An updated 2024 version of this analysis is available here.

Public pension reform is not for the faint of heart. It requires an understanding of a myriad of arcane subjects and issues, including actuarial methods and assumptions, economic forecasting, investment strategies, and solvency risk analysis. Successful public pension reform also requires an intimate understanding of various public retirement planning approaches and design, the role benefits play in managing workforce needs, and the tradeoffs between defined benefit and defined contribution plans.

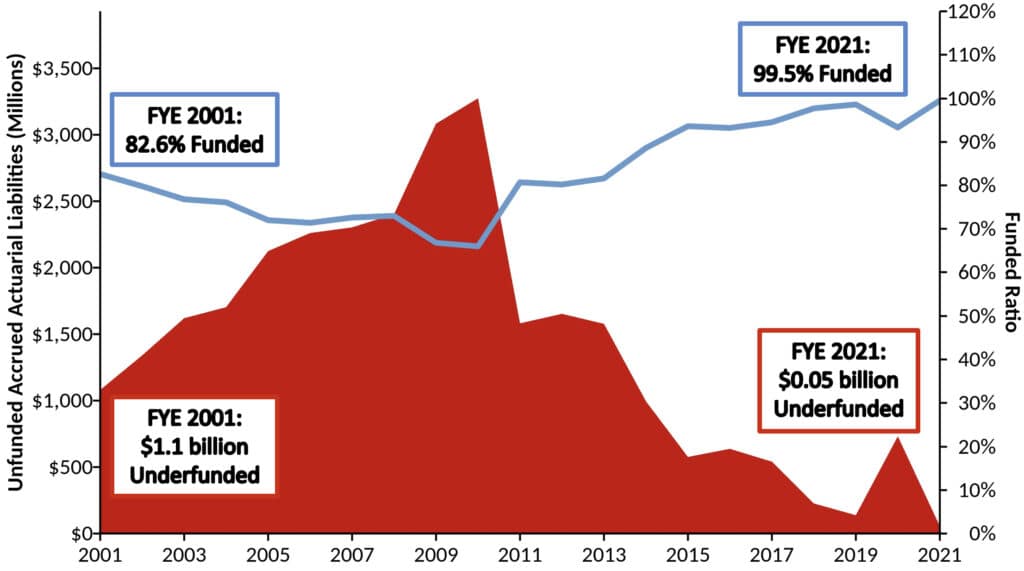

Despite these significant challenges, some states and cities provide good examples of what successful public pension reforms should look like. For example, the pension reforms made by Oklahoma between 2011 and 2014 have resulted in the public pension system being almost 100% funded in 2021.

Oklahoma Defined Benefit Pension Reform

In 2014, Oklahoma’s state legislature capped a multi-year effort to improve the funding and sustainability of the Oklahoma Public Employees Retirement System, OKPERS, which provides benefits for state and local government employees. The pension system was only 66% funded in 2010. A 2014 Reason Foundation interview with Oklahoma State Rep. Randy McDaniel summarized the two major changes made to OKPERS between 2011 and 2014:

- 2011 – Elimination of future cost-of-living adjustment (COLA) benefit increases without full advance funding, which reduced pension liabilities and improved funding levels from about 66% to over 80% on an actuarial asset basis.

- 2014 – Freezing the OKPERS defined benefit plan to new entrants after Nov. 2015 and creation of a new defined contribution plan – the Oklahoma Pathfinder Retirement Plan — for new hires after that date.

In the Reason interview, Rep. McDaniel outlined some of the key principles that led to these successful pension reform efforts, including “acknowledging the problem” and “teamwork”, but he put a particular emphasis on tenacity:

“The final issue is tenacity. Reforms were required if we were going to have a sustainable Oklahoma. We could no longer make excuses and turn our backs on a problem that was impacting all of our other funding priorities. There is no substitute for hard work and dedication to mission accomplishment.”

These public pension reforms, as well as the state’s proactive pension contribution and assumption policies, helped OKPERS improve its funding and reduce pension debt at an impressive rate.

In 2010 the system was only about 66% funded. But, a combination of actuarial assumption adjustments, legislative funding, and benefit changes dramatically improved the financial solvency of OKPERS in the last decade and the most recent actuarial reporting shows the system reached 99.5% funded in 2021.

Figure 1. Oklahoma PERS Unfunded Liabilities (2001 -2021)

How did Oklahoma achieve moving from 66% funding in 2010 to 99.5% funding in 2021 when many other public pension plans struggled to improve their solvency over that same period?

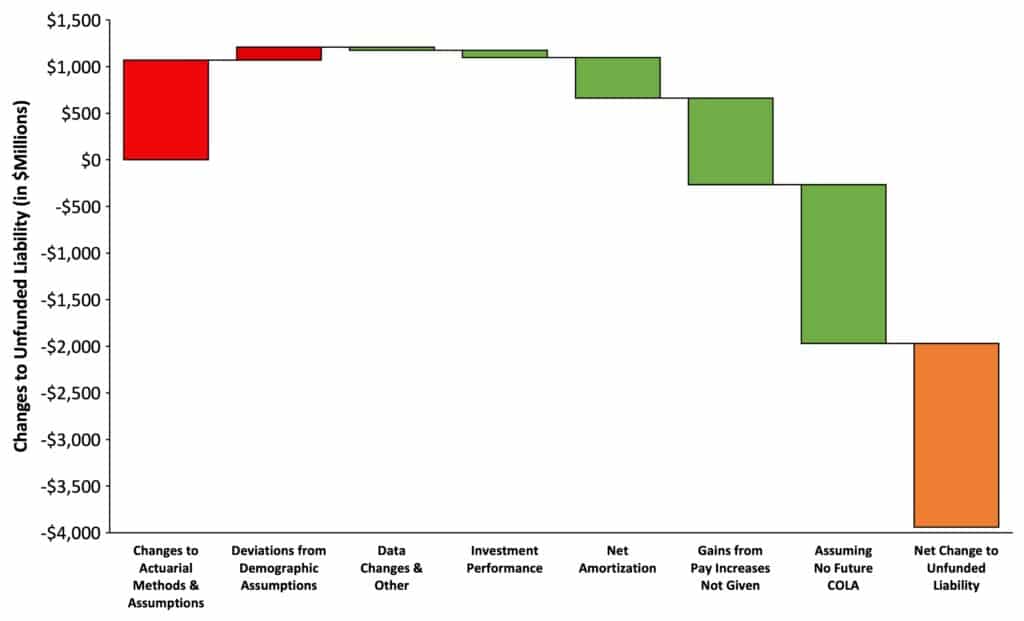

The keys to the state’s success include:

- Eliminating the automatic cost-of-living adjustments in 2011, which reduced OKPERS’ pension debt by $1.7 billion in a single year.

- Maintaining a 16.5% statutory employer contribution rate on total OKPERS and DC Pathfinder covered payroll, which exceeds the actuarial determined employer contribution rate of 13.41% (a surplus contribution of 3.09% of pay in the 2020 actuarial valuation). This provides a funding cushion against future actuarial negative experience. This cushion set the stage for the system to make real progress on eliminating pension debt by $360 million between 2006 and 2020.

- Continuing the 20-year closed amortization period methodology adopted in 2007 (which pays off unfunded liabilities more quickly).

The combination of these benefit changes and funding policies resulted in a nearly 100% funding level by 2019 (98.6%), which allowed OKPERS to take on additional de-risking measures. OKPERS reduced the investment return assumption (ARR) from 7.25% to 7.00% in 2017, and from 7.0% to 6.5% in 2020. The recent reduction to 6.5% increased reported unfunded liabilities by about $545 million and reduced the funded status from 98.6% to 93.6% in 2020. However, OKPERS significantly reduced the risks of unexpected growth in unfunded liabilities in the future by lowering its assumed rate of return.

The chart below provides a breakdown of the changes in unfunded pension liabilities by major category for the 2006-2021 period. The red bars indicate an increase in pension debt while the green bars indicate a reduction in liability.

Figure 2. Cause of OKPERS Pension Debt (2006-2021)

The Oklahoma “Pathfinder” Defined Contribution Plan

The design of the new Pathfinder defined contribution plan for new hires launched in 2015 received substantial consideration and debate by Oklahoma policymakers. Rep. McDaniels noted in the 2014 Reason interview how important it is that public pension plan design balance the needs of employees with sustainable and affordable contribution levels for taxpayers. The predictability of costs associated with the Pathfinder was also an important factor supporting the state’s ability to maintain adequate funding of the legacy defined benefit plan.

While defined contribution (DC) plans have been used as public retirement plans for many decades, not all DC plans meet the definition of an effective retirement plan. Reason has identified a few straightforward plan design principles, that when carefully incorporated into DC plans, serve to create a sound retirement plan that checks all the boxes.

The Oklahoma Pathfinder Plan meets many of these DC retirement plan principles including an adequate total contribution design. It provides a 6% employer contribution, a mandatory 4.5% employee contribution, and an additional employer match of 1% if the employee makes an elective 457(b) deferral of at least 2.5%. The 10.5%-to-14% contribution range meets what Reason Foundation’s Pension Integrity Project and most other retirement experts consider best practice, which is a 10%-15% total contribution rate.

There are, however, some remaining areas of improvement for Oklahoma’s defined contribution plan that could be considered by the state. Vesting in employer contributions is currently 20% per year with 100% vesting after five years of service. Shorter vesting periods are preferred as a best practice to help preserve retirement savings for shorter service employees.

Another concern is the plan does not offer any lifetime income solution for participants notwithstanding the authorizing legislation for the Pathfinder plan does allow the OKPERS Board to offer lifetime income solutions to Pathfinder participants. Oklahoma Statutes §74-935.9 provides in relevant part:

“In selecting investment options for participants in the plan, the Board shall give due consideration to offering investment options provided by business entities that provide guaranteed lifetime income in retirement such as annuities, guaranteed investment contracts, or similar products.”

While the statutory directive to the OKPERS Board is not prescriptive, it does indicate legislative intent that retirement income is an important consideration. The OKPERS Board has elected to only offer a participant-directed investment menu of mutual funds with a target-date series. The default investment is a custom-balanced fund. According to the most recent annual financial report, about 91% of assets are in the balanced fund, largely because of this default feature.

The summary of the investment policy statement in the annual financial report for the Oklahoma Pathfinder is wealth accumulation oriented with no focus on lifetime income as a plan objective. It provides the following purpose statements, which are focused on wealth accumulation:

- “To provide participants with a prudent menu of investment options to diversify their investment portfolios in order to efficiently achieve reasonable financial goals for retirement.

- To provide education to participants to help them build portfolios which maximize the probability of achieving their investment goals.”

The Pension Integrity Project recommends the state and the OKPERS Board consider making retirement income a formal objective for the Pathfinder plan with the addition of appropriate lifetime income solutions. Strengthening the current statutory language to provide more direct guidance to the OKPERS Board should also be considered.

Conclusion

The public pension reform efforts in Oklahoma are a success story that can guide other state and local governments as they address their own unfunded public pension plans. Oklahoma’s successful reforms can be partially attributed to being tenacious in pursuing sound funding policy for the legacy defined benefit retirement system, along with reforms to manage runaway costs for new members going forward. Such policy improvements preserved the promised benefits for those employees while ensuring a sound retirement plan for future employees. Also of note, Oklahoma did not view the 2011 and 2014 pension reforms as one-time efforts, but rather the beginning of a long-term and ongoing process of monitoring changing fiscal circumstances.

Oklahoma has remained willing to take additional measures to ensure the resiliency of its public retirement system for the benefit of participating employers, employees, and taxpayers.

Stay in Touch with Our Pension Experts

Reason Foundation’s Pension Integrity Project has helped policymakers in states like Arizona, Colorado, Michigan, and Montana implement substantive pension reforms. Our monthly newsletter highlights the latest actuarial analysis and policy insights from our team.