The price of lumber soared earlier this year and despite falling more than 50 percent from its May 2021 peak, lumber is still around its 2020 pre-pandemic high. The price of an individual good, like lumber, does not indicate a problem with inflation. But with the Consumer Price Index increasing at the fastest rate since 2008 (5 percent year-over-year), fears of inflation and broad price-level changes are rising.

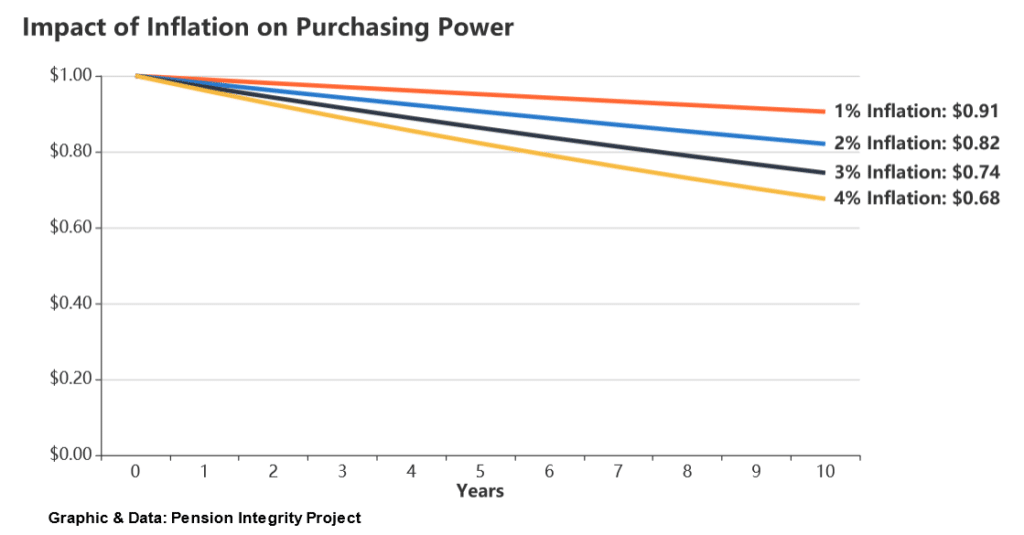

Sustained inflation is a concern not only for consumers but also for governments and public pension plans. For current workers, the magnitude of inflation alters the purchasing power of their retirement benefits. Over one decade, the purchasing power of a dollar can be considerably diminished. Just one percent annual inflation will drop the purchasing power of one dollar to 91 cents—at four percent inflation, that dollar drops to 68 cents.

To help employees preserve the value of their retirement benefits, most public pension plans include cost-of-living adjustments (COLA) that increase benefit payments over time. For plans, COLAs can add significant costs, which vary depending on their structure. A June report from the National Association of State Retirement Administrators (NASRA) outlined these COLA structures, their relative cost impacts, and recent changes to state-administered pension plans.

While the explicit purpose of a cost-of-living adjustment is to retain the purchasing power of benefits eroded by inflation, not every COLA is directly tied to an inflation index. The report says 14 state-provided pension plans have cost-of-living adjustments that respond to their public pension plan’s investment performance or funding levels as a way to help manage risk. Thirty-four state-provided pension plans use a “fixed percentage increase or other factor” for determining their COLA. Meanwhile, the cost-of-living adjustments of most major state pension plans, 52 of them, are linked to inflation in some form.

In their report, NASRA found that, compared to a pension plan with no cost-of-living-adjustment, a full Consumer Price Index (CPI) adjusted COLA, which increases benefits in line with inflation, adds 26 percent to the cost of benefits if you assume three percent inflation each year. A fixed two percent COLA decreases these costs to 16 percent, and a half-match of CPI, assuming a three percent annual increase in inflation, adds 11 percent to total costs.

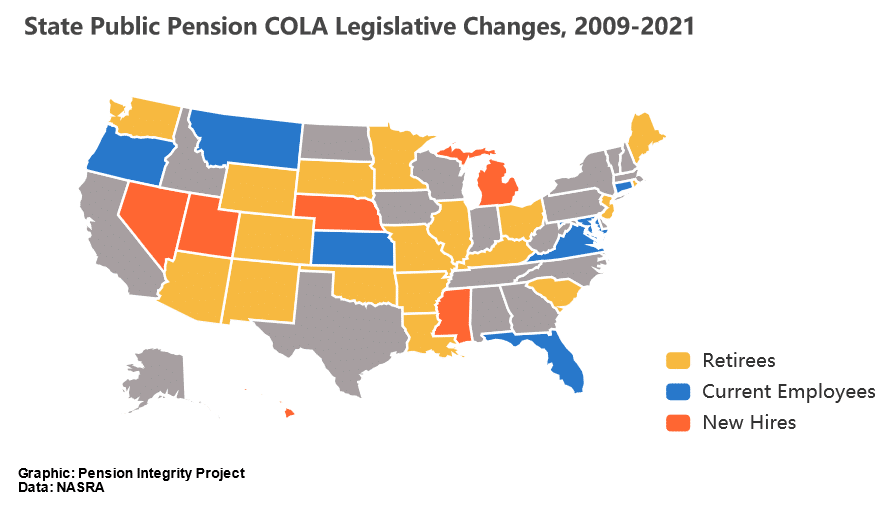

Even more moderate cost-of-living adjustments can still add significant costs to funding benefits. Since the 2008 financial crisis, a number of public pension plans began tweaking their COLA structures to try to better manage costs. As the NASRA brief notes, many of these changes, particularly for current retirees, faced legal challenges. NASRA says “since, 2009, 18 states have changed COLAs affecting current retirees, seven states have addressed current employees’ benefits, and six states have changed the COLA structure only for future employees.”

The map below shows which states made changes to their public pension plans’ cost-of-living adjustments during this period.

Retirement planning involves a variety of risks and trade-offs due to the inherent uncertainty of the future. After four decades of relative price stability, it is unfortunate that inflation is currently a serious concern for public pension plan participants and managers. If retirees and pension plans foresee persistent periods of inflation and want to better manage these risks, any increase or addition to a COLA benefit needs to be properly structured and funded. Otherwise, the cost-of-living adjustment will add to an already serious underfunding problem for state and local government pension plans.

Stay in Touch with Our Pension Experts

Reason Foundation’s Pension Integrity Project has helped policymakers in states like Arizona, Colorado, Michigan, and Montana implement substantive pension reforms. Our monthly newsletter highlights the latest actuarial analysis and policy insights from our team.