In August, New York state’s Common Retirement Fund announced its decision to lower the plan’s assumed rate of return on investments from 6.8% to 5.9%. This move gave New York the second-lowest assumed rate of return (ARR) among the country’s 130 largest state and local pension plans. The New York Common Retirement Fund (NYCRF) is a leader in recognizing updated market forecasts, particularly those that are looking at the next 10-to-15 years. Reason Foundation’s Pension Integrity Project’s analysis confirms that the pension plan is acting appropriately by reducing its investment expectations. Market forecasts also suggest that other public pension plans around the country should take a similarly proactive approach to lower their assumed rates of return.

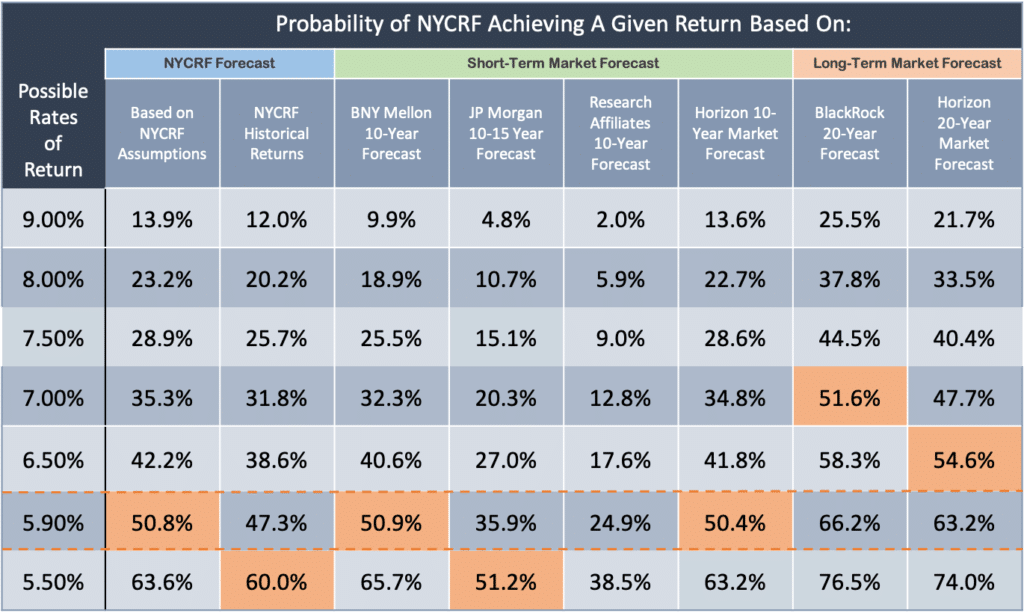

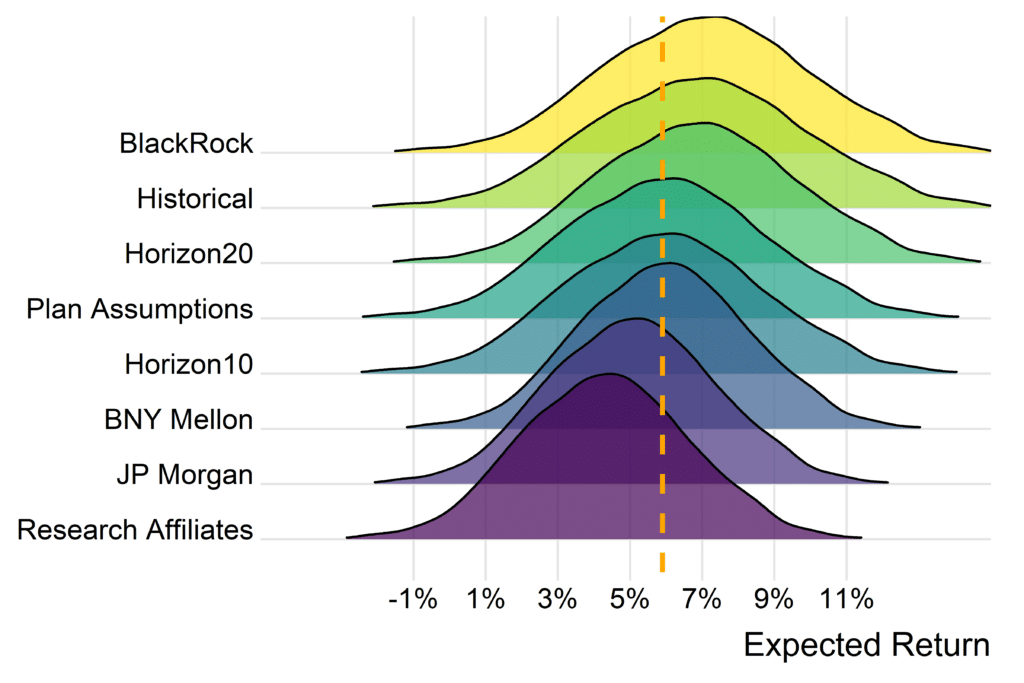

Table 1 and Figure 1 below show the results of a Monte Carlo simulation model based on NYCRF’s target asset allocation and reported expected returns by asset class. This analysis uses 10,000 simulations to generate both the probabilities of hitting certain returns and expected return distributions. Using forecasts of investment returns by asset class from BNY Melon, JP Morgan Chase, BlackRock, Research Affiliates, and Horizon Actuarial Services, the analysis matches the specific target allocation of asset classes set by NYCRF. These data indicate NYCRF’s probability of achieving a target return if all other economic and demographic assumptions are hit.

Table 1. Probability Analysis: Measuring the Likelihood of NYCRF Achieving Various Rates of Return

Graph 1. Probability Analysis: Probability Distribution of Return Outcomes

The results show that the pension fund’s new assumed rate of return is in line with 10-year forecasts from most market experts and better reflects the system’s investment experience from the last few decades. Even though New York’s new assumed rate of return of 5.9% will put the system’s rate well below the nation’s average of 7.2%, it is still slightly higher than the 5.7% average actual rate of return. over the last 20 years. It’s also important to note that two of the short-term forecasts used in this analysis still indicate that NYCRF may be wise to lower expectations even further.

Like many other public pension systems, New York has had a year of exceptional investment returns but the plan should not expect excellent returns moving forward.

Having realistic expectations of long-term investment outcomes plays a major factor in a pension system reaching its fiscal goals. When long-term investment returns are consistently below the rate a plan assumes it will achieve each year, asset growth will lag behind the levels needed to fund promised benefits. This leads to growth in unfunded pension liabilities and long-term costs for employees and taxpayers.

Going forward, public pension plans across the country should follow NYCRF’s lead and assess their near-term investment outlook and adjust assumptions accordingly.

Stay in Touch with Our Pension Experts

Reason Foundation’s Pension Integrity Project has helped policymakers in states like Arizona, Colorado, Michigan, and Montana implement substantive pension reforms. Our monthly newsletter highlights the latest actuarial analysis and policy insights from our team.