This newsletter from the Pension Integrity Project at Reason Foundation highlights articles, research, opinion, and other information related to public pension challenges and reform efforts across the nation. You can find previous editions here.

In This Issue:

Articles, Research & Spotlights

- Department of Labor to Withhold Funds from California Due to 2013 Pension Reform

- Oklahoma Reaches Full Pension Funding

- New York State’s Updated Investment Return Assumption

- Employee Pension Contributions on the Rise

- More Governments Turning to Pension Obligation Bonds

- No Better Time Than Now to Reassess Retirement Plan Design

News in Brief

Quotable Quotes on Pension Reform

Data Highlight

Contact the Pension Reform Help Desk

Articles, Research & Spotlights

Federal Department of Labor Halts California Transit Grants

California’s 2013 public pension reform that withstood years of legal scrutiny is now facing renewed opposition from the federal government. The U.S. Department of Labor recently indicated that it will be cutting off California transit agencies from billions in expected federal funding because the Office of Labor-Management Standards is claiming the state’s 2013 pension reform was a violation of funding conditions, specifically around mass transit workers’ collective bargaining rights. Reason Foundation’s Marc Joffe explains this development and gives background on the origin of these laws that could determine the outcome of whether California will receive around $12 billion in federal funding.

Oklahoma’s Pension Reforms Have Led the State Employees’ Plan to Full Funding

According to 2021 financial reports, the Oklahoma Public Employees Retirement System (OPERS) climbed from 66% funded in 2010 to now essentially fully funded at 99.5% funded today. The pension system’s success can be attributed to a combination of actuarial assumption adjustments that accurately estimated costs, legislative funding to bring assets back to necessary levels, and significant benefit changes that kept the growth of liabilities to manageable levels. In this commentary, Reason Foundation’s Rod Crane evaluates the reforms that brought Oklahoma out of the pension funding quagmire.

New York State’s New Pension Investment Assumptions Will Help Plan Funding

The country’s third-largest public retirement fund, the New York State Common Retirement Fund, recently adopted a significantly reduced assumed rate of return, bringing its assumption down from 6.8% to 5.9%. A new analysis from Reason’s Jen Sidorova suggests that this move will align the fund’s expectations with the forecasts of market experts. Public pension plans around the country should follow New York’s lead, as this new return rate assumption will improve the state’s chances of achieving and maintaining full funding of promised pension benefits.

Most Public Pension Plans Raised Employee Contribution Rates in the Last Decade, Report Shows

A new report from the National Association of State Retirement Administrators (NASRA) finds that 80% of states have increased pension contribution rates for employees since 2009. On average, state employees are now paying 1.25% more of their paychecks in pension contributions. Reason’s Ryan Frost summarizes these findings, explaining how many plans are turning to risk-sharing options and alternative types of plans to address growing costs.

Governments Increased Their Use of Pension Obligation Bonds in 2021

A recently released brief from S&P Global Ratings reports that the amount of pension obligation bonds (POBs) rated this year is already double the amount from the previous year, totaling $6.3 billion by mid-September. In this commentary, Reason’s Jordan Campbell summarizes the report and highlights the risks and rewards involved in issuing POBs.

Amidst Great Investment Returns, Public Pension Systems Should Reassess Plan Designs

Excellent investment returns from the last fiscal year will give many public pension plans some much-needed breathing room, but financial experts are still predicting lower returns in the long term. Reason’s Richard Hiller and Rod Crane suggest that policymakers should use this moment to reflect on how public pension plan’s can be improved to better serve their evolving workforces.

News in Brief

Brief Explores the Challenges and Potential Solutions of an Aging American Workforce

Elderly workers have played an increasingly valuable role in the country’s economic growth, but a spike in retirements during the COVID-19 pandemic could signal a shift in behavior. A new brief from the Terry Group and the Global Aging Institute examines trends in an aging workforce and highlights the economic benefits that elderly workers provide. The report surmises that the shift from defined benefit pension plans (which require higher costs for older workers) to defined contribution plans has incentivized employers to hire and retain older workers. The full brief is available here.

Quotable Quotes on Pension Reform

“It’s simply not designed for the times…Times have changed since this portfolio was put together.”

—CalPERS Managing Investment Director Sterling Gunn on their move to increase allocation in private equity investments in “Many California Public Employees to Pay More for Pensions as CalPERS Lowers Earnings Target,” The Sacramento Bee, Nov. 16, 2021

“I do think the $500,000 is going to have a very significant (positive) impact.”

—Tampa Bay Finance Director Allison Broihier on a one-time contribution to reduce unfunded pension liabilities in “City Set to Pare Firefighters’ Pension Debt,” Tampa Bay Newspapers, Nov. 12, 2021

“It’s imperative to change the governance model at PERA for the sake of the retirees, current PERA members and for that matter, the people of New Mexico because, ultimately, it’s the taxpayer that holds the bill…In my opinion, history will judge us harshly if we don’t act to clean up the governance structure.”

—New Mexico Educational Retirement Board Deputy Chief Investment Officer Stephen Neel in “Some Seek to Change Governance Structure of PERA,” Santa Fe New Mexican, Oct. 31, 2021

Data Highlight

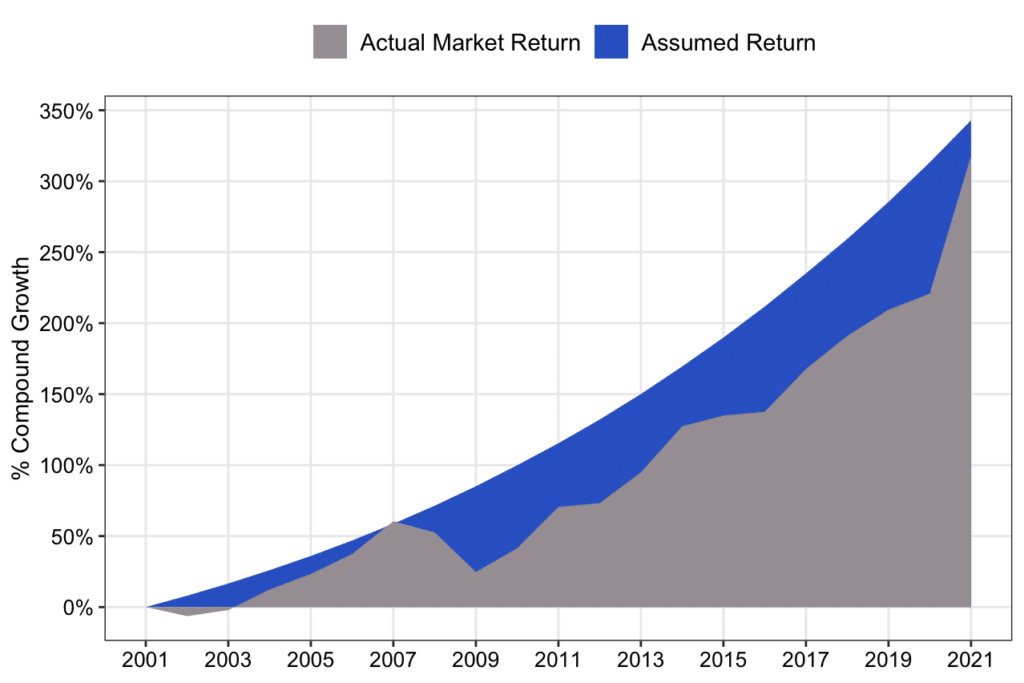

Each month we feature a pension-related chart or infographic of interest generated by one of our Pension Integrity Project analysts. This month, analyst Anil Niraula created a visualization of expected vs actual asset growth for all state-managed pension plans from 2001 to 2021. Access the visualization and details here.

Compound Percentage Growth Based on Median Assumed vs. Actual State-Managed Pension Plan Returns (2001-2021)

Source: Pension Integrity Project database sourced from publicly available valuation reports, ACRFs, and other publications.

Contact the Pension Reform Help Desk

Reason Foundation’s Pension Reform Help Desk provides information on Reason’s work on pension reform and resources for those wishing to pursue pension reform in their states, counties, and cities. Feel free to contact the Reason Pension Reform Help Desk by e-mail at pensionhelpdesk@reason.org.

Follow the discussion on pensions and other governmental reforms at Reason Foundation’s website and on Twitter @ReasonPensions. As we continually strive to improve the publication, please feel free to send your questions, comments, and suggestions to zachary.christensen@reason.org.