Mariana Trujillo is managing director of government finance at Reason Foundation.

She holds a B.A. in economics from George Mason University. Before joining Reason Foundation, she interned at JP Morgan, The Mercatus Center, and The Cato Institute.

Trujillo’s research focuses on the fiscal health of federal, state, and local governments, particularly the impact of pension liabilities on fiscal condition and the effect of retirement benefits on public-employee recruitment and retention. Her work has appeared in outlets such as Reason magazine, the San Diego Tribune, Hartford Courant, Los Angeles Daily News, CQ Researcher, and more. She has also testified on these issues before the Oklahoma House of Representatives and the Connecticut General Assembly.

-

Frequently asked questions about public pensions investing in Bitcoin and other digital assets

Are public pension systems investing in digital assets effectively gambling with taxpayer-backed retirement assets?

-

U.S. public pension and trust fund investment in digital assets

Policy considerations for public sector investment in Bitcoin and other cryptocurrencies.

-

Report: Cities have $1.4 trillion in debt

San Francisco, Nantucket, New York City, Ocean City, and Miami Beach are the cities with the most per capita debt.

-

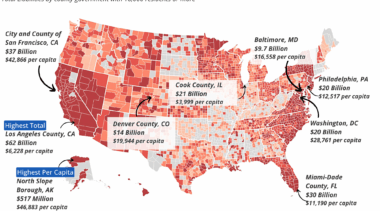

Report: County governments have $757 billion in debt

In per capita terms, North Slope Borough, Alaska, ranks first, with its total debt representing $46,883 per county resident.

-

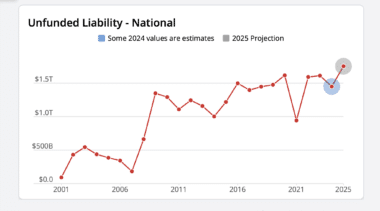

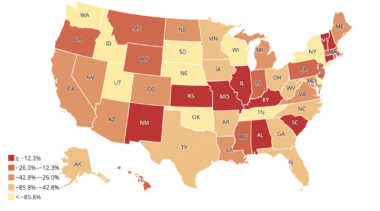

Report: State and local pension plans have $1.48 trillion in debt

State pension systems have $1.29 trillion in unfunded liabilities, and local governments have $187 billion.

-

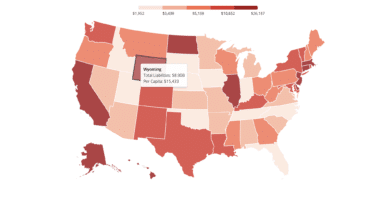

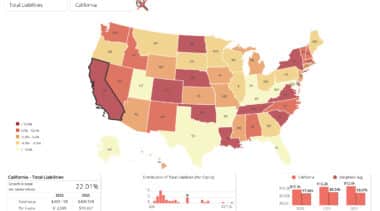

Report ranks every state’s debt, from California’s $497 billion to South Dakota’s $2 billion

Study finds state governments have a total of $2.7 trillion in debt, with 26 states exceeding $20 billion in debt each and 10 states over $70 billion.

-

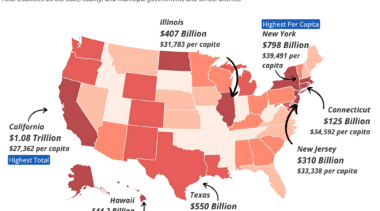

Report: State and local governments have $6.1 trillion in debt

State and local debt is over $100 billion in 16 states and exceeds $50 billion in 27 states. California’s state and local governments have over $1 trillion in debt.

-

Debt trends for state and local governments 2020-2022

This tool provides debt and spending insights for the 100 largest municipalities, counties and school districts in America and all 50 states for fiscal years 2020, 2021 and 2022.

-

City debt: New York has more than four times the liabilities of Chicago, Los Angeles, Houston and other cities

New York City, the District of Columbia, Chicago, Atlanta, Yonkers and Austin have the most per capita liabilities.

-

County debt: Los Angeles, Miami-Dade and Cook counties among worst in nation

Los Angeles County had $54 billion in liabilities at the end of 2022. Miami-Dade County had $29 billion in total liabilities.

-

State debt: California, Illinois, New York, New Jersey and Texas each have over $200 billion in total liabilities

On a per capita basis, Connecticut's $27,031 total liabilities per capita are worst in the nation, followed by New Jersey.

-

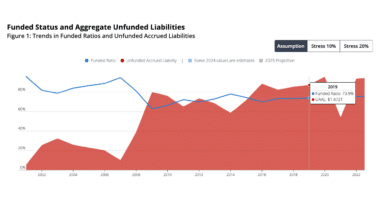

Annual pension solvency and performance report

At the end of the 2023 fiscal year, the nation's public pension systems had $1.59 trillion in total unfunded liabilities.

-

The case for Connecticut’s fiscal guardrails

The “fiscal guardrails” have saved Connecticut more than $170 million and could save $7 billion over the next 25 years.