Ryan Frost is a managing director of Reason Foundation's Pension Integrity Project.

Frost contributes to Reason's ongoing Gold Standard In Public Retirement System Design series, produced an in-depth analysis of the Arizona PSPRS pension systems, and presented testimony before the Michigan House Appropriations Committee, among others.

Ryan's work has been published in various outlets, including The Orange County Register, and cited by The Center Square, The Tennessee Star, and the National Association of State Retirement Administrators.

Before joining Reason, Frost spent seven years as the senior research and policy manager for the Washington State Law Enforcement Officers' and Fire Fighters' Retirement System (LEOFF 2), a plan that is nationally recognized for its exceptional funding level. Frost conducted multiple pension studies for the Washington State Legislature. He also drafted and testified on six pieces of adopted legislation affecting LEOFF 2 members, including a first-of-its-kind annuity rollover provision for defined-benefit plans.

Frost earned his B.A. in politics and government from Pacific Lutheran University and a Certificate of Achievement in Public Plan Policy (CAPPP) from the International Foundation of Employee Benefit Plans.

-

Study: Illinois, Connecticut, Alaska, Hawaii, New Jersey and Mississippi have the most per capita pension debt

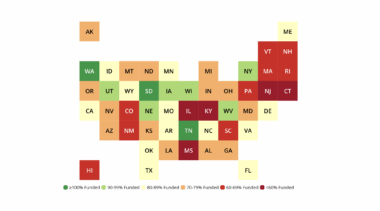

Illinois, Kentucky, New Jersey, Mississippi, and Connecticut have less than 60% of funding needed to pay for promised pension benefits.

-

The public pension plans with the most debt, best and worst investment return rates

The Maryland and Massachusetts teachers' retirement plans saw the largest growth in debt, the Fire Fighters' Relief and Retirement Fund of Austin posted the worst returns and the Miami General Employees and Sanitation Employees Plan had the highest return rate.

-

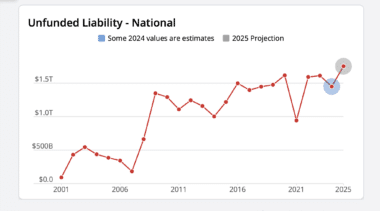

Report: State and local pension plans have $1.48 trillion in debt

State pension systems have $1.29 trillion in unfunded liabilities, and local governments have $187 billion.

-

Best practices in cash balance plan design

A transition to a cash balance structure offers an opportunity to reset actuarial assumptions, enforce strict funding discipline, and improve stakeholder transparency.

-

Proxy firms’ lawsuits highlight need for public pension systems to prioritize investment returns

When pension funds follow flawed advice, the result is lower returns and higher taxpayer costs.

-

With additional plans reporting, total unfunded public pension liabilities in the U.S. grow to $1.61 trillion

Information added to the Annual Pension Solvency and Performance Report finds the median funded ratio across public pension plans decreased marginally to 75.8%.

-

Washington lawmakers passed a ticking time bomb for pension solvency and the state budget

Engrossed Substitute Senate Bill 5357 jeopardizes pension solvency to divert funds toward other budget items.

-

Alaska House Bill 78 would reopen defined benefit plans for public employees

Under a best-case scenario, House Bill 78 would cost Alaska an additional $2.1 billion over the next 30 years.

-

Washington Substitute Senate Bill 5085 would increase pension costs

Substitute Senate Bill 5085 threatens the integrity of pension funding by increasing liabilities in two closed plans.

-

House Bill 78 exposes Alaska to significant additional costs

This bill could realistically add $11.4 billion in additional costs to future state budgets and reintroduce Alaska to significant pension risk.

-

Arizona Senate Bill 1365 threatens higher taxpayer costs and pension risks

Arizona Public Safety Personnel Retirement System Tier 3 reform is working. Senate Bill 1365 would fundamentally alter the current system.

-

Legal analysis suggests Michigan House Bill 6060 violates state law

Actuarial analysis of proposed pension benefit changes of this magnitude is required by law in Michigan under MCL Section 38.1140h

-

Michigan Senate Bills 165, 166, and 167 would increase public pension costs

Under a best-case scenario, the additional cost of this pension proposal would be just north of $800 million over the next 30 years.

-

Michigan House Bill 6060 would negatively impact the teacher pension system

Michigan House Bill 6060 would add between $17 billion to $20 billion in new employer costs over the next few decades.

-

Michigan House Bill 6061 would undo public pension progress

Proposed changes would re-expose Michigan to unnecessary unfunded liabilities, financial risks, and billions in hidden costs.

-

Webinar: 2024 Public pension solvency and performance report

Discussing the 2024 Pension Solvency and Performance Report's findings on public pension debt, investment return trends and more.

-

A Texas law governing firefighter pensions is straining city budgets

Without reforms, Texas cities will continue to face escalating public pension liabilities, jeopardizing their financial stability and burdening taxpayers.

-

Annual pension solvency and performance report

At the end of the 2023 fiscal year, the nation's public pension systems had $1.59 trillion in total unfunded liabilities.