In This Issue

Articles, Research & Spotlights

- Flaws in proposed COLAs in Pennsylvania

- Warnings of issuing pension obligation bonds in Dallas

- Grading Ohio’s defined contribution plans for public workers

- Texas voters approve cost-of-living adjustment for retired teachers

- Michigan’s model for reducing pension debt in cities and counties

- Examination of the actuarial firms overseeing public pensions

News in Brief

Quotable Quotes on Pension Reform

Data Highlight

Contact the Pension Reform Help Desk

Articles, Research & Spotlights

Pennsylvania’s Proposed Pension Bills Don’t Meet Best Practices for Cost-of-living Adjustments

Three bills under consideration in the Pennsylvania legislature—Senate Bill 864, House Bill 1415, and HB 1416—would provide a one-time cost-of-living adjustment (COLA) to retired public workers. House Bill 1415 recently passed in the House and will be up for the Senate to consider. Reason Foundation’s Steven Gassenberger and Rod Crane explain that since a COLA benefit was not promised or funded in advance, the costs would be high and fall squarely on today’s taxpayers’ shoulders. They compare the three proposals with Reason’s best practices for COLA benefits, finding that they neither fund the cost-of-living adjustment efficiently nor tie them to inflation measurement. Pennsylvania’s main public pension plans are struggling to fund the benefits promised to workers and retirees. Both main state plans have less than 70% of the funds needed to fulfill promises, so policymakers should cautiously approach proposals to promise more benefits.

Dallas Should Not Bet on Pension Obligation Bonds to Save Pension System

Responding to state requirements to be on track to fully fund the Dallas Police and Fire Pension System by 2055, a newly appointed city council committee is evaluating the possibility of issuing a pension obligation bond (POB) to reduce the plan’s $3 billion in unfunded liabilities. Reason’s Mariana Trujillo and Truong Bui warn that while this strategy may alleviate the city’s pension funding woes in the short term, it comes with more exposure to market losses. They explain that a POB differs from an interest refinance because it does not release the government of the original benefit obligation or any of its continued unexpected costs. They warn that POBs are more akin to leverage strategies that amplify investment risk.

Evaluation of Defined Contribution Plans Offered to Ohio Public Workers

When teachers and general government workers are hired in Ohio, they can choose between several retirement plan options. Among those available plans are the State Teachers Retirement System and Public Employee Retirement System defined contribution plans, which offer a flexible and modern approach to retirement savings. In these evaluations of the state’s two major defined contribution plans, Rod Crane and Rich Hiller apply Reason’s best practices to identify what Ohio’s plans do right and where there are opportunities for improvement.

Texas Voters Approve Cost-of-Living Adjustment for Retired Teachers

With 83% of the vote, Texas voters overwhelmingly approved a constitutional amendment granting the state legislature the authority to give retired teachers a one-time cost-of-living adjustment. Before the election, Reason’s Steven Gassenberger outlined how Prop. 9 will increase benefits and long-term liabilities of the Texas Teacher Retirement System, which holds $63 billion in unfunded liabilities. With these added benefits come more risks of unfunded liabilities if investments fall below the system’s assumed 7% return.

The Way Michigan’s Pension Reform Tackles Public Pension Debt Is a Model for Other States

In 2017, Michigan lawmakers took strides to improve the health of severely underfunded municipal pensions with the Protecting Local Government Retirement and Benefits Act 202. The initiative established detailed reporting and required corrective action from local plans that fell to funding below 60%. With transparency and funding expectations now well established, the legislature followed up with Act 166 in 2022, which offered state funding in the form of grants conditional on a local government’s continued adherence to a correction plan. Reason’s Mariana Trujillo illustrates how the combination of these strategies proved a powerful avenue for reforming Michigan’s public pension systems and reducing long-term costs for taxpayers in ways that are a model for other states grappling with municipal pension debt.

The Actuarial Firms Working with the Most Public Pension Plans and a Surge of Unfunded Liabilities

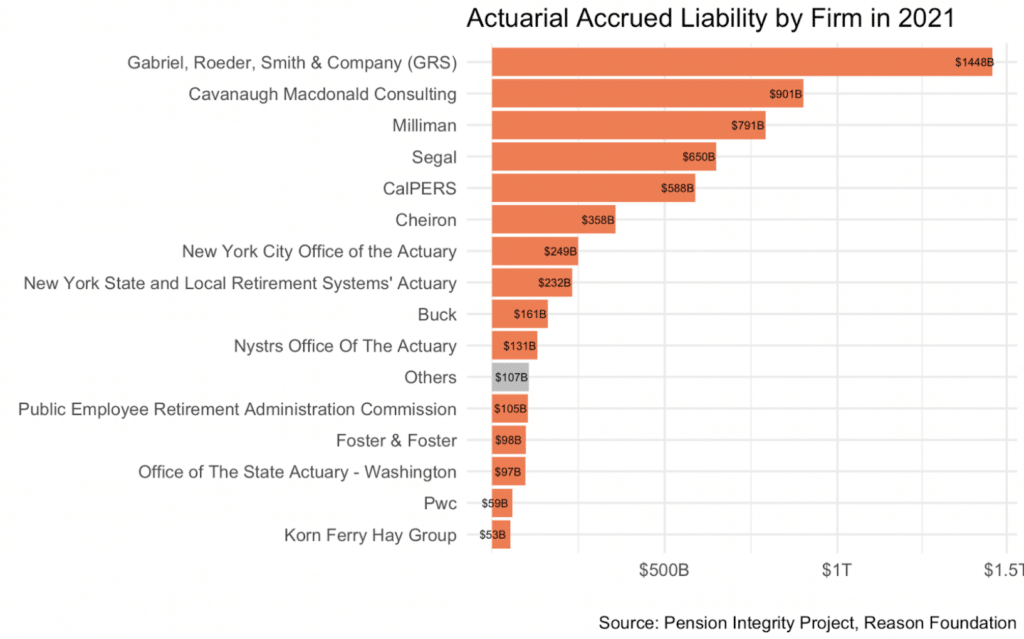

Public pension plans contract with actuaries to calculate and report funding projections and contribution requirements. According to Reason’s Thuy Nguyen examination of 209 major public pension plans, most of this work is being done by 32 actuarial firms. As of 2021, Gabriel, Roeder, Smith & Company (GRS) was the leader, overseeing public pension plans with an aggregate of over $1.5 trillion in actuarial accrued liabilities, followed by Cavanaugh Macdonald Consulting with $901 billion in total debt and Milliman with $791 billion in unfunded liabilities. Most actuarial firms added to the number of plans they consulted over the last five years. Since 2016, the Segal Group added eight new plans to their clientele, Cheiron Inc. added four, and Foster & Foster added two.

News in Brief

Growing Allocations in Alternatives Pressures Plans to Improve Fee Reporting

A new report from the Pew Charitable Trust Public Sector Retirement Systems Project measures the proliferation of “alternatives” in pension investment portfolios and calls for more effective risk disclosures. According to the analysis, funds have doubled their allocation to riskier alternative investments, like private equity and hedge funds, over the past 15 years, leading to an aggregate 30% increase in investment fees as a percentage of total assets. The number of funds adhering to more robust disclosure practices has increased since 2016. Out of the 73 largest funds controlling 95% of all pension assets, there was a slight increase in those who made their investment policy statements available online, from 59 to 64. Further, there was a reduction in funds reporting only gross-of-fees investment performance, from 27 in 2016 to 18 in 2021. The full report can be found here.

Incorporating Automatic Enrollment in Defined Contribution Plans Could Improve Retirement Outcomes

Incorporating automatic features in defined contribution (DC) plans, such as automatic enrollment and escalation, could significantly aid state and local government employees in mitigating longevity risks (the risk of outliving one’s retirement savings). A new report from MissionSquare Research Institute finds that although automatic enrollment has been adopted in 17 DC plans across states and the District of Columbia over the past 15 years, the use of automatic escalation remains notably sparse. This lack of adoption is attributed to various factors, including government officials’ reluctance to proceed without explicit statutory authority. The report advocates for integrating automatic escalation in DC plans to ensure public sector employees’ financial security in retirement. It offers case studies of states that have successfully applied this approach. The full report can be found here.

Quotable Quotes on Pension Reform

“When people started working for the school district or working for the state, there is nothing that says they’re going to get a COLA…The way that school districts pay for their bills are through school property taxes…So without a doubt, this would lead to a school district property tax increase.”

— Pennsylvania State Rep. Brad Roae (R-Crawford County) on proposals to give ad hoc COLA benefits, quoted in “Nearly 70K Pa. School, Government Retirees Have Had No COLA Increase in 21 Years,” Penn Live, Oct. 31, 2023

“It’s been said that we have an obligation to our retirees current and future…This will substantially weaken the pension fund for our future retirees.”

— Pennsylvania State Rep. Brett Miller (R-Lancaster County) on proposals to give ad hoc COLA benefits, quoted in “Nearly 70K Pa. School, Government Retirees Have Had No COLA Increase in 21 Years,” Penn Live, Oct. 31, 2023

Data Highlight

Each month, we feature a pension-related chart or infographic of interest generated by our team of analysts. This month, we are showcasing an analysis by Reason’s Thuy Nguyen that illustrates the size of pension liabilities managed by the largest actuarial firms. You can access the visualization and more information here.

Stay in Touch with Our Pension Experts

Reason Foundation’s Pension Integrity Project has helped policymakers in states like Arizona, Colorado, Michigan, and Montana implement substantive pension reforms. Our monthly newsletter highlights the latest actuarial analysis and policy insights from our team.