On June 21, the White House Office of Management and Budget’s Office of Information and Regulatory Affairs (OIRA) released the Spring 2022 Uniform Agenda of Regulatory and Deregulatory Actions, the biannual snapshot of the federal administrative state. It’s a large and unwieldy document but sheds some light on regulatory activities usually shrouded by the complexity of the federal bureaucracy.

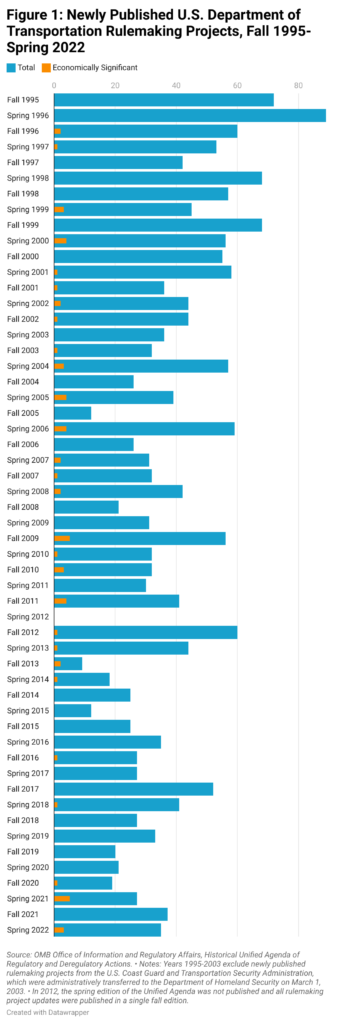

I previously examined the transportation rulemakings contained in Fall 2021, Spring 2021, and Spring 2020 editions of the Unified Agenda for Reason Foundation. From a historical perspective, Figure 1 below shows the current volume of regulatory activity at the U.S. Department of Transportation is typical of what has been seen over the past two administrations.

The Spring 2022 Unified Agenda lists 228 active rulemaking projects at the U.S. Department of Transportation. Of those 228, 35 are new rulemaking projects listed in Table 1 at the bottom of this article. And of those 35, the most impactful are the three deemed “economically significant.” Economically significant rules are defined by Executive Order 12866 (1993) as regulations that would have an annual impact on the economy of $100 million or more or otherwise “adversely affect in a material way the economy, a sector of the economy, productivity, competition, jobs, the environment, public health or safety, or State, local, or tribal governments or communities.”

For the U.S. Department of Transportation, the three economically significant rulemakings first published in the Spring 2022 Unified Agenda were all from the National Highway Traffic Safety Administration (NHTSA):

- Advanced Impaired Driving Technology: Mandated by November 2021’s Infrastructure Investment and Jobs Act (aka the Bipartisan Infrastructure Law) Section 24220, this rulemaking would potentially mandate that new cars be equipped with technology designed to detect drunk and/or drugged driving. NHTSA anticipates publishing an advance notice of proposed rulemaking in December 2022. While the law mandates this rulemaking to be completed by November 2024, this statutory deadline will almost certainly be missed. NHTSA auto safety rulemakings involving established technologies typically take at least eight years, and the technology mandated here does not exist in a reliable form. Fortunately, the law provides an escape hatch if regulators cannot identify an appropriate technology to mandate within the next decade.

- Rear Designated Seating Position Alert: Also mandated by the Infrastructure Investment and Jobs Act (Section 24222), this rulemaking would mandate that all new cars be equipped with audio and visual rear-seat occupant reminders. This comes in response to tragic accidents of parents forgetting their young children in the backseat of hot cars. NHTSA anticipates publishing a notice of proposed rulemaking in December 2022. The law requires this rulemaking to be completed by November 2023, but NHTSA will almost certainly miss this statutory deadline as well.

- Light Vehicle CAFE Standards Beyond MY [Model Year] 2026: Unlike the other two new economically significant rulemakings, this planned fuel economy regulation is purely discretionary and is the companion to what will likely become the most costly rule on record. Over the past two decades, the two most costly federal regulations have been the Biden administration’s “Revised 2023 and Later Model Year Light-Duty Vehicle Greenhouse Gas Emissions Standards” final rule from 2021 ($14 billion/year at a 7% discount rate) and the Obama administration’s “2017 and Later Model Year Light-Duty Vehicle Greenhouse Gas Emissions” final rule from 2012 ($10.8 billion/year at a 7% discount rate). Both of those rules were published by the Environmental Protection Agency, which jointly administers the Corporate Average Fuel Economy (CAFE) program with NHTSA. NHTSA anticipates publishing a notice of proposed rulemaking in March 2023.

In addition to these new economically significant rulemaking projects, there are several with smaller economy-wide impacts in the regulatory pipeline at the DOT that are worth highlighting in light of the current supply chain and energy market turmoil. These include:

- Safe Integration of Automated Driving Systems-Equipped Commercial Motor Vehicles: This rulemaking from the Federal Motor Carrier Safety Administration (FMCSA) could begin to clear the path for autonomous heavy trucking. The technologies involved have the potential to dramatically improve freight transportation productivity and cut costs. However, the Biden administration is considered close with organized labor, which opposes transportation automation. FMCSA anticipates publishing a notice of proposed rulemaking in January 2023. However, in the Fall 2021 Unified Agenda, FMCSA indicated that it expected to publish the NPRM in June 2022, and politics may cause this rulemaking project to be delayed again.

- Train Crew Staffing: While the U.S. Department of Transportation under the Biden administration is slowly moving forward on trucking automation, it appears poised to take a significant step backward on freight rail automation. Despite being forced to spend billions of their own funds over the past decade installing automated train safety technology known as positive train control, America’s private freight railroads may be prohibited from taking full advantage of emerging train automation technologies due to union opposition. This proposed regulation from the Federal Railroad Administration (FRA) was previously rejected as lacking a safety basis and would require that a minimum of two crewmembers be on board a freight train at all times, save a few limited potential exceptions. Such a rule would disadvantage freight rail relative to trucks, which produce 10 times more carbon dioxide to move shipping containers over the same distance. It also raises an interesting political question: Will this proposed rule from FRA cause friction between labor and environmental groups? In the Spring 2022 Unified Agenda, FRA anticipated a June 2022 publication of this proposed rule, suggesting publication is likely imminent.

- Hazardous Materials: Suspension of HMR Amendments Authorizing Transportation of Liquefied Natural Gas by Rail: This final rule from the Pipelines and Hazardous Materials Safety Administration (PHMSA) would ban recently authorized liquefied natural gas (LNG) by rail until a separate new rule from PHMSA on LNG tank cars is completed or June 30, 2024, whichever comes first. Since PHMSA does not anticipate publishing the notice of proposed rulemaking on that second regulation until January 2023, the practical effect of this rule will likely be an 18-month ban on LNG by rail. While ostensibly about safety, this is largely being carried out at the insistence of environmental groups, which have adopted an absolutist “keep it in the ground” position on all fossil fuels. The safety basis is both unsupported by the data and ignores that LNG is currently shipped around the country by tank trucks on America’s roadways, which present far more potential safety conflicts than railways. Railroads have also safely moved liquefied petroleum gas for decades, which poses a similar or greater risk than LNG transportation. PHMSA anticipates the final rule to be published in December 2022.

The Biden administration faces some tough decisions. While the U.S. DOT under Transportation Secretary Pete Buttigieg often seems reflexively pro-regulation, the economic fallout from the COVID-19 pandemic and responses to it are casting an unfavorable light on some of its preferred policies. Thus, it would not be surprising if the regulatory pipeline slows over the next few months in response to the upcoming elections, inflation, supply chain issues, and other economic concerns.

Table 1: U.S. Department of Transportation Rulemaking Projects First Published in the Spring 2022 Unified Agenda

| Agency | Stage of Rulemaking | Title | RIN |

| OST | Proposed Rule Stage | Periodic Reviews of Basic Essential Air Service Levels | 2105-AF13 |

| OST | Proposed Rule Stage | Ensuring Safe Accommodations for Air Travelers With Disabilities Using Wheelchairs | 2105-AF14 |

| OST | Final Rule Stage | Revisions to Civil Penalty Amounts, 2023 | 2105-AF12 |

| FAA | Proposed Rule Stage | Airman Certification Standards & Practical Test Standards for Airmen: Incorporation by Reference | 2120-AL74 |

| FAA | Final Rule Stage | Prohibition Against Certain Flights in the Tehran Flight Information Region (FIR) (OIIX) | 2120-AL75 |

| FAA | Final Rule Stage | Prohibition Against Certain Flights in the Baghdad Flight Information Region (FIR) (ORBB) | 2120-AL76 |

| FHWA | Proposed Rule Stage | National Electric Vehicle Infrastructure Formula Program | 2125-AG10 |

| FMCSA | Proposed Rule Stage | Emergency Egress Requirements for Buses; Amendments to Determination of Seating Capacity and Designated Seating Positions | 2126-AC55 |

| FMCSA | Proposed Rule Stage | Parts and Accessories Necessary for Safe Operation; General Amendments | 2126-AC56 |

| FMCSA | Proposed Rule Stage | Providers of Recreational Activities | 2126-AC57 |

| FMCSA | Proposed Rule Stage | Self-Insurance Program Cost Recovery | 2126-AC58 |

| NHTSA | Prerule Stage | Advanced Impaired Driving Technology | 2127-AM50 |

| NHTSA | Prerule Stage | Seatback Safety Standards | 2127-AM53 |

| NHTSA | Prerule Stage | Side Underride Guards on Trailers and Semitrailers | 2127-AM54 |

| NHTSA | Proposed Rule Stage | Uniform Procedures for State Highway Safety Grant Programs | 2127-AM45 |

| NHTSA | Proposed Rule Stage | Registered Importer Regulation Modernization | 2127-AM47 |

| NHTSA | Proposed Rule Stage | Seat Belts in Limousines | 2127-AM48 |

| NHTSA | Proposed Rule Stage | Rear Designated Seating Position Alert | 2127-AM49 |

| NHTSA | Proposed Rule Stage | Amend FMVSS No. 108 For On-Vehicle Headlamp Testing | 2127-AM51 |

| NHTSA | Proposed Rule Stage | Minimum Performance Standards for Lane Departure Warning and Lane-Keeping Assist Systems | 2127-AM52 |

| NHTSA | Proposed Rule Stage | Light Vehicle CAFE Standards Beyond MY 2026 | 2127-AM55 |

| NHTSA | Proposed Rule Stage | Part 572 THOR 5th Female Crash Test Dummy | 2127-AM56 |

| NHTSA | Final Rule Stage | Regulatory Update to Transfer Programs | 2127-AM46 |

| FRA | Proposed Rule Stage | Dispatcher Certification | 2130-AC91 |

| FRA | Proposed Rule Stage | Signal Employee Certification | 2130-AC92 |

| FTA | Proposed Rule Stage | Rail Transit Roadway Worker Protection | 2132-AB41 |

| FTA | Proposed Rule Stage | State Safety Oversight | 2132-AB42 |

| FTA | Proposed Rule Stage | Public Transportation Safety Certification Training Program | 2132-AB43 |

| FTA | Proposed Rule Stage | Public Transportation Agency Safety Plans | 2132-AB44 |

| FTA | Proposed Rule Stage | Statewide and Nonmetropolitan and Metropolitan Transportation Planning | 2132-AB45 |

| MARAD | Proposed Rule Stage | Cable Security Fleet | 2133-AB93 |

| MARAD | Proposed Rule Stage | Revision of the State and Regional Maritime Academy Regulations | 2133-AB94 |

| MARAD | Proposed Rule Stage | Amendment to the United States Merchant Marine Academy Regulations; Maritime Service Obligation | 2133-AB96 |

| MARAD | Final Rule Stage | Tanker Security Program | 2133-AB95 |

| PHMSA | Prerule Stage | Hazardous Materials: Adjusting Registration and Fee Assessment Program | 2137-AF59 |

Source: Office of Information and Regulatory Affairs, Unified Agenda of Regulatory and Deregulatory Actions, Spring 2022

Note: RIN = Regulation Identifier Number, a unique alphanumeric code assigned by the Regulatory Information Service Center to each rulemaking project listed in the Unified Agenda. An explanation of Stage of Rulemaking terms can be found on page 8 of the Introduction to the Unified Agenda from the Regulatory Information Service Center.