Public comments submitted to the Texas House Committee on Pensions, Investments and Financial Services.

Chair Capriglione and members of the committee:

Thank you for the opportunity to offer our perspective on House Bill 3495 (HB 3495), which would remove the cap on hedge funds in the Teacher Retirement System of Texas (TRS) investment portfolio.

My name is Steven Gassenberger, and I serve as a policy analyst based in Houston for the Pension Integrity Project at Reason Foundation. Our team conducts quantitative public pension research and offers pro-bono technical assistance to officials and stakeholders aiming to improve pension resiliency and advance retirement security for public servants in a financially responsible way.

HB 3495 (and its Senate companion Senate Bill 1246) includes several policy changes, including removing the 10% cap placed on hedge fund assets within the TRS investment portfolio, which is the focus of the following comments. Given that TRS already holds $52 billion in unfunded pension liabilities and relies on contribution rates that are politically, not actuarially, determined, we believe it is essential to contextualize the potential risks of the proposed investment class expansion based on our analysis of TRS data. Additionally, we highlight two opportunities to mitigate some of the dangers that HB 3495 and SB 1246 would introduce in a way that would also improve the TRS pension plan’s long-term resiliency and solvency.

TRS Investment at a Glance

- The TRS trust fund holds over $180 billion in assets, making it one of the largest investors in the world.

- TRS has $52 billion in unfunded pension liabilities owed to current and retired members.

- According to the latest TRS report, the system’s total hedge fund value exceeded $17 billion, with an additional $567 million in unfunded capital commitments.

- The fees paid from the TRS trust fund in Fiscal Year 2022 amounted to $1.3 billion, which included $43 million in management fees and $59 million in performance fees.

- TRS paid $744 million in management fees from returns and $1.4 billion in carried interest.

Hedge Funds Are Another Alternative Asset

Hedge funds and other alternative assets are investments that fall outside traditional cash, publicly-traded stocks, and bonds. These alternative assets are typically less transparent and bring higher financial costs and fees than more traditional equity and bond holdings. Commonly, alternative investments take the form of shares in limited partnerships, such as with hedge funds and private equity. As a government-backed pension fund worth over $180 billion, TRS is considered a major source of capital for alternative investment providers.

Why Would TRS Seek to Expand its Alternative Asset Holdings?

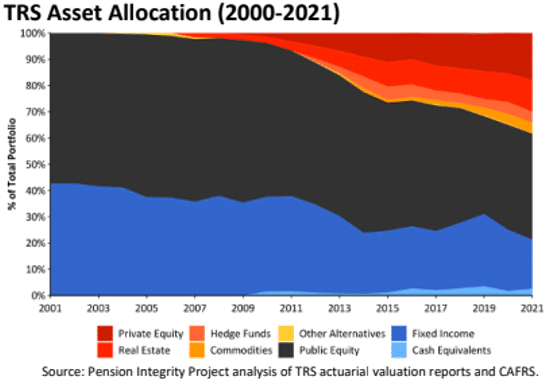

Like many of its national peers, TRS has adjusted its investment strategy in recent decades in response to the significant fluctuations in global interest rates, increased market volatility, economic recessions and other factors that made it increasingly difficult to maintain assumed investment returns of 8% and higher. Facing the challenge of maintaining high investment returns in an evolving environment, fund managers began moving away from safe fixed-income sources to more exotic—and often higher-risk—assets with increased potential upside.

Like many public systems around the country, TRS has pointed to alternatives like private equity and hedge funds as their highest-performing asset class over the last five years. With the system’s investment return assumption set at 7% and low-risk bonds yielding less than 4%, the TRS board now wants the option to move more of the TRS investment portfolio to high-risk/high-reward-style alternative assets. TRS has $52 billion in debt and hopes that the internal rate of return reported from alternatives will help the system avoid the need for higher contributions from the state government and its taxpayers. SB 1246 and HB 3495, in their current forms, would allow the TRS board to continue down this path of risk-taking, exposing more taxpayer and member contributions to private and opaque money managers. Today, TRS already holds a higher proportion of private assets than the average public pension system. Removing the cap on hedge funds would be the last limit the legislature has placed on TRS investments at a time when concerns about public money being used by private asset managers for political activism has never been more worrisome.

Concerns with Expanding Alternative Investments

Calling an investment safe implies a guarantee, which no investments can claim outright, but traditional fixed-income assets like U.S. Treasury bonds come close. Returns on bonds and large publicly-traded stocks are what sustained large public pension systems like TRS for generations without the need for supplemental infusions of public funds to close pension funding gaps.

Treasury bond rates were well above the TRS’ assumed rate of investment return until the mid-1990s, at which point U.S. Treasury bond rates began a long-term decline reaching levels far below the TRS assumed rate of investment return, prompting a “chase for yield” via an increasing reliance on alternative investments. TRS then began slowly drawing down its surplus, which totaled $2.1 billion in 2000.

TRS has historically assumed an investment return rate as high as 8% before lowering its assumption to 7.25% in 2018. The plan lowered the return assumption again in 2022 to the current 7%. With the experience of the last few decades, there is a concern that TRS is still depending on an outdated and artificially high investment return assumption, which may be a source of pressure to take undue investment risks in expensive and higher-risk alternatives.

Actively managed assets come with management, administrative, and performance fees that can drain hundreds of millions from the TRS trust fund. Such hefty fees are not inherently bad for TRS if they result in equally hefty returns for the fund, but just like other investments, there is no guarantee those extra fees will generate returns that exceed those gained by passively managed, much less expensive, and more transparently valued assets like index funds.

Building on Senate Bill 1246 and House Bill 3495

Although alternative assets are not inherently harmful to public pension systems, they do introduce a significant level of risk. Hence, it is prudent for policymakers to install boundaries around investment decisions—like the current 10% cap on hedge funds—and provide increased oversight capabilities to the public.

Option #1 – Systematically Reduce the Need for Higher Investment Returns

Our first suggested course of action is to continue to systematically reduce the assumed rate of return (ARR) used by TRS actuaries from its current 7% set in 2022. The average assumed rate of return for state pension plans in the United States has fallen from over 8% in 2000 to an average of 6.9% today. New York State’s Common Fund—which manages assets for state and local civilian and public safety personnel in that state—lowered its assumed rate of return last year to 5.9%. The nation’s largest public pension fund, CalPERS, lowered its investment assumption to 6.8% in 2021, and internal advisors said they should target 6%.

Continuing to reduce the return rate assumption used by TRS would reduce the chances of adding more unfunded liabilities and unexpected costs in the future if the lower rate is combined with a modernized funding policy like the new actuarially determined rate that was implemented for the Texas Employees Retirement System (ERS) in 2021. It would also reduce the system’s reliance on the high-yield gambles it is taking in an effort to reduce its debt and fund the retirement promises already made to teachers.

Option #2 – Increase Investment Cost Reporting Details

Alternative assets usually involve higher costs. A 2018 report by the Pew Charitable Trusts found pension plans spend at least $2 billion a year on investment fees alone, and TRS is no exception to this trend. Despite efforts to reduce fees through increased in-house investment management, fees such as carried interest (i.e., performance fees) could be adding high unnecessary costs. Performance fees for private equity investments are typically far higher than the standard management fees for those assets, and most public pension funds—including TRS—do not publicly report those performance fees.

Improving transparency and financial reporting by adopting a robust Investment Cost Report would directly address the issue of opaque fee reporting. This would shine a light on the fees and other expenses TRS incurs while managing its portfolio. California’s teacher pension system, CalSTRS, offers a model in this regard, producing a report showing its investment costs by type and asset category. An example report can be found at resources.calstrs.com.

This report is designed to provide stakeholders with detailed fee data and trends for each asset class and investment strategy over a four-year period, opening the door for a detailed cost-effectiveness evaluation. Fees and expenses should be consistently monitored, and managers should be held accountable for the effectiveness of investments relative to the overall growth and resiliency of TRS.

Thank you for the opportunity to share our perspective on HB 3495 and SB 1246. We welcome any questions or information requests the committee members may have.

Stay in Touch with Our Pension Experts

Reason Foundation’s Pension Integrity Project has helped policymakers in states like Arizona, Colorado, Michigan, and Montana implement substantive pension reforms. Our monthly newsletter highlights the latest actuarial analysis and policy insights from our team.