Ryan Frost is a managing director of Reason Foundation's Pension Integrity Project.

Frost contributes to Reason's ongoing Gold Standard In Public Retirement System Design series, produced an in-depth analysis of the Arizona PSPRS pension systems, and presented testimony before the Michigan House Appropriations Committee, among others.

Ryan's work has been published in various outlets, including The Orange County Register, and cited by The Center Square, The Tennessee Star, and the National Association of State Retirement Administrators.

Before joining Reason, Frost spent seven years as the senior research and policy manager for the Washington State Law Enforcement Officers' and Fire Fighters' Retirement System (LEOFF 2), a plan that is nationally recognized for its exceptional funding level. Frost conducted multiple pension studies for the Washington State Legislature. He also drafted and testified on six pieces of adopted legislation affecting LEOFF 2 members, including a first-of-its-kind annuity rollover provision for defined-benefit plans.

Frost earned his B.A. in politics and government from Pacific Lutheran University and a Certificate of Achievement in Public Plan Policy (CAPPP) from the International Foundation of Employee Benefit Plans.

-

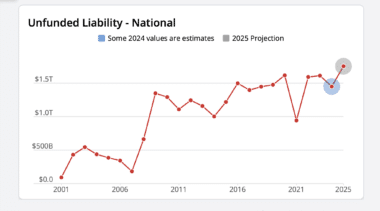

Report: State and local pension plans have $1.48 trillion in debt

State pension systems have $1.29 trillion in unfunded liabilities, and local governments have $187 billion.

-

Best practices in cash balance plan design

A transition to a cash balance structure offers an opportunity to reset actuarial assumptions, enforce strict funding discipline, and improve stakeholder transparency.

-

House Bill 78 exposes Alaska to significant additional costs

This bill could realistically add $11.4 billion in additional costs to future state budgets and reintroduce Alaska to significant pension risk.

-

Arizona Senate Bill 1365 threatens higher taxpayer costs and pension risks

Arizona Public Safety Personnel Retirement System Tier 3 reform is working. Senate Bill 1365 would fundamentally alter the current system.

-

Annual pension solvency and performance report

At the end of the 2023 fiscal year, the nation's public pension systems had $1.59 trillion in total unfunded liabilities.

-

State taxpayers’ share of MPSERS debt would increase under various proposals

The first 20.96% of each year’s unfunded accrued liability contribution is currently paid by local school districts, and any amount required above that is paid by the state.

-

Redirecting MPSERS’ debt payment could cost taxpayers $1.4 billion

Eliminating a $670 million annual contribution into MPSERS would require an additional $1.4 billion over the next 14 years in net pension payments.

-

Missouri’s bill would revive bad pension funding policy

Pensions should not rely on variable fee revenue streams tied to the volume of activity in the criminal justice system.

-

Examining an Alaska pension reform counterfactual

A look at what would have happened to the Public Employee Retirement System and Teacher Retirement System if proposed pension reforms from 2021 had been enacted.

-

Pension changes in House Bill 22 and Senate Bill 35 threaten Alaska’s budgets

HB 22 and SB 35 could cost Alaska upwards of $800 million in the coming decades.

-

Scrutinizing NDPERS’ cost claims on House Bill 1040

NDPERS is choosing to adopt the costliest interpretation of HB 1040 and is cherry-picking the worst from a range of actuarial cost estimates to scare away proponents.

-

Does the defined contribution plan in North Dakota’s HB 1040 meet gold standards?

Examining the the proposed contribution rate, portability, enrollment options and other retirement plan features in North Dakota's House Bill 1040.

-

Does North Dakota House Bill 1040 meet the objectives for good pension reform?

The bill would help ensure North Dakota has the ability to pay 100% of the benefits earned and accrued by active workers and retirees.

-

Examining the pension reform benefits of North Dakota House Bill 1040

HB 1040 would shift NDPERS to an actuarially sound method of funding, ensuring the state can deliver on its promises to members and retirees.

-

Best practices in hybrid retirement plan design

The recent shift toward offering hybrid plans to newly hired government employees suggests that governmental employers may be changing their perceptions of the balance of financial risk between employees and employers.

-

Actuary highlights House Bill 55’s costs and risks to the Alaska Public Employees’ Retirement System

Changes of the magnitude being proposed in Alaska House BIll 55 should receive rigorous actuarial and risk analyses that have not yet been conducted.

-

Expanding prefunding programs for the Arizona State Retirement System

Prefunding contributions for the Arizona State Retirement System could help ease the burden of rising pension costs on taxpayers.

-

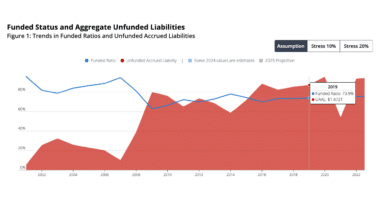

Defined Benefit Plans: Best Practices in Incorporating Risk Sharing

Public pension risk sharing can increase plan solvency, provide better accountability, and lessen the burden that unfunded liabilities have on taxpayers.