Jordan Campbell is managing director of government finance and senior quantitative analyst at Reason Foundation.

Prior to joining Reason, Campbell worked at a marketing analytics firm building econometric models. Before starting his analytics career, he was a policy and research assistant at the Charles Koch Institute.

Campbell’s work has been published by The Press-Enterprise and the Platte Institute. His quantitative work on educational policy has been cited by The Thomas B. Fordham Institute.

Recently, Campbell appeared on a panel entitled “Don’t Fence Me In: Texans Crossing School Boundaries” sponsored by the Texas Public Policy Foundation.

Campbell received his bachelor’s degree from Portland State University and a master’s degree in quantitative economics from California Lutheran University.

He lives with his wife in Los Angeles.

-

The effect of menthol bans on cigarette sales: Evidence from Massachusetts

Massachusetts' flavored tobacco ban primarily sent buyers to other states and illicit markets.

-

The 2022 fiscal year investment results for state pension plans

Overall, the median investment return result for state pension systems in 2022 is -5.2%.

-

Public education funding without boundaries: How to get K-12 dollars to follow open enrollment students

How to ensure state and local education funds flow seamlessly across district boundaries.

-

The mechanics of ESG-driven divestment, engagement and proxy voting

It is inappropriate for public pension systems to engage in political, non-pecuniary investment activities, regardless of whether it occurs through divestment or shareholder proposals.

-

Scrutinizing high ESG fees, greenwashing and the politicization of public pension funds

ESG-focused investing is drawing criticism, even from some supporters, due to overstated claims and high fees.

-

Debtor Nation

The national debt is over $30 trillion. The federal government ran an annual budget deficit in 52 of the last 57 years.

-

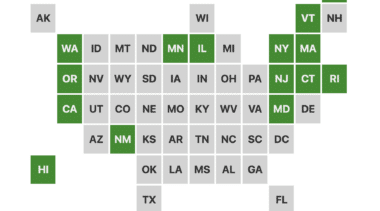

The public pension systems signing on to politicized ESG investment efforts

State and local public pension systems that have signed on to the Ceres Investor Network on Climate Risk and Sustainability and Climate Action 100+.

-

K-12 Education Spending Spotlight: An in-depth look at school finance data and trends

Reason Foundation’s new K-12 Education Spending Spotlight provides critical insight into key school finance trends across the country.

-

California’s public schools are losing kids while getting more money

Even though there are fewer kids in public schools, the state’s education spending continues to go up.

-

Projecting the funded ratios of state-managed pension plans

The funded ratios for 2022 are projections based on a -6% investment return, which may be overly optimistic for many pension systems.

-

Unfunded public pension liabilities are forecast to rise to $1.3 trillion in 2022

The 2022 Public Pension Forecaster finds aggregate unfunded liabilities will jump back over $1 trillion if 2022 investment results end up at or below 0%.

-

The difficulties of assigning ESG ratings

The problems with public pension systems and private companies trying to create environmental, social, and corporate governance (ESG) risk ratings.

-

Despite historic 2021 returns, many public pension plans are wisely preparing for lower investment returns

Public pension plans also need to resist the temptation to use last year's one-off, one-year investment return windfalls to fund new benefits like higher cost-of-living adjustments.

-

Modeling how public pension investments may perform over the next 30 years

This tool runs a simulation of the investment performance of a hypothetical public pension portfolio over 30 years.

-

K-12 funding in Tennessee: A student-centered approach

By adopting a student-centered funding model, Tennessee would replace the state's outdated education finance system that lacks transparency and local control.

-

Governments increased their use of pension obligation bonds in 2021

In September, pension obligation bonds rated by S&P in 2021 totaled $6.3 billion—compared to $3.0 billion in 2020.

-

State pension plan funded ratios in 2020

Most state pension plans saw significant drops in funding in the last two decades.

-

Suggested reforms for Pennsylvania’s Public School Employees’ Retirement System

The pension system's high investment fees and unrealistic investment return expectations are in need of reform.