-

From prison to paperwork: A 50-state survey of policies on reentry identification documents

State correctional agencies can facilitate the reentry process by assisting inmates with obtaining essential identification documents prior to release.

-

Frequently asked questions about public pensions investing in Bitcoin and other digital assets

Are public pension systems investing in digital assets effectively gambling with taxpayer-backed retirement assets?

-

U.S. public pension and trust fund investment in digital assets

Policy considerations for public sector investment in Bitcoin and other cryptocurrencies.

-

House Bill 78 would expose Alaska to billions in additional costs

House Bill 78 could cost Alaska's taxpayers more than $7 billion in the coming decades.

-

Alaska’s defined contribution plan is a better benefit than a pension for most state public workers

State policymakers should keep the defined contribution plan open as an option for those who would like to take advantage of its inherent advantages.

-

Restoring the Florida Retirement System’s COLA would increase pension costs, risk

State policymakers should look beyond best-case scenarios when evaluating the restoration of a cost-of-living adjustment.

-

Staffing surges and student outcomes: Rethinking unions, resource allocation, and school choice in American education

Despite declining student enrollment in many U.S. school districts, K-12 education spending and staffing have grown substantially over the past two decades.

-

Evaluating Amtrak and intercity bus performance for smarter federal investment

Six of the eight Amtrak routes examined are losing more than $100 per passenger.

-

Proposed Model Policy: “Veterans Mental Health Innovations Act”

This model legislation is intended to authorize state ibogaine research and participation in a larger multistate effort to complete a supervised clinical drug trial.

-

Model legislation would authorize groundbreaking research into ibogaine for mental health

Growing research has demonstrated the promise of ibogaine in treating a wide range of intractable conditions, which could benefit veterans.

-

K-12 Education Spending Spotlight 2025: Annual public school spending nears $1 trillion

Eight states spend more than $25,000 per student: New York, New Jersey, Vermont, Connecticut, Pennsylvania, California, Rhode Island and Hawaii. Public school enrollment fell in 39 states from 2020 to 2023.

-

Report: Cities have $1.4 trillion in debt

San Francisco, Nantucket, New York City, Ocean City, and Miami Beach are the cities with the most per capita debt.

-

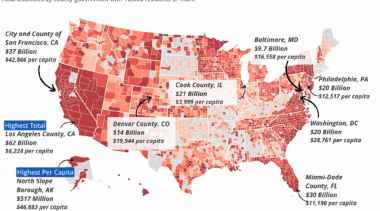

Report: County governments have $757 billion in debt

In per capita terms, North Slope Borough, Alaska, ranks first, with its total debt representing $46,883 per county resident.

-

Ibogaine could transform public spending on opioid treatment

Using ibogaine as a treatment for opioid use disorder could be significantly more cost-effective than traditional medication-assisted treatments.

-

FAQ: Timeline for FDA ibogaine approval

It can take between 5 and 12 years to complete a drug trial, but the timeline to drug approval can vary significantly depending on the type of treatment.

-

Ibogaine and veterans’ mental health

Innovative psychedelics therapy offers military veterans struggling with their mental health newfound hope.

-

Ibogaine offers breakthrough treatment for mental health, addiction, and TBIs

Ibogaine, a psychedelic, holds promise as a potential treatment for numerous conditions, ranging from PTSD to multiple sclerosis.

-

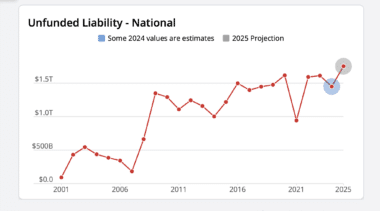

Report: State and local pension plans have $1.48 trillion in debt

State pension systems have $1.29 trillion in unfunded liabilities, and local governments have $187 billion.