Steven Gassenberger is a policy analyst with Reason Foundation's Pension Integrity Project.

Prior to joining Reason Foundation, Gassenberger worked as a consumer advocacy manager for Xerox Corporation, specializing in financial consumer regulation and compliance. He also worked as a senior associate for Stateside Associates, where he developed state-level management strategies for a variety of policy areas. Prior to that, Gassenberger held positions at the National Breast Cancer Coalition and the International Fund for Agricultural Development.

At Reason, Gassenberger has contributed to in-depth analysis of the Arkansas TRS, Florida FRS, Louisiana LASERS, Louisiana TRSL, Mississippi PERS, Montana MPERS, Montana TRS, New Mexico ERB, New Mexico PERA, North Dakota PERS, Texas ERS, and Texas TRS pension systems.

Gassenberger has also presented testimony in Montana, Nebraska, and Texas during state pension reform efforts.

His work has been published in The Wall Street Journal and Business Observer.

Gassenberger recently shared the stage at the Pelican Institute’s Solutions Summit 2.0 with Louisiana State Senator Barrow Peacock, Michigan State Senator Phil Pavlov, and Jonathan Williams, Chief Economist at The American Legislative Exchange Council in discussing “Fostering a Sustainable System for Louisiana.”

Gassenberger graduated from the University of New Orleans with a BA in international relations and received an MA in public policy from Tel Aviv University.

-

Texas legislature continues bipartisan push to modernize public retirement benefits

But the state’s most intractable public pension challenge—addressing the Teacher Retirement System’s $51 billion of debt and unsustainable fiscal path—remains.

-

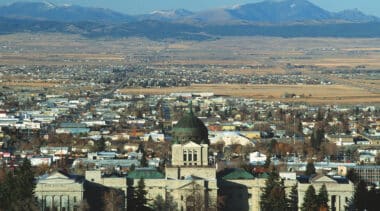

Montana makes public pension progress but major opportunities remain

The major policies adopted this spring will help protect the state's public pensions.

-

“The Liability Trap” authors’ critique of pension fiduciary model misses the mark

Requiring a fiduciary responsible for public dollars to adhere to objective criteria and remain oriented towards achieving the pecuniary goals of the pension trust is the most basic policy.

-

Comments on Texas House Bill 3495 and Senate Bill 1246

TRS already holds $52 billion in pension debt so it is essential to examine the risks of the proposed investment class expansion.

-

Comments on Texas House Bill 3367 and Senate Bill 1245

The proposed bills would provide a modern, low-risk cash balance retirement plan for new judges while addressing the core issues causing today’s unfunded liabilities.

-

Montana’s default retirement benefit option should best serve most public workers

Montana House Bill 226 would better align the default retirement benefit option with what would best most workers need.

-

Proposed changes to Houston fire and police pension benefits require actuarial analysis

Texas lawmakers need to know and examine the long-term costs to taxpayers associated with HB 3340 before adding more benefit promises to an already underfunded retirement system.

-

Montana reform would improve pension funding and retirement savings for public employees

Montana House Bill 226 would adopt actuarially determined employer contributions funding to guarantee benefits are fully funded within a specified timeframe.

-

Comments on Montana House Bill 226 (2023)

The changes offered in HB226 would address how PERS is only optimal to a fraction of public employees at an ever-rising cost, and turn the system towards best practices in public retirement benefit design.

-

Testimony: Montana House Bill 228 (2023)

Montana House Bill 228 would help improve governance and give stakeholders even more confidence in their system for future generations.

-

Testimony: Michigan Senate Bill 1192 would depoliticize pension investments and protect taxpayers

Michigan Senate Bill 1192 would help ensure the goals of public pension managers and trust fiduciaries align with reality.

-

Is Texas’ definition of an actuarially sound public pension system outdated?

With this year's high inflation rates hitting retirees living on fixed incomes the hardest, it is not surprising that retiree groups and their allies are advocating for a cost-of-living adjustment.

-

Examining the Teachers Retirement System of Texas after the pension reforms of 2019

Senate Bill 12 of 2019 made reforms, but TRS contributions will likely be insufficient because the pension plan is using outdated economic assumptions.

-

Testimony: Teacher Retirement System of Texas can improve funding policies to benefit taxpayers, employees

The pension plan's outdated actuarial assumptions, funding policies, and benefit offerings hurt teachers' retirement security.

-

Evaluating the potential impacts of Louisiana Senate Bill 438

The proposed hybrid plan is more expensive than the current pension under all scenarios.

-

Paying down PSPRS debt faster is a win for taxpayers

Unfunded PSPRS and ASRS liabilities make those pension systems more costly, pressuring government budgets. Paying down pension debt as fast as possible avoids interest costs and saves taxpayers money.