-

Why Florida Should Shift from Gas Taxes to Per-Mile User Fees— and How to Do It

This policy brief focuses on how Florida policymakers can address the looming highway-funding problem by transitioning from per-gallon taxes to per-mile charges.

-

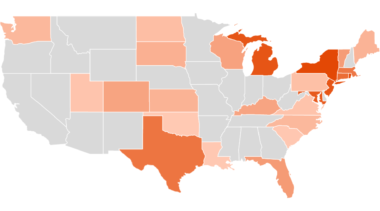

How Much Gas Tax Money States Divert Away From Roads

Examining the percentage of state gas tax revenue that is allocated for expenses unrelated to roads, including money shifted to law enforcement, education, tourism, environmental programs and more.

-

Mississippi Public Employees’ Retirement System Solvency Analysis

Underperforming investment returns have been the biggest contributor to the growing unfunded liability, adding $6.8 billion in debt to the system since 2001.

-

Marijuana Business Insurance: Another Hurdle For Entrepreneurs

The current regulatory landscape has resulted in business owners who are hesitant to purchase insurance and few companies willing to provide insurance.

-

Answering Frequently Asked Questions About COVID-19 and Public Pensions

This resource, designed for state legislators and staff, will assist in answering crucial questions regarding how the pandemic and resulting market conditions have affected state sponsored public pension plans.

-

Working Paper: Does Compulsory Schooling Affect Innovation? Evidence from the United States

We consider how the initial adoption of compulsory schooling affected state-level rates of patenting and real output per worker, finding declines in both once the originally affected cohorts reach middle age.

-

Frequently Asked Questions About Chloroquine and Hydroxychloroquine In Treating Covid-19

Our approaches to defeating the coronavirus should be given the greatest degree of regulatory freedom possible, leaving life and death treatment options to the physicians and their patients.

-

Working Paper: An Evidence-Based Approach to Fighting the Coronavirus Pandemic

"A realistic plan for unlocking society must be found. Urgently. This brief seeks to offer elements of what such a plan might look like, based on evidence from actions taken in many jurisdictions."

-

Arkansas Teacher Retirement System Pension Solvency Analysis

Investment returns failing to meet unrealistic expectations has been the single largest contributor to unfunded liability growth, adding $1.9 billion in debt to ATRS since 2000.

-

The “New Normal” In Public Pension Investment Returns

The primary culprit of growing pension debt has been the across-the-board investment underperformance of pension assets relative to plans’ own return targets.

-

Are Charter Schools Safer Than District-Run Schools? Evidence From Pennsylvania

This study finds that public charter schools generally report fewer school climate problems than district-run public schools in Pennsylvania.

-

The Economic Consequences of Fuel Economy Standards

This is the fourth in a series of briefs explaining and evaluating Corporate Average Fuel Economy (CAFE) and zero-emissions vehicle (ZEV) standards.

-

A Roadmap to Fix Arizona’s School Finance System

Arizona needs to adopt a system that more effectively attaches dollars to individual students based on their needs—regardless of property wealth and district boundaries.

-

13 Frequently Asked Questions About Mileage-Based User Fees

With the gas tax becoming increasingly unsustainable, mileage-based user fees offer a fair, reliable and sustainable funding mechanism for roadways.

-

Working Paper — School Sector and Climate: Evidence from New York

Public charter schools tended to report fewer school climate problems than district-run public schools in New York state in the 2017-18 school year.

-

North Carolina Teachers’ and State Employees’ Retirement System: A Pension Solvency Analysis

Better risk management and more realistic plan assumptions can help ensure the state delivers the promised retirement benefits to its employees.

-

The Economic Impacts of School Choice in Kentucky

This report finds that access to public charter schools in Louisville could provide the $138 million in economic benefits from higher lifetime earnings associated with increases in academic achievement.

-

How Occupational Licensing Hurts Florida’s Most Vulnerable

Florida could remove barriers to employment by eliminating unnecessary licenses and reducing the requirements for widely licensed occupations.