Mariana Trujillo is managing director of government finance at Reason Foundation.

She holds a B.A. in economics from George Mason University. Before joining Reason Foundation, she interned at JP Morgan, The Mercatus Center, and The Cato Institute.

Trujillo’s research focuses on the fiscal health of federal, state, and local governments, particularly the impact of pension liabilities on fiscal condition and the effect of retirement benefits on public-employee recruitment and retention. Her work has appeared in outlets such as Reason magazine, the San Diego Tribune, Hartford Courant, Los Angeles Daily News, CQ Researcher, and more. She has also testified on these issues before the Oklahoma House of Representatives and the Connecticut General Assembly.

-

Frequently asked questions about public pensions investing in Bitcoin and other digital assets

Are public pension systems investing in digital assets effectively gambling with taxpayer-backed retirement assets?

-

U.S. public pension and trust fund investment in digital assets

Policy considerations for public sector investment in Bitcoin and other cryptocurrencies.

-

How the proposed billionaire tax would backfire and hurt California

While taxing billionaires may feel cathartic to some, it’s neither a smart nor a sustainable solution to California’s debt and deficits.

-

Pension Reform News: Public pension reform drives fiscal responsibility, not inequality

Plus: How property tax cuts will impact pensions in Texas, Louisiana's pension crisis threatens taxpayers, and more.

-

Public pension reform does not increase inequality

Well-designed pension reform is essential to safeguarding public services, protecting taxpayers, and ensuring sustainable retirement security.

-

San Diego’s government needs more competition, not more taxes

San Diego’s rising pension costs and mounting long-term debt are creating significant budget pressures that have city officials turning to tax and fee increases.

-

State and local governments are drowning in debt

To address this mountain of debt and restore fiscal stability, state and local governments must sustainably align spending with revenues.

-

Connecticut’s pensions shouldn’t make political investment in WNBA team

Keeping the Connecticut Sun in the state may be good politics, but would be an unwise financial move that puts the state's taxpayers at risk.

-

Most public pension contributions go toward paying off debt, not funding benefits

Over 50% of the public pension contributions by state and local governments are directed toward paying off pension debt rather than to benefits themselves.

-

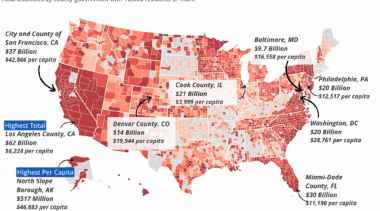

Report: Cities have $1.4 trillion in debt

San Francisco, Nantucket, New York City, Ocean City, and Miami Beach are the cities with the most per capita debt.

-

Report: County governments have $757 billion in debt

In per capita terms, North Slope Borough, Alaska, ranks first, with its total debt representing $46,883 per county resident.

-

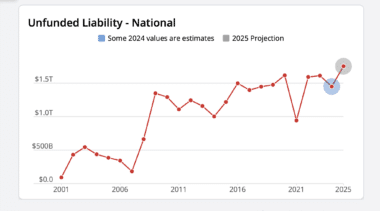

Pension Reform News: Reason’s annual report finds $1.5 trillion in aggregate pension debt

Plus: Undoing California's pension reforms could cost billions, what government worker reductions mean for pensions, and more.

-

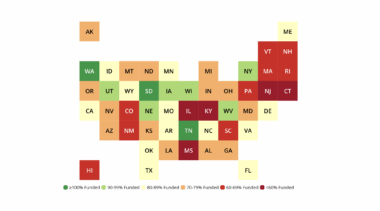

Study: Illinois, Connecticut, Alaska, Hawaii, New Jersey and Mississippi have the most per capita pension debt

Illinois, Kentucky, New Jersey, Mississippi, and Connecticut have less than 60% of funding needed to pay for promised pension benefits.

-

The public pension plans with the most debt, best and worst investment return rates

The Maryland and Massachusetts teachers' retirement plans saw the largest growth in debt, the Fire Fighters' Relief and Retirement Fund of Austin posted the worst returns and the Miami General Employees and Sanitation Employees Plan had the highest return rate.

-

Report: State and local pension plans have $1.48 trillion in debt

State pension systems have $1.29 trillion in unfunded liabilities, and local governments have $187 billion.

-

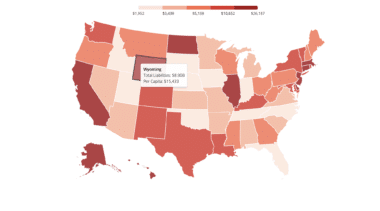

Report ranks every state’s debt, from California’s $497 billion to South Dakota’s $2 billion

Study finds state governments have a total of $2.7 trillion in debt, with 26 states exceeding $20 billion in debt each and 10 states over $70 billion.

-

Report: State and local governments have $6.1 trillion in debt

State and local debt is over $100 billion in 16 states and exceeds $50 billion in 27 states. California’s state and local governments have over $1 trillion in debt.

-

Best practices to prevent misuse of opioid settlement funds

States should adopt clear guidelines to ensure settlement funds support evidence-based treatment and recovery.