Leonard Gilroy is vice president of government reform at Reason Foundation and senior managing director of Reason's Pension Integrity Project.

Under Gilroy's leadership, the Pension Integrity Project at Reason Foundation assists policymakers and other stakeholders in designing, analyzing and implementing public sector pension reforms. The project aims to promote solvent, sustainable retirement systems that provide retirement security for government workers while reducing taxpayer and pension system exposure to financial risk and reducing long-term costs for employers/taxpayers and employees. The project team provides education, reform policy options, and actuarial analysis for policymakers and stakeholders to help them design reform proposals that are practical and viable.

Gilroy and the Pension Integrity Project have provided technical assistance to several successful pension reform efforts in recent years in Michigan, Colorado, Arizona, South Carolina and other states aimed at tackling persistent pension solvency challenges.

In his role as vice president, Gilroy also leads Reason's government reform efforts, with over 18 years of experience researching fiscal management, government operations, infrastructure public-private partnerships, government contracting, and urban policy topics. He also regularly consults with federal, state and local officials on ways to improve government performance and efficiency.

Gilroy has a diversified background in policy research and implementation, with particular emphasis on competition, government efficiency, transparency, accountability, and government performance. Gilroy has testified before Congress on several occasions and has testified on pension reform before the Arizona, Florida, Michigan, and Texas legislatures. Gilroy works closely with state and local elected officials across the country in efforts to design and implement market-based policy approaches, improve government performance, enhance accountability in government programs, and reduce government spending.

Gilroy's articles have been featured in such leading publications as The Wall Street Journal, Los Angeles Times, New York Post, The Weekly Standard, Washington Times, Houston Chronicle, Atlanta Journal-Constitution, Arizona Republic, San Francisco Examiner, San Diego Union-Tribune, Philadelphia Inquirer, Sacramento Bee, and The Salt Lake Tribune. He has also appeared on CNN, Fox News Channel, Fox Business, CNBC, National Public Radio and other media outlets.

Prior to joining Reason, Gilroy was a senior planner at a Louisiana-based urban planning consulting firm. He also worked as a research assistant at the Virginia Center for Coal and Energy Research at Virginia Tech. Gilroy earned a B.A. and M.A. in Urban and Regional Planning from Virginia Tech.

-

The Potential Risks and Rewards of CalPERS’ New Investment Policy

The nation's largest public pension plan is seeking better returns by investing in more private equity and allowing strategic borrowing.

-

Mississippi Public Employees’ Retirement System Solvency Analysis

Underperforming investment returns have been the biggest contributor to the growing unfunded liability, adding $6.8 billion in debt to the system since 2001.

-

Arkansas Teacher Retirement System Pension Solvency Analysis

Investment returns failing to meet unrealistic expectations has been the single largest contributor to unfunded liability growth, adding $1.9 billion in debt to ATRS since 2000.

-

Seeking Pension Resiliency

National public pension funding barely improved over the last decade despite a historic bull market. It would be false hope to think that we will invest our way out of the current crisis. It’s time to think differently.

-

Proposed Reforms to Georgia’s Teacher Pension System Missed the Mark

Previously introduced legislation to reform the Teachers Retirement System of Georgia attempted to address out of control costs but fell short of comprehensive reform for retirees and taxpayers.

-

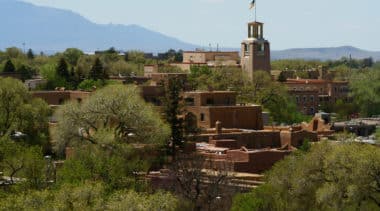

New Mexico Enacts Bipartisan Pension Reform to Improve PERA Solvency

Senate Bill 72 was a necessary and crucial first step towards improving the financial health of PERA and ensuring the sustainable delivery of public employee retirement benefits for state and local workers

-

The Impacts of Proposed Changes to Georgia’s Teacher Retirement System

Understanding the bills’ short-term costs along with their potential long-term benefits is critical to fully evaluating these reforms.

-

PERA’s Redesigned COLA Provides Retirees Inflation Protection and Improved Sustainability

Senate Bill 72 aligns the New Mexico Public Employees Retirement Association’s benefit adjustments with other fully-funded state pension plans and provides robust protections for retirees against inflation.

-

Key Stakeholders Agree It’s Time to Reform the New Mexico’s Largest Public Pension System

The proposed reforms to PERA are a great first step toward addressing the debt currently looming over the state budget.

-

North Carolina Teachers’ and State Employees’ Retirement System: A Pension Solvency Analysis

Better risk management and more realistic plan assumptions can help ensure the state delivers the promised retirement benefits to its employees.

-

Proposed New Mexico PERA Board Restructuring Would Improve Expertise, Balance Representation Long-Term

The proposed legislation offers the promise of improving the experience and oversight capabilities of the Public Employees Retirement Association's governing board.

-

Modernizing Arizona’s Pension Policy

Testimony to the Arizona Senate Finance Committee on Arizona Senate Bill 1280, which is part of the state's effort to modernize pension policy and tackle underfunding.

-

Redesigning Cost of Living Adjustments Would Improve PERA Sustainability

The Public Employees Retirement Association Pension Solvency Task Force projects PERA currently has only a 38 percent chance of reaching full funding by 2043.

-

Why PERA Being Only 71 Percent Funded Is Not Enough

The New Mexico Public Employees Retirement Association has at least $6.1 billion in pension debt and potentially more if its current actuarial assumptions are too aggressive, which is likely.

-

Why New Mexico Needs to Reform the Public Employees Retirement Association Now

The proposed reforms would be a meaningful step toward strengthening PERA while putting as little stress on members and taxpayers as possible.

-

PAYGO Is the Most Costly Way to Fund a Public Retirement System and Would Be Bad for New Mexico

Pensions are meant to be prefunded so that current taxpayers and current public employees share the costs of those workers’ benefits.

-

California’s Pension Systems Need To Continue Lowering Return Expectations and Reducing Risk

CalPERS achieved an investment return of 6.7 percent during the latest fiscal year, and similarly, CalSTRS saw a 6.8 percent net return, both short of the 7 percent benchmark established by their managing boards.

-

Credit Rating Upgrade Doesn’t Clear Arizona of its Pension Problems

The state has $27 billion in unfunded pension liabilities today in its four major pension plans.