-

California’s unfunded pension liabilities will burden state and local governments

CalPERS now has approximately $611 billion in pension debt and is 72% funded.

-

What Congress needs to know about drone airspace integration

Congress should pay close attention to ongoing activities in the drone industry and at FAA.

-

Social media companies and Section 230 are not to blame for Jan. 6 riot

Section 230 helps protect free speech online.

-

Wisconsin’s open enrollment policy success is a model for states looking to increase educational opportunities

Wisconsin's public school open enrollment program has grown from serving less than 3,000 students in the 1998-99 school year to 70,428 students in the 2020-21 school year.

-

Amtrak’s Gulf Coast line proposal would make taxpayers prop up a financially unsustainable service

Policymakers should look to rail alternatives that require no (or smaller) per-passenger subsidies and less interference with freight rail.

-

Regulations keep homeownership out of reach for young Americans

Housing policy reforms are urgently needed to place homeownership back within the reach of younger adults.

-

Reformed pensions in Arizona, Michigan receiving supplemental funding to pay down debt faster

Arizona and Michigan’s recent treatment of funding for pension systems is an example of the value of comprehensive pension reform.

-

Examining the populations best served by defined benefit and defined contribution plans

The claim that a defined benefit plan is more efficient than a defined contribution plan, purely on a basis of cost, overlooks a larger and more meaningful perspective regarding benefit distribution.

-

How to maximize Arizona’s water investment

Arizona has set aside millions for water conservation and augmentation projects, but the state needs private partners to deliver this needed infrastructure.

-

Florida Gov. DeSantis continues to pursue Everglades restoration

Florida lawmakers have taken significant steps to advance restoration goals and speed up various projects that have been in progress for nearly two decades.

-

Report says big tech monopoly claims are overblown

Paper says to look at Amazon, Google, Facebook, Netflix, Apple, Amazon and others by the level of firm concentration in the economy.

-

California repeals cannabis cultivation tax

California has just made tremendous progress in trying to turn around its regulated cannabis market, and more could soon be on the way.

-

What states can learn from Arizona’s new student transportation law

State policymakers can work to remove restrictions on the types of vehicles schools can use to transport students and reform licensing rules that prevent schools from hiring qualified drivers.

-

New regulatory burdens for the transportation sector from the Biden administration

The current volume of regulatory activity at the U.S. Department of Transportation is typical of what has been seen over the past two administrations.

-

North Carolina House won’t take up bipartisan medical marijuana bill passed by State Senate

North and South Carolina are among the last remaining bastions of medical marijuana prohibition in America.

-

Public pension funds and public-private partnerships could increase funding for transportation infrastructure

Public pension funds could invest in public-private partnerships that produce more greenfield and brownfield transportation projects across the United States.

-

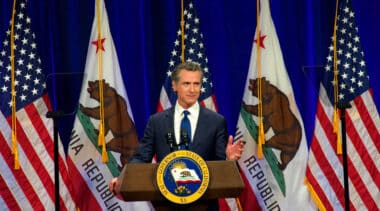

It’s time to end the COVID emergency and limit Newsom’s state of emergency powers

According to a recent analysis, 48 states of emergency declarations are currently in force in California.

-

What will public schools do when federal pandemic relief funding runs out?

Pre-pandemic trends offer clues of how this might play out across state capitals.