Zachary Christensen is a managing director of Reason Foundation's Pension Integrity Project.

Christensen’s work with Reason's Pension Integrity Project aims to promote solvent, sustainable retirement systems that provide retirement security for government workers while reducing long-term costs for taxpayers and employees. Zachary and his team provide education, reform policy options, and actuarial analysis for policymakers and stakeholders to help them design practical and viable reform proposals.

The Pension Integrity Project has provided technical assistance to several successful pension reform efforts in recent years, including in Michigan, Colorado, Arizona, South Carolina, Texas, and other states tackling persistent pension solvency challenges.

Christensen has contributed to in-depth solvency analysis of the Arizona PSPRS, Arkansas TRS, Louisiana TRSL, Texas ERS, and Texas TRS pension plans.

Christensen's work has been published in the Los Angeles Daily News, Orange County Register, NJ.com, Colorado Politics, and many other publications. He has also been featured in the Carolina Journal and the Michigan Capitol Confidential. His research has been published by the Hoover Institution, The Platte Institute, Texas Public Policy Foundation, and Rio Grande Foundation.

Prior to joining Reason Foundation, Christensen was a pension finance analyst at Stanford University’s Hoover Institution, where he worked on widely-cited research on the funding status and accounting methods for public sector retirement systems.

Christensen holds an M.S. in Public Policy from Pepperdine University and a B.S. in Political Science from Brigham Young University.

-

Senate Bill 88 would expose Alaska to potentially higher pension costs

Senate Bill 88 would likely cost Alaska more than $8 billion in the coming decades.

-

House Bill 22 and Senate Bill 35 threaten Alaska’s budgets

HB 22 and SB 35 would likely cost Alaska upwards of $800 million in the coming decades.

-

Senate Bill 11 would bring public pension risk back to Alaska

SB 11 would likely cost Alaska $9 billion in the coming decades.

-

Pension Reform News: Public pension bills in Texas, Alaska, Montana, and more

A move to undo pension reforms in Texas and Alaska, plus how pension costs crowd out other services.

-

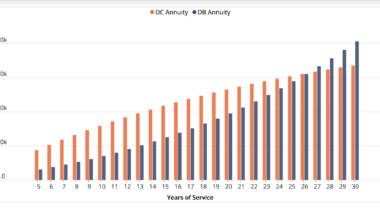

Comparing Alaska’s defined benefit and defined contribution retirement plans

Most of Alaska’s public employees would be better served in the existing defined contribution plan.

-

Pension Reform News: Modeling pension changes and costs, Alaska’s rollback of reform, and more

Plus: A pension bill in Montana, retirement benefits aren't priority for young public workers, SECURE Act 2.0 improvements, and more.

-

Modeling methodology and approach to analysis of public retirement systems

The Pension Integrity Project uses custom-built actuarial and employee benefit models that are tailored to reflect each unique retirement system.

-

Pension Reform News: Montana’s proposed reforms, poor 2022 investment results, and more

Plus: Undoing Alaska's pension reforms could cost $800 million, PRO Plan offers modern approach to public retirement, and more.

-

The 2022 fiscal year investment results for state pension plans

Overall, the median investment return result for state pension systems in 2022 is -5.2%.

-

Pension Reform News: Modernizing public sector retirement plans, North Dakota reforms, and more

Plus: Public pension funds take on more risk, and ESG proxy-voting trends.

-

Webinar: The Personal Retirement Optimization Plan

A plan for incorporating the benefits of 401(k)-style solutions into modern-day public sector retirement plans that give their workers flexibility and predictability of their benefits.

-

Frequently asked questions about the Personal Retirement Optimization Plan

The Personal Retirement Optimization Plan (or PRO Plan) is a new framework for public worker retirement benefits that delivers post-employment security in a cost-effective way.

-

Pension Reform News: ESG, public pensions exposed to FTX, and more

Plus: California's public pension debt grows, Georgia's hybrid plan improves, and more.

-

The Department of Labor’s new ESG rule puts the onus on states

This new rule sets the stage for state governments to establish their own standards.

-

Pension Reform News: ESG blueprint, Arizona’s pre-funding, and more

Plus: Cost-of-living increases in Texas, portable retirement plans, and warning signs from the U.K.

-

Pension Reform News: ESG debates, public pension plans’ worrying investment results, and more

Plus: Best practices for pension debt amortization and why state-run pension systems need to plan for recessions.

-

Most state pension plans are not adequately prepared for a recession

A recession could add trillions in debt to public retirement systems’ existing unfunded liabilities.

-

Pension Reform News: Join our ESG webinar, best practices for addressing inflation, and more

Plus: Join us for a webinar on Sept. 20 to discuss how ESG may impact public pension systems and taxpayers.