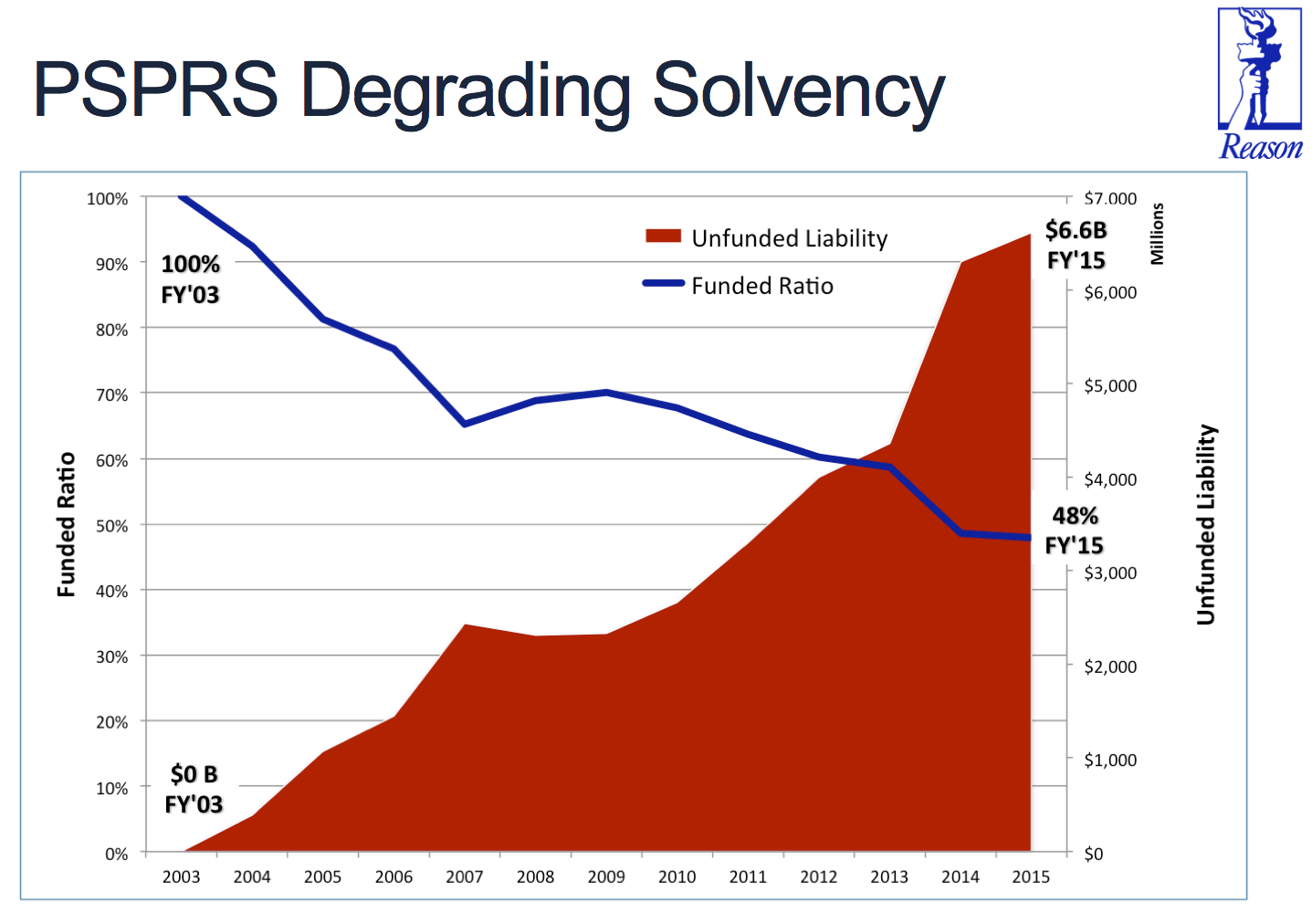

This afternoon, Arizona Gov. Doug Ducey signed into law comprehensive pension reform legislation that will put Arizona’s beleaguered public safety pension system on a path to financial solvency. The Arizona Public Safety Personnel Retirement System (PSPRS)-which covers all law enforcement personnel and firefighters statewide-has accumulated $6.6 billion in unfunded liabilities over the past dozen years and stands at only 48% funded today.

Arguably more notable than the reform itself is the process used to achieve stakeholder consensus on the reform package, as it avoided the adversarial dynamic of pension reform policy debates that typically pit employers/taxpayers against employees and labor interests. In the case of PSPRS, the legislation-a package of three bills sponsored by State Sen. Debbie Lesko-was the result of a year-long, collaborative stakeholder process launched by Lesko and Senate President Andy Biggs that garnered extensive support from public safety associations and many other stakeholders in the government and business community.

The legislation had strong bipartisan support, passing the Senate unanimously and the House of Representatives overwhelmingly, with a 49-10 vote.

Reason Foundation was a key player from the beginning of the process, with its Pension Integrity Project team providing education, policy options, and actuarial analysis for all stakeholders. We also facilitated the development of consensus among stakeholders on the conceptual design and framework of the reform. Further, more than once we resorted to shuttle diplomacy to keep stakeholder parties at the table when negotiations became difficult or threatened to break down.

Arizona’s public safety associations-led by the Professional Fire Fighters of Arizona, the state lodge of the Fraternal Order of Police, and the Phoenix Law Enforcement Association-also deserve major credit for recognizing the need for reform early on and proactively bringing reform ideas to the table that ultimately led to the launch of the stakeholder collaboration process.

Conservative legislators, public safety unions, and a libertarian think tank may seem like strange bedfellows when it comes to forging an agreement on a precedent-setting pension reform affecting law enforcement and fire personnel, but the ultimate success of the effort suggests that a collaborative process may be just the recipe needed to achieve reform on such a complex and intractable issue. Arizona Republic editorial board member and columnist Robert Robb recently described this reform effort as “a paradigm-buster,” adding that, “public employee unions and libertarian wonks blazed new ground on a difficult and emotional topic that is producing paralysis around the country.”

The Need for Reform

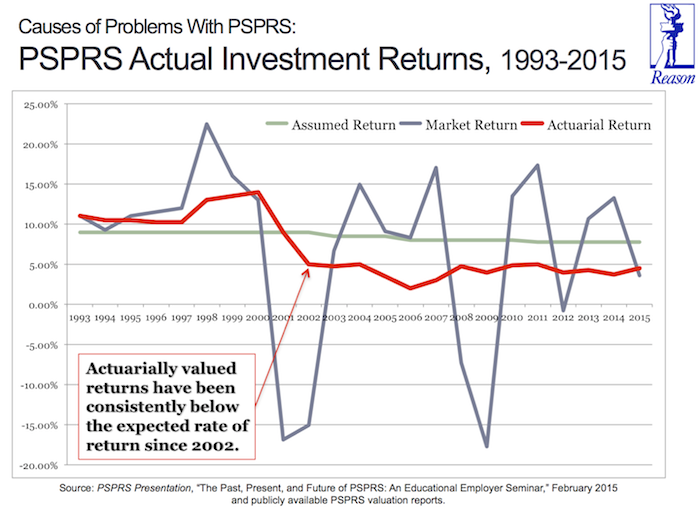

A number of factors have influenced PSPRS’s decline, the two biggest factors being: (1) the system’s current Permanent Benefit Increase (PBI) mechanism, and (2) underperforming investment returns.

The PBI mechanism-which is intended to adjust benefit levels for retirees upward over time to partially offset inflation-has undermined PSPRS’s solvency by skimming assets off the top of the fund in years of good market performance. Among the problems associated with the PBI:

- For most retirees, 50% of PSPRS’s investment returns over 9% in a given year are deemed “excess” and diverted to a separate PBI fund to pay out PBI benefits. These diverted funds cannot be used to reduce unfunded liabilities and cannot earn interest over time, constraining PSPRS’s asset growth as a result.

- PBI benefits are not directly linked to inflation and are not distributed equitably among retirees, making it a poor method of adjusting retiree benefit levels to keep up with actual changes in the costs of living. The PBI is calculated as up to 4% of the average pension benefit in PSPRS, then distributed in a level dollar amount, regardless of the retiree’s actual pension benefit level.

- Worse, the PBI benefit has not been pre-funded like a traditional pension cost of living adjustment (COLA). Two years ago the PSPRS board began requiring employers to make an additional contribution to offset some of the negative effects of skimming investment returns into the PBI fund, but these have been experimental and are not directly related to the actual costs of the PBI benefit.

- Until last year, most retirees in the PSPRS system have received a PBI benefit over 20 consecutive years, despite the continuing decline in PSPRS’s funding status. Now that the PBI account is empty, the plan would have to have several years of very strong returns for retirees to receive a full PBI. Given the current market conditions, it is uncertain when retirees may receive future PBI distributions.

Goals of Reform

The PSPRS reform effort sought to establish a retirement system that is affordable, sustainable, and secure. The primary goals of reform included:

- Providing retirement security for members (current and future) and retirees.

- Reducing taxpayer and pension system exposure to financial and market risk.

- Maintaining a reasonable and stable total normal cost of approximately 20% of payroll.

- Reducing long-term costs for both employers/taxpayers and employees.

- Providing new options to ensure the ability of government employers to recruit and retain 21st century employees.

- Improving PSPRS governance and transparency.

Reform Overview

The PSPRS reform includes a wide range of elements, summarized in this section, that affect current workers, retirees and future workers alike. (Links to additional materials with more details on the reform are listed at the end of this article.)

First, for current employees and retirees, the reform will replace the uncertain, inequitable, unsustainable PBI with a traditional, pre-funded cost of living adjustment (COLA) that provides certainty and equity in retirement. This will serve the public interest by fixing the broken PBI mechanism that has been a major factor causing increased unfunded liabilities:

- The new COLA will be based on the changes in the consumer price index for the Phoenix region, with a cap of 2% maximum.

- The COLA will be equitable because the percentage will be applied to each PSPRS retiree’s actual benefit level (as opposed to a level dollar amount granted under the current PBI, regardless of the individual retiree’s benefit level).

- Further, the new COLA will be pre-funded and actuarially accounted for in advance as part of normal cost determination, which has historically not been the case with the current PBI.

Replacing the PBI with a traditional COLA for current personnel and retirees will require a constitutional amendment that will require voter approval at the ballot box in an election this May.

Second, the reform creates an entirely new retirement plan design for all new employees hired on or after July 1, 2017 that will:

- For the first time, allow public safety employees the choice of entering a full defined contribution plan or a defined benefit hybrid plan.

- Reduce the pensionable pay cap from $265,000 per year to $110,000 per year, significantly limiting pension spiking.

- Change the pension benefit multiplier from a flat 2.5% to a graded multiplier that ranges from 1.5% to 2.5% depending on years of service.

- Increase the retirement benefit eligibility age from 52.5 years to 55 years old.

- Implement the same CPI, with a cap of 2%.

- Restrict or eliminate cost of living adjustments when the plan falls below 90% funded.

- Require employees to pay 50% of all retirement costs, including normal costs, administrative costs, and any potential future unfunded liabilities if the plan’s experience does not meet actuarial assumptions.

Lastly, the legislation implements significant governance reforms, including:

- Matching the PSPRS board composition to reflect the shared costs and risks. The new board will consist of five independent, outside professionals with at least 10 years experience in fields related to the board’s duties and four members that represent employees, with two of these positions open to independent professionals as well.

- Codifying comprehensive fiduciary standards for pension board members in state law.

- Prohibiting employers from taking pension holidays.

- Requiring that any future benefit increases be paid in full at the time of enactment if they create any unfunded liabilities for the plan.

- Replacing the governor’s office as sole board appointment authority with a process by which stakeholders nominate board candidates, and the appointment of board members is split between the governor, the senate president, and the speaker of the house.

- Prohibiting the removal of a board member without cause.

Expected Effects of Reform

Overall, the reform plan will yield several key benefits to taxpayers, employers and public safety personnel:

- Government agencies will save between 20% and 43% on the normal cost of retirement for each new employee hired, relative to the status quo.

- The reduction in cost for each new hire is estimated to save taxpayers $1.5 billion over the next 30 years, relative to the status quo.

- The reform will reduce the future accrual of total PSPRS pension liabilities by at least 36%.

- The reform will reduce the taxpayer’s exposure to future market risk by more than 50%.

- The reform will reduce the volatility in employer contribution rates by more than 50%.

- All new employees will equally share costs and investment risk with taxpayers under this reform.

- The reform creates incentives for the revamped PSPRS board to set more responsible actuarial assumptions in a way that minimizes the negative effects of underperforming investment returns.

- For the first time, the reform will offer new public safety hires a choice in retirement benefits-either a 100% defined contribution plan or a defined benefit hybrid plan designed to be more sustainable than the current benefit structure.

- New employees will pay lower annual employee contributions under the reform than the status quo.

Conclusion

Both the process and the content of the PSPRS reform offer models to other jurisdictions on how to approach meaningful pension reform. With regard to process, the Arizona PSPRS reform experience demonstrates that stakeholders with very different interests and perspectives can come together to achieve a consensus agreement on a very difficult issue that has vexed many other policymakers elsewhere.

And this example shows that consensus need not be tepid; it can produce substantive, wide-ranging and meaningful reform that will reduce taxpayer and pension system exposure to financial risk and market risk, reduce long-term costs for employers/taxpayers and employees, and stabilize contribution rates for both employers and employees. The reform will also ensure retirement security for all employees (current and future) and retirees, while ensuring state and local governments’ ability to recruit and retain 21st century public safety employees.

Additional Resources:

- For a more in-depth analysis of the fiscal components of the PSPRS reform, see our article on how the changes will improve the plan’s solvency.

- Reason Foundation presentation: Analysis of Proposed PSPRS Pension Reform (.pdf)

- Arizona Senate Finance Committee testimony by Reason Foundation’s Pete Constant

- Full text and legislative history: Senate Bill 1428 | Senate Bill 1429 | Senate Concurrent Resolution 1019

- Arizona Auditor General, Performance Audit and Sunset Review of the Public Safety Personnel Retirement System (Report No. 15-111, September 2015)

Leonard Gilroy is director of government reform at Reason Foundation. Pete Constant is director of Reason Foundation’s Pension Integrity Project. Anthony Randazzo is director of economic research at Reason Foundation.

Stay in Touch with Our Pension Experts

Reason Foundation’s Pension Integrity Project has helped policymakers in states like Arizona, Colorado, Michigan, and Montana implement substantive pension reforms. Our monthly newsletter highlights the latest actuarial analysis and policy insights from our team.