-

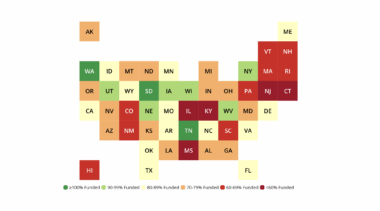

Study: Illinois, Connecticut, Alaska, Hawaii, New Jersey and Mississippi have the most per capita pension debt

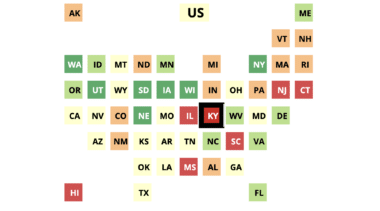

Illinois, Kentucky, New Jersey, Mississippi, and Connecticut have less than 60% of funding needed to pay for promised pension benefits.

-

The public pension plans with the most debt, best and worst investment return rates

The Maryland and Massachusetts teachers' retirement plans saw the largest growth in debt, the Fire Fighters' Relief and Retirement Fund of Austin posted the worst returns and the Miami General Employees and Sanitation Employees Plan had the highest return rate.

-

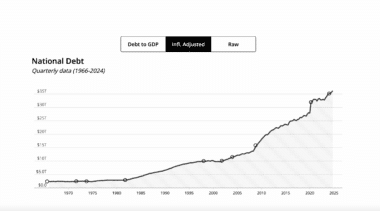

Debtor Nation 2025

At $36 trillion, the United States' debt-to-GDP ratio now exceeds 120%, surpassing the peak reached after World War II.

-

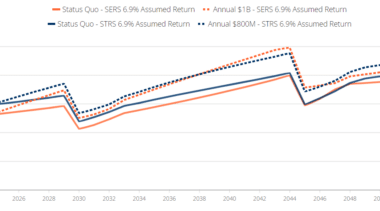

How Connecticut pensions can save $7 billion in interest costs over the next 30 years

The Connecticut Pensions Dashboard explores various economic scenarios that could impact the state's public pension debt.

-

Forecast: State pension debt totals $1.3 trillion at the end of 2023

California, Illinois, New Jersey, and Texas have the most public pension debt.

-

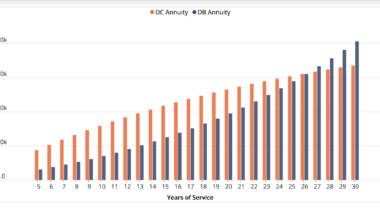

Comparing Alaska’s defined benefit and defined contribution retirement plans

Most of Alaska’s public employees would be better served in the existing defined contribution plan.

-

Continuum of risk for tobacco and nicotine products

The Food and Drug Administration recognizes a continuum of risks for nicotine products, with cigarettes being the most dangerous.

-

Examining day-to-day crypto volatility and why it’s important

Bitcoin, Ethereum, and other cryptocurrencies frequently exhibit daily price drops during bull markets and increases during bear markets far in excess of traditional assets.

-

The 2022 fiscal year investment results for state pension plans

Overall, the median investment return result for state pension systems in 2022 is -5.2%.

-

Local governments collected $9 billion in fines and fees in 2020

Local governments in three states—New York ($1.4 billion), California ($1.26 billion), and Texas ($1.17 billion)—collected well over a third of the nation's $9 billion in fines and fees in 2020.

-

Debtor Nation

The national debt is over $30 trillion. The federal government ran an annual budget deficit in 52 of the last 57 years.

-

Projecting the funded ratios of state-managed pension plans

The funded ratios for 2022 are projections based on a -6% investment return, which may be overly optimistic for many pension systems.

-

Unfunded public pension liabilities are forecast to rise to $1.3 trillion in 2022

The 2022 Public Pension Forecaster finds aggregate unfunded liabilities will jump back over $1 trillion if 2022 investment results end up at or below 0%.

-

Modeling how public pension investments may perform over the next 30 years

This tool runs a simulation of the investment performance of a hypothetical public pension portfolio over 30 years.

-

State pension plan funded ratios in 2020

Most state pension plans saw significant drops in funding in the last two decades.

-

Investment return results for state pension plans

Tracking state-managed public pension plan investment return results for the latest fiscal year.

-

Public Pension Plans Need to Put a Year of Good Investment Returns In Perspective

A year or two of great returns will not resuscitate the public pension plans at risk of financial insolvency.

-

How State Pension Funding Ratios Have Declined Over Time

Twenty years ago, state pension plans were nearly 100 percent funded, on average. Today they are roughly 72 percent funded.