-

How text message reminders can help reduce technical parole and probation violations

This report's findings suggest that sending text message reminders for scheduled appointments could reduce canceled and missed parole and probation appointments by as much as 21% and 29%, respectively.

-

Fines and fees: Consequences and opportunities for reform

The use of fines and fees to directly fund courts, law enforcement agencies, or other government activities can result in undesirable conflicts of interest.

-

Grading every state’s telehealth laws

While many state telehealth laws changed during the COVID-19 pandemic, some of those reforms have expired and many best practices that would improve health care and help patients still need to be implemented.

-

The effects of cash bail on crime and court appearances

Research suggests that curtailing the use of monetary release conditions among low-risk defendants would not result in dramatic drops in court attendance or increased risk of reoffending.

-

Rating states on telehealth best practices

This toolkit aims to help policymakers move towards quality-oriented, affordable, and innovative health systems by ensuring that their state telehealth laws remove barriers that prevent access to care.

-

Actuary highlights House Bill 55’s costs and risks to the Alaska Public Employees’ Retirement System

Changes of the magnitude being proposed in Alaska House BIll 55 should receive rigorous actuarial and risk analyses that have not yet been conducted.

-

Does North Dakota House Bill 1040 meet the objectives for good pension reform?

The bill would help ensure North Dakota has the ability to pay 100% of the benefits earned and accrued by active workers and retirees.

-

Pension changes in House Bill 22 and Senate Bill 35 threaten Alaska’s budgets

HB 22 and SB 35 could cost Alaska upwards of $800 million in the coming decades.

-

Examining an Alaska pension reform counterfactual

A look at what would have happened to the Public Employee Retirement System and Teacher Retirement System if proposed pension reforms from 2021 had been enacted.

-

State taxpayers’ share of MPSERS debt would increase under various proposals

The first 20.96% of each year’s unfunded accrued liability contribution is currently paid by local school districts, and any amount required above that is paid by the state.

-

House Bill 78 exposes Alaska to significant additional costs

This bill could realistically add $11.4 billion in additional costs to future state budgets and reintroduce Alaska to significant pension risk.

-

Defined Benefit Plans: Best Practices in Incorporating Risk Sharing

Public pension risk sharing can increase plan solvency, provide better accountability, and lessen the burden that unfunded liabilities have on taxpayers.

-

Best practices in hybrid retirement plan design

The recent shift toward offering hybrid plans to newly hired government employees suggests that governmental employers may be changing their perceptions of the balance of financial risk between employees and employers.

-

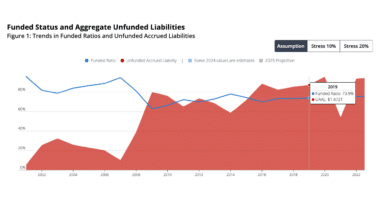

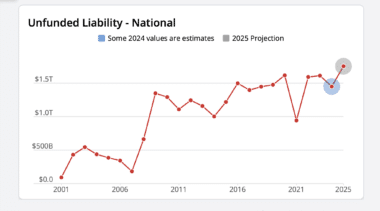

Annual pension solvency and performance report

At the end of the 2023 fiscal year, the nation's public pension systems had $1.59 trillion in total unfunded liabilities.

-

Report: State and local pension plans have $1.48 trillion in debt

State pension systems have $1.29 trillion in unfunded liabilities, and local governments have $187 billion.

-

Consumer Surplus in the FDA’s Tobacco Regulations

The forthcoming cost-benefit analyses of the FDA’s proposals for nicotine reduction in tobacco and for banning flavors in e-cigarettes must follow standard economic methodology and not assume away part of the consumer surplus.

-

Public Health Models and Related Government Interventions: A Primer

What are the main concepts and models of public health? To which extent do public health considerations require government intervention?

-

Best Practices for Providing Education Funding for Economically Disadvantaged Students

This report examines federal education funding for student poverty and how state education finance systems can best fund students.