Actuarial consultants recently presented their evaluation of the Texas Teachers Retirement System (TRS) assumptions to the system’s board. The consultants suggested that the public pension plan should lower its return investment return rate target, putting it in line with the national average return. The consultants advised the TRS board to reduce the pension return assumption from 7.25% to 7.00%, stating that “a 7.00% return assumption would be a longer-term hedge against market returns not meeting the 7.25% [target].”

The turbulence across financial markets to this point in 2022, with virtually all U.S. companies in the S&P 500 index in the red, means TRS will likely be among the public pension plans missing annual investment return targets this year. Just as strong, double-digit investment returns in 2021 greatly enhanced TRS’ funded status, this year’s investment losses are expected to lower the plan’s funding level.

This dramatic up and down following the COVID-19 pandemic illustrates the folly of reading too much into pension funding measurements based on a single year of reported returns. Prudent public pension plan managers need to maintain a longer perspective and continue lowering investment return assumptions to accurately reflect what most market prognosticators expect to see over the next 10-to-15 years.

Maintaining an overly optimistic investment return assumption is costly. Doing so raises the risk of significant growth in pension funds’ unfunded liabilities, which historically tend to spiral into colossal costs for taxpayers and take decades to remedy.

The Teachers Retirement System of Texas is a perfect example of this. The plan has accrued $47.6 billion in pension debt since 2002, and most of it, around $25 billion, came from investment returns falling below the plan’s assumptions (displayed in Figure 1 as “Underperforming Investments”). The primary contributor to this was TRS maintaining an unrealistic 8.0% rate of return assumption until 2018, well past the time most other pension plans had started adjusting their return rate targets downward in reaction to a lower yield return environment on financial markets. Policymakers’ failure to be nimble with return assumptions ended up contributing to the system’s current funding challenges, and it would be wise to not repeat that mistake.

Figure 1. The Causes of the Texas TRS Pension Debt (Cumulative 2002-2021)

Data represents cumulative unfunded actuarial liability by gain/loss category.

It is critical for Texas policymakers to consider improving the TRS contribution policy by changing “statutorily-set” to “actuarially determined” rates. As the Pension Integrity Project has covered, annual contributions capped by statutory rates have generated significant funding challenges for the system. Since 2004, contributions have routinely fallen below the interest accrued on TRS’ unfunded liability that year (a situation called negative amortization). This has led to the Teachers Retirement System falling further behind in its ability to pay for promised obligations.

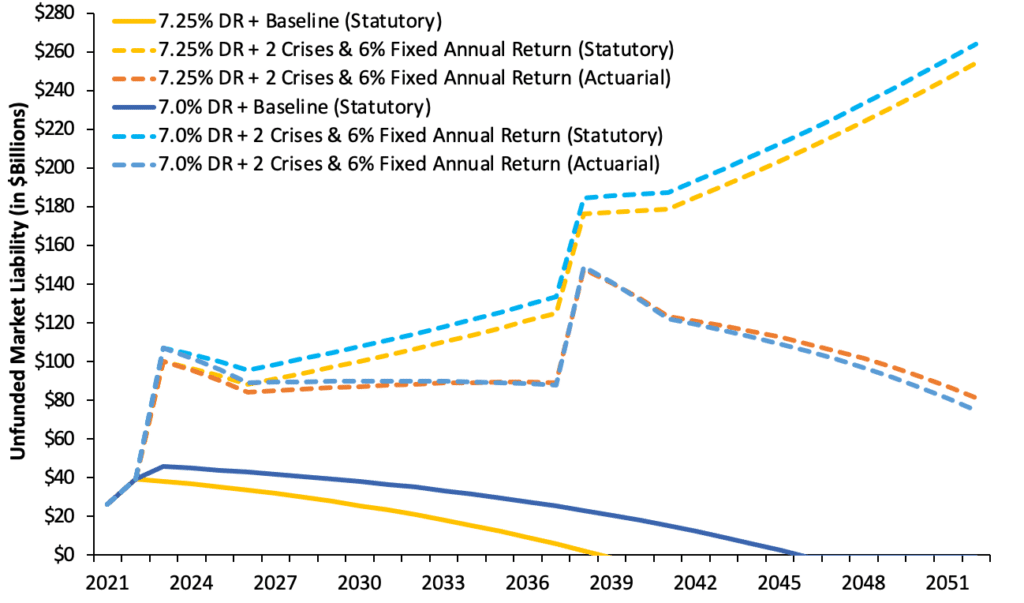

An adjustment of the assumed rate of return down to 7.0% means the plan will recalculate pension debt upwards in 2023, but will also be better positioned to avoid future debt growth over the longer run. The forecast in Figure 2 compares the growth of TRS’ unfunded liabilities under three scenarios:

- Returns meet TRS assumptions;

- TRS experiences two major recessions over the next 30 years;

- And, TRS makes actuarially determined contributions (also using the two-recession scenario).

With this actuarial modeling of the system, it is clear that statutorily limited contributions will continue to pose funding risks for TRS that will be borne by Texas taxpayers. A proposed 7.0% assumed return will readjust 2023 unfunded liabilities upwards by $6.5 billion, but the plan will suffer fewer investment losses over the next 30 years when the plan inevitably experiences returns that diverge from expectations. TRS’ unfunded liabilities will remain elevated under the rigid statutorily-set contributions. If, however, TRS was to transition to Actuarially Determined Employer Contributions (ADEC) each year, then even by recognizing higher 2023 debt (under a 7.0% assumption) TRS could shave billions off its unfunded liabilities by 2052 ($74.7 billion down from $81.3 billion with current 7.25% assumption).

Figure 2. Texas TRS Stress Testing: Unfunded Liabilities (2021-2052)

The lower return target should improve TRS’ ability to withstand turbulent market periods like we are seeing today.

A switch to an actuarial (or ADEC) contribution policy is what lawmakers did with the state’s other major pension plan—the Employees Retirement System of Texas (ERS)—just last year in a landmark pension reform. Unlike rigid contributions set in statute, actuarial contributions adjust and respond according to needs. This means that in situations of volatile market conditions (as tested and confirmed in the analysis above) contributions adjust automatically to ensure that the state’s unfunded obligations do not get out of control. This change in the ERS contribution policy is projected to save state taxpayers billions in long-term costs, and now would be a good time to consider similar reforms to how the state funds TRS.

Seeing the obvious reduction in funding risks through actuarial modeling, it is clear that lowering the Teachers Retirement System’s assumed rate of return is a step in the right direction to safeguard the pensions for the state’s teachers. In addition to heeding the advice of the pension system’s actuaries, Texas policymakers should also consider addressing the rigid statutory contribution policies, which currently prevent Texas from meaningfully cutting down existing unfunded liabilities and curbing future pension debt. At a time when market results appear to be extremely unpredictable and volatile, the state’s teachers and taxpayers need to ensure that TRS is positioned to weather whatever storms may come.

Stay in Touch with Our Pension Experts

Reason Foundation’s Pension Integrity Project has helped policymakers in states like Arizona, Colorado, Michigan, and Montana implement substantive pension reforms. Our monthly newsletter highlights the latest actuarial analysis and policy insights from our team.