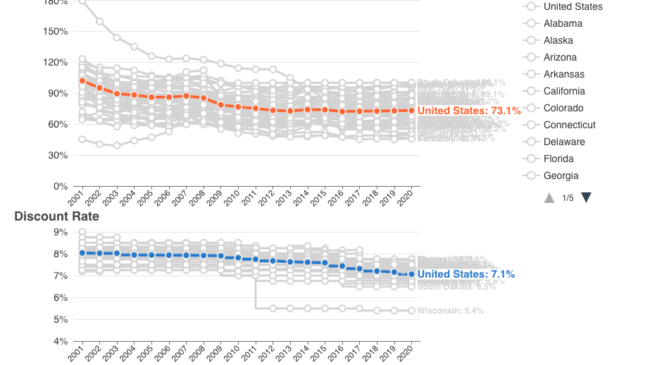

As official reports for the 2020-2021 fiscal year begin to trickle in, it is valuable to see how state pension plans have fared in their funding over the last twenty years. The latest complete year of data on state pension plans (2019-2020 fiscal year) show, in aggregate, plans were roughly 73 percent funded at the end of the reporting period. Funded ratios are used to display the dollars a pension plan has saved compared to the amount the plan will need to fulfill pension promises already made to public workers and retirees.

This analysis reveals that most state pension plans saw significant drops in funding in the early and late 2000s, followed by a minor rally during the largest bull market run of our nation’s history. In the last five years, the average has remained in the lower 70 percent range.

Fortunately, a strong year of returns in FY 2021 will result in a significant bounce to the funding status of nearly all plans. Still, twenty years ago, state pension plans were nearly 100 percent funded in aggregate, and most plans are still working to overcome funding shortfalls that arose over a decade ago during the Great Recession. This year’s funded ratio increase does not change the trends plans have experienced for the last two decades and such history should inform plan assumptions going forward.

The graphic below shows each state’s public pension funded ratio (total reported actuarial assets compared to liabilities for all plans aggregated by state) from 2001 to 2020.

Methodology: Displayed funded ratios are the quotient of the actuarial value of assets (AVA) and actuarial accrued liabilities (AAL) of state-managed plans. The discount rate is a weighted average of state-managed plans’ discount rates with AAL as the weight. Source: Data primarily come from Public Plans Data and is supplemented by Pension Integrity Project analysis of annual financial reports.

One of the largest reasons funded ratios have declined over time is investment returns coming in below plan expectations and insufficient annual contributions from states. For years, most pension plans have held too high assumed rates of investment returns that have led to underfunding. Despite excellent returns this year, a number of plans have taken prudent steps to lower their assumed rate of return in 2021.

A pension plan’s discount rate is also highly influential on a plan’s funded ratio and if the rate is too high it will hide the true extent of the state’s public pension liabilities. As some public pension plans have prudently adjusted their discount rates down to realistic levels, they have also revealed the true cost of fully funding their public pension systems. This affects funded ratios by revealing a higher pension liability. The second chart of this tool shows the change in each state’s discount rate between 2001 and 2020.

Stay in Touch with Our Pension Experts

Reason Foundation’s Pension Integrity Project has helped policymakers in states like Arizona, Colorado, Michigan, and Montana implement substantive pension reforms. Our monthly newsletter highlights the latest actuarial analysis and policy insights from our team.