-

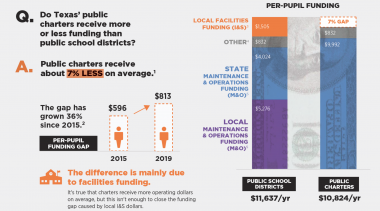

Infographic: Texas Charter Funding Gap

Public charter schools in Texas receive an average of 7 percent less education funding than the state's public school districts.

-

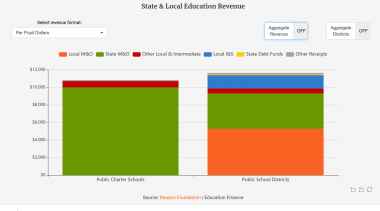

Examining Student Funding in Texas Charter Schools and Traditional Public Schools

Texas students who choose to attend a charter school receive $813 fewer dollars, on average, compared to peers in traditional public schools.

-

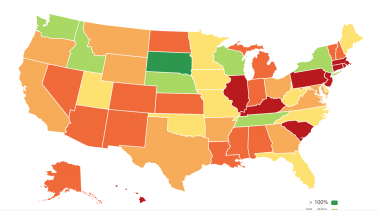

Public Pension Plans’ Funded Ratios Have Been Declining for Years

New data visualization reveals the decline of public pension funding across the country.

-

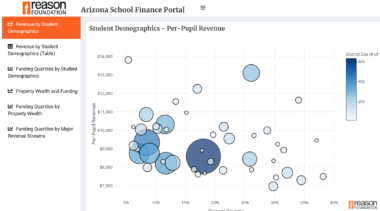

Arizona School Finance Dashboard

This interactive data portal displays how Arizona's K-12 school district student demographics compare to school district revenues.

-

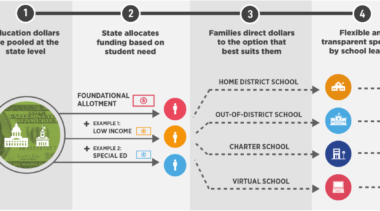

Infographic: How Student-Centered Funding Works and How to Get There

How policymakers can align education funding with students' needs.

-

Examining How Much Money That Pension Debt Takes Away From Michigan’s Classrooms Each Year

In 2018, Detroit Public Schools spent $2,202 per student on MPSERS debt, which equals nearly 27 percent of the district's per pupil foundation grant from the state.

-

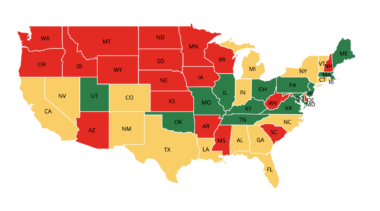

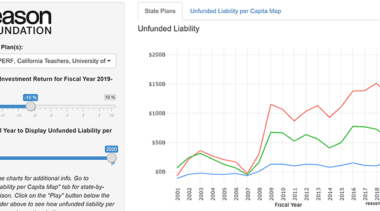

The Funded Status of State-Managed Public Pension Plans

State-level public pension plans' funded status dropped from 97.7 percent in 2001 to 73.6 percent in 2019.

-

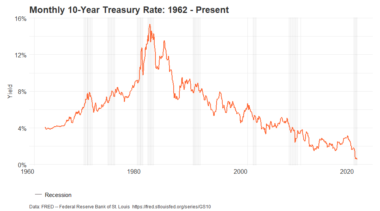

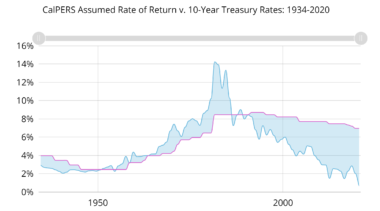

Historically Low 10-Year Treasury Yields Show Ongoing Challenges for Public Pensions

The all-time low 10-year Treasury rate yield is the latest reminder of the “new normal” in institutional investing.

-

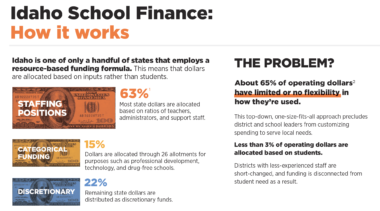

Infographic — Idaho School Finance: How It Works and How to Improve the System

Idaho should streamline its education funding system into a weighted-student formula that allocates dollars based on local students' needs.

-

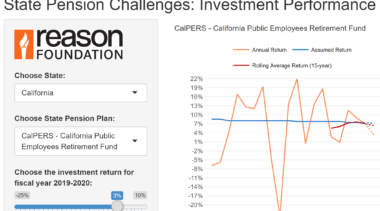

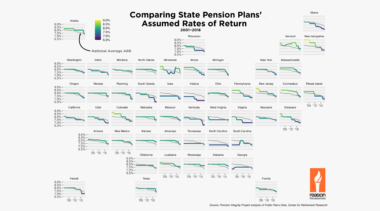

Public Pension Investment Performance Has Historically Fallen Short of Return Assumptions

Declining interest rates and market volatility over the last three decades have made it harder for public pension plan investment performance to match assumed rates of return - and plans have been slow to lower their assumptions.

-

What Happens to Taxpayer-Funded Pensions When Public Officials Are Convicted of Crimes?

The police officer charged with killing George Floyd is eligible for his full taxpayer funded pension. In fact, a majority of states provide retirement benefits to officers and public servants convicted of serious crimes.

-

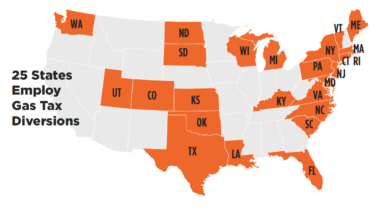

The State Gas Tax Money That Is Diverted Away From Roads and Highways

Half of the states divert state fuel taxes to pay for expenses unrelated to roads, including money shifted to law enforcement, education, tourism, environmental programs and more.

-

The Surprisingly Risk-Free Origin of Public Pension Investment Return Assumptions

A look back at the history of the California Public Employees’ Retirement System shows that pension systems originally took a very safe approach to investments - which may offer some lessons for today.

-

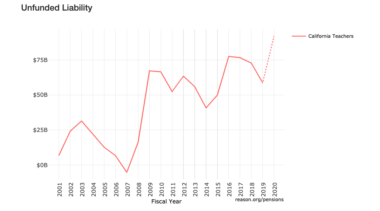

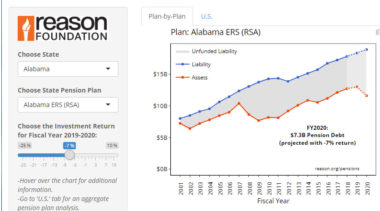

How Teacher Pension Plans Are Impacted by the Economic and Market Volatility

Choose a public pension plan and an investment return rate to see how that plan's unfunded liabilities and funded ratios change.

-

State Pension Challenges – Unfunded Liabilities Before and After COVID-19-Related Economic Downturn

This new interactive tool shows how one year of bad returns can affect the funding status of public pension plans and previews the challenges ahead for state-run pensions.

-

Previewing the COVID-19 Impact on State Pension Plans

Use this tool to choose your state's public pension plans and possible investment return rates to see how unfunded liabilities and funded ratios are impacted.

-

Map: Comparing State Pension Plans’ Assumed Rates of Return

This visualization shows how states have been gradually adjusting their assumed rates of return down to more realistic levels.