Jordan Campbell is managing director of government finance and senior quantitative analyst at Reason Foundation.

Prior to joining Reason, Campbell worked at a marketing analytics firm building econometric models. Before starting his analytics career, he was a policy and research assistant at the Charles Koch Institute.

Campbell’s work has been published by The Press-Enterprise and the Platte Institute. His quantitative work on educational policy has been cited by The Thomas B. Fordham Institute.

Recently, Campbell appeared on a panel entitled “Don’t Fence Me In: Texans Crossing School Boundaries” sponsored by the Texas Public Policy Foundation.

Campbell received his bachelor’s degree from Portland State University and a master’s degree in quantitative economics from California Lutheran University.

He lives with his wife in Los Angeles.

-

Annual pension solvency and performance report

At the end of the 2023 fiscal year, the nation's public pension systems had $1.59 trillion in total unfunded liabilities.

-

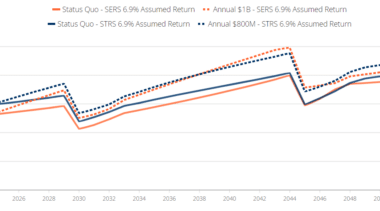

How Connecticut pensions can save $7 billion in interest costs over the next 30 years

The Connecticut Pensions Dashboard explores various economic scenarios that could impact the state's public pension debt.

-

The case for Connecticut’s fiscal guardrails

The “fiscal guardrails” have saved Connecticut more than $170 million and could save $7 billion over the next 25 years.

-

Four takeaways from the U.S. Census Bureau’s latest school finance data

With federal data from the 2022 school year now available, policymakers can better grasp how the COVID-19 pandemic affected public school budgets.

-

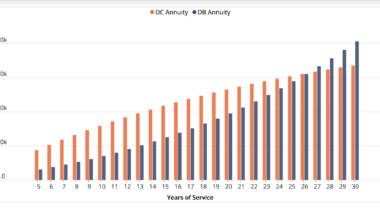

For most workers, the value of Alaska’s defined contribution plan surpasses that of a traditional pension

The following tool created by the Pension Integrity Project displays the year-by-year accrual of retirement benefits for a wide variety of Alaska workers in different fields and starting at different ages.

-

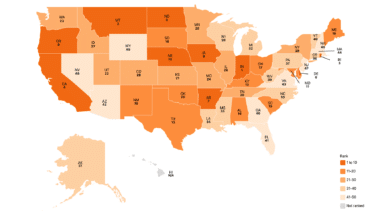

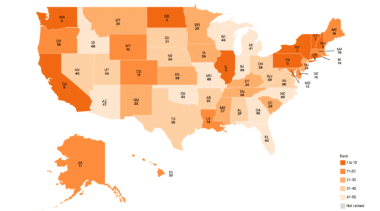

Public education at a crossroads: A comprehensive look at K-12 resources and outcomes

Examining key education spending, enrollment, staffing, and student performance data over the past two decades in all 50 states.

-

Public education at a crossroads: K-12 education revenue and expenditure trends 2002-2020

Nationwide, inflation-adjusted public school revenues grew from $12,852 per student in 2002 to $16,065 per student in 2020.

-

Public education at a crossroads: Enrollment, staffing, and teacher salary trends 2002-2020

Nationwide, inflation-adjusted average teacher salaries fell by 0.6% between 2002 and 2020 with a total of 26 states seeing declines.

-

Public education at a crossroads: Math and reading outcomes (low-income students only)

Between 2003 and 2019, the average U.S. 4th grade NAEP math score for free and reduced-price lunch eligible students increased by seven points.

-

Public education at a crossroads: Math and reading outcomes (all students)

Between 2003 and 2019, the average U.S. 8th-grade NAEP reading score was flat. The average 8th-grade NAEP math score increased by four points.

-

Public education at a crossroads: Education spending data for all 50 states 2002-2020

Examining every state's K-12 public education spending, staffing and enrollment levels, teacher salaries and more.

-

Public pension systems continue to support ESG proposals

The public should be able to view proxy votes well before they are cast and access annual reports showing all of a pension plan’s proxy votes.

-

Calls for public pension systems to divest from energy sector are shortsighted

Public pension systems have a fiduciary duty to make investment decisions in the best financial interest of their members.

-

Homeschooling is on the rise, even as the pandemic recedes

As of May 2023, 85% of students are enrolled in public schools, 9.6% attend private schools, and 5.4% are homeschooled.

-

Vanguard’s shift away from ESG fits with its focus on low fees

“Our research indicates that ESG investing does not have any advantage over broad-based investing.”

-

Comparing Alaska’s defined benefit and defined contribution retirement plans

Most of Alaska’s public employees would be better served in the existing defined contribution plan.

-

Examining day-to-day crypto volatility and why it’s important

Bitcoin, Ethereum, and other cryptocurrencies frequently exhibit daily price drops during bull markets and increases during bear markets far in excess of traditional assets.