms are working well, but more needed

The Pension Integrity Project finds approximately 75% of STRS’ unfunded liabilities can be attributed to interest on pension debt that has accrued since 2001.

-

Examining calls to bring back Alaska’s defined benefit pensions

Bringing back Alaska's defined benefit pensions would be unlikely to improve retention or recruitment but could add $9 billion in unfunded liabilities.

-

Florida strengthens retirement plan but also increases taxpayers’ burden and rolls back pension reforms

Gov. Ron DeSantis recently signed Senate Bill 7024, which makes several changes to the Florida Retirement System, the state’s retirement plan for government workers.