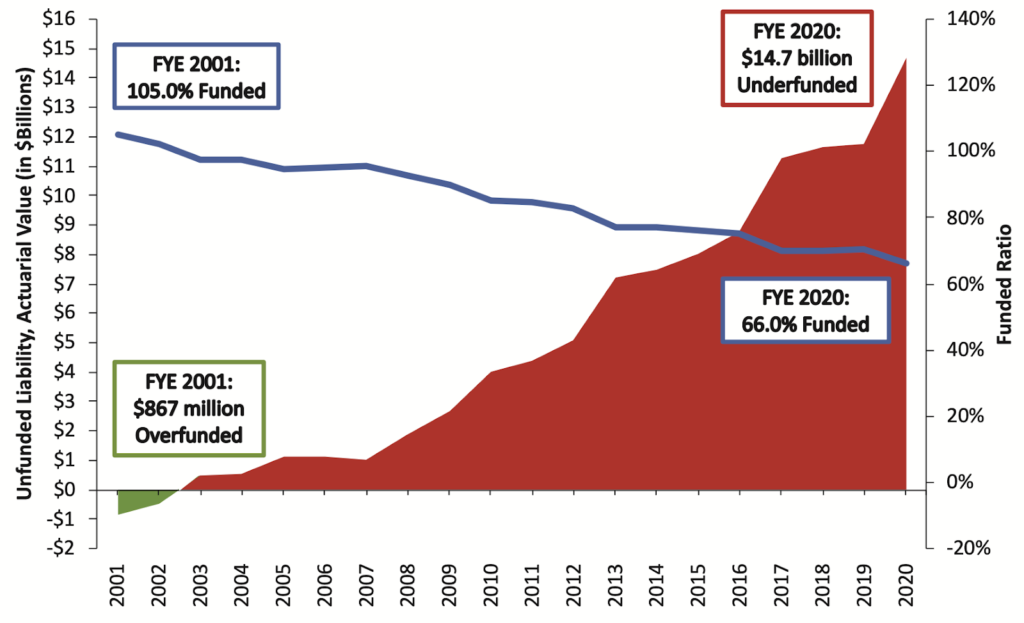

Despite being overfunded at the turn of the century, the Employees Retirement System of Texas (Texas ERS), which provides pension benefits for state employees, is now facing the challenge of how to avoid insolvency in the coming decades.

With $14.7 billion in unfunded liabilities, the retirement security of state employees and retirees may be in jeopardy. Even the system’s own actuaries have warned that “there is a strong possibility that Texas ERS will become insolvent in a 30 to 40 year timeframe which is within the current generation of members.” This very real threat is the result of two decades of underperforming investments, insufficient contributions, and undervalued pension promises. The shocking growth of the Employees Retirement System’s debt can be seen below.

The $14.7 billion in unfunded benefits earned and owed to ERS members and retirees have driven up pension costs, which are ultimately borne by taxpayers and members alike. Furthermore, underperforming investments and growing liabilities have led to Texas reaching its constitutionally set cap on annual contributions. The cap on state contributions does not stop members from accruing benefits, however.

Challenges Facing ERS

- Deviations from Investment Return Assumptions have been the largest contributor to the ERS unfunded liability, adding $8.43 billion since 2001.

- Extended Amortization Timetables and Statutory Contribution Limits have resulted in interest on ERS debt exceeding the actual debt payments (negative amortization) since 2001 and a net $4.46 billion increase in the unfunded liability.

- Deviations from Demographic Assumptions including deviations from withdrawal, retirement, disability, and mortality assumptions — added over $1.5 billion to the unfunded liability since 2001.

- Changes in Actuarial Methods & Assumptions have exposed over $2 million in previously unrecognized unfunded liabilities over the last decade.

- Undervaluing Debt through discounting methods has led to the tacit undercalculation of required contributions on the part of the state.

Assumed Rate of Investment Return

Unrealistic Expectations

Despite recently lowering the investment return assumption to 7.0 percent, Texas ERS remains exposed to significant investment underperformance risk.

Underpricing Contributions

The current investment return assumption leads to underpricing benefits and an under-calculated actuarially determined contribution rate.

Investment Returns Have Underperformed for Years

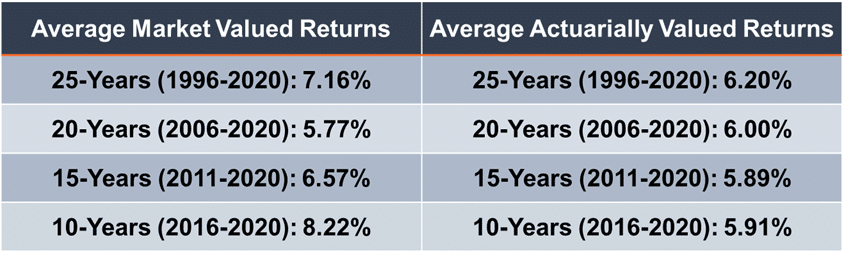

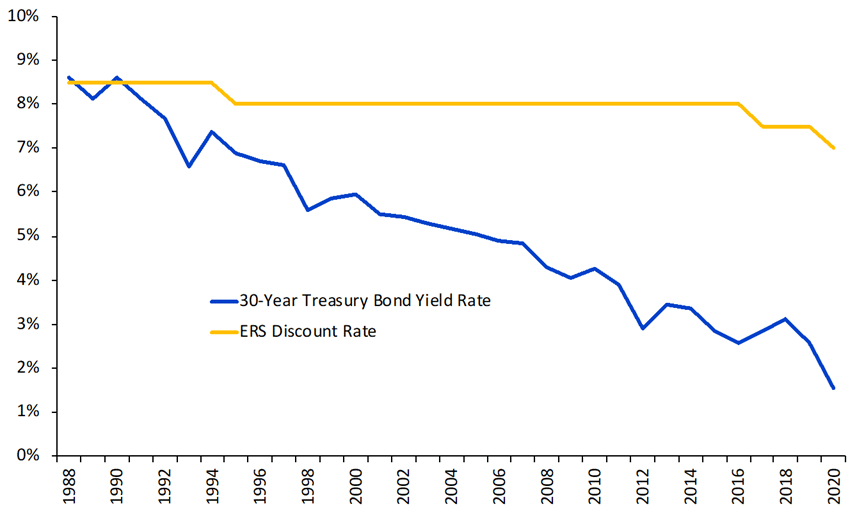

- ERS Texas actuaries have historically used an 8 percent assumed rate of return to calculate member and employer contributions, slowly lowering the rate to 7 percent over the past two decades in response to significant market changes.

- Average long-term portfolio returns have not matched long-term assumptions over different periods of time: Note: Past performance is not the best measure of future performance, but it does help provide some context to the challenge created by having an excessively high assumed rate of return.

New Normal: The Market Has Changed

The “new normal” for institutional investing suggests that achieving even a 6 percent average rate of return in the future is optimistic.

- Over the past two decades, there has been a steady change in the nature of institutional investment returns. 30-year Treasury yields have fallen from near 8 percent in the 1990s to consistently less than 3 percent. Read more: Why Low-Interest Rates Are Bad for Public Pension Plans. The U.S. just experienced the longest economic recovery in history, yet average growth rates in GDP and inflation are below expectations.

- McKinsey & Co. forecast the returns on equities will be 20 percent to 50 percent lower over the next two decades compared to the previous three decades. Using their forecasts, the best-case scenario for a 70/30 portfolio of equities and bonds is likely to earn around 5% return.

- ERS consulting actuary comments:

“[…] if the investment experience had met the current assumptions over the last 20 years, ERS would effectively be fully funded […]”

“[…] actual returns have not been available in the market to meet the assumption.”Source: Texas ERS CAFRs and *2019 valuation report, page 8.

Risk Assessment & State Budget

Our risk assessment analysis shows that under likely market fluctuations, ERS Texas funding could decline significantly more.

If you assume the current economy does not fully recover until 2023, and also predict an additional downturn sometime between 2035 and 2038, as well as a 6 percent rate of investment return over the next 30 years, analysis shows that Texas ERS’s unfunded liability would equal $64 billion in the year 2050. Currently, the state assumes that the plan’s unfunded liabilities will increase to only $26.8 billion by 2050.

Seeing as ERS Texas only averaged a 5.83 percent investment return rate between 2000 and 2019 and that we have seen two major economic crises in the last 20 years, it is reasonable to assume the next 30 years will look somewhat similar.

If this is the case, our projections show that the cost of the pension plan would increase to nearly 25 percent of employer payroll, putting significant strain on the state budget.

Texas State Constitution Limits Contributions

Texas Constitution Article 16, Section 67(b)(3) caps state contributions to Texas ERS at 10 percent of payroll, which can only be exceeded under an emergency declaration and requires that benefits should be financed in a way that is consistent with best practices.

The definition of actuarially sound principles is not expressly defined in the Texas Constitution, however, The Society of Actuaries Blue Ribbon Panel has outlined pension best practices, such as ensuring the amortization schedule is less than 30-years and paid off over a fixed period.

The need for higher contributions is likely to be on-going for at least the next 20 to 30 years. Thus, the use of an emergency clause would likely not be a viable solution should the legislature desire to contribute above the 10 percent of payroll cap on contributions.

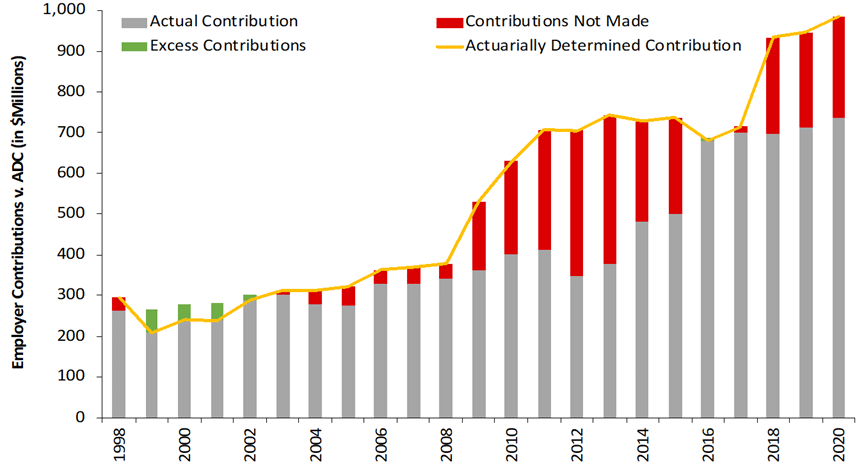

Insufficient Contributions & Pension Debt Management

State Statutes Have Created a Structural Underfunding Challenge for Texas ERS:

- Over the past 18 years, statutory employer contributions have routinely fallen below actuarially determined contribution (ADC) rates.

- Employer contribution rates determined by legislative statute are not enough to keep up with the actual amount necessary to amortize the debt.

- 2019: Employer ADEC v. Statute

- Statutory Employer Contribution: 10 percent of payroll

- Actuarially Determined Employer Contribution: 15.98 percent of payroll

With the employer contribution rate fixed in statute and a 31-year, open amortization policy, Texas ERS now faces an infinite amortization period, meaning it is not projected to ever pay off its unfunded liabilities.

Actuarial Assumptions & Methods

Flawed Contribution and Debt Management Policies

Setting contribution rates in the statute that are below ADEC and using optimistic return assumption resulted in interest on ERS Texas debt exceeding the actual debt payments (aka negative amortization) and have added a net $4.46 billion increase in the unfunded liability since 2001.

Changes in Actuarial Assumptions and Methods

ERS Texas made alterations to its actuarial assumptions (e.g. changes in the assumed rate of return in 2017) that have collectively unveiled $2 billion of hidden unfunded liabilities from 2001-2020.

Deviations from Service Retirement and Other Demographic Assumptions

ERS’s unfunded liability has increased by $1.45 billion between 2001-2020 due to misaligned demographic assumptions, which include deviations from the plan’s withdrawal, retirement, disability, and mortality assumptions.

Overestimated Payroll Growth

ERS employers have not raised salaries as fast as expected, resulting in lower payrolls and thus lower earned pension benefits. This has meant a reduction in unfunded liabilities of $1.1 billion from 2001 to 2019.

However, overestimating payroll growth is creating a long-term challenge for ERS because of its combination with the level-percentage of payroll amortization method used by the plan.

This method backloads pension debt payments by assuming that future payrolls will be larger than today (a reasonable assumption). But when payroll does not grow as fast as expected, employer contributions must rise as a percentage of payroll. This means the amortization method combined with the inaccurate assumption is delaying debt payments.

Discount Rate & Undervaluing Debt

The discount rate for a public pension plan should reflect the risk inherent in the pension plan’s liabilities:

- Most public sector pension plans — including Texas ERS — use the assumed rate of return and discount rate interchangeably, even though each serves a different purpose.

- The Assumed Rate of Return (ARR) adopted by Texas ERS estimates what the plan will return on average in the long run and is used to calculate contributions needed each year to fund the plans.

- The Discount Rate (DR), on the other hand, is used to determine the net present value of all of the already promised pension benefits and supposed to reflect the risk of the plan sponsor not being able to pay the promised pensions.

Setting a discount rate too high leads to undervaluing the amount of accrued pension benefits:

If a pension plan is choosing to target a high rate of return with its portfolio of assets, and that high assumed return is then used to calculate/discount the value of existing promised benefits, the result will likely be that the actuarially recognized amount of accrued liabilities is undervalued.

It is reasonable to conclude that there is almost no risk that Texas would pay out less than 100 percent of promised retirement income benefits to members and retirees:

Article 16, § 66(d) of the Texas Constitution protects against impairment or reduction of accrued pension benefits “[A] change in service or disability retirement benefits or death benefits of a retirement system may not reduce or otherwise impair benefits accrued by a person…”

The discount rate used to account for this minimal risk should be appropriately low:

The higher the discount rate used by a pension plan, the higher the implied assumption of risk for the pension obligations.

The Existing Benefit Design Does Not Work for Everyone

The turnover rate for members of ERS suggests that the current retirement benefit design is not supporting goals for retention.

64 Percent of new ERS Texas members hired at age 25 leave before 5 years

- Regular State employees must work 5 years before their benefits become vested.

- Members who leave the plan before then must forfeit contributions their employer made on their behalf.

- Another 19 percent of new members still working after 5 years will leave before 15 years of service.

Recruiting a 21st Century Workforce

- There is little evidence that retirement plans — DB, DC, or other design — are a major factor in whether an individual wants to enter public employment.

- The most likely incentive to increase recruiting to the public workforce is increased salary.

Retaining Employees

- If worker retention is a goal of the ERS Texas system, it is clearly not working, as nearly 65% of employees leave within 5 years.

- After 20 to 30 years of service, there is some retention effect, but the same incentives serve to push out workers in a sharp drop off after 30 years of service or reaching the “Rule of 80” threshold.

Framework & Solutions for Reform

Pension Integrity Project Policy Objectives

- Keeping Promises: Ensure the ability to pay 100 percent of the benefits earned and accrued by active workers and retirees

- Retirement Security: Provide retirement security for all current and future employees

- Predictability: Stabilize contribution rates for the long-term

- Risk Reduction: Reduce pension system exposure to financial risk and market volatility

- Affordability: Reduce long-term costs for employers/taxpayers and employees

- Attractive Benefits: Ensure the ability to recruit 21st Century employees

- Good Governance: Adopt best practices for board organization, investment management, and financial reporting

Practical Policy Framework

- Adopt better funding policy, risk assessment, and actuarial assumptions. Lower the assumed rate of return to align with independent actuarial recommendations. These changes should aim at minimizing risk and contribution rate volatility for employers and employees.

- Establish a plan to pay off the unfunded liability as quickly as possible. The Society of Actuaries Blue Ribbon Panel recommends amortization schedules be no longer than 15 to 20 years. Reducing the amortization schedule would save the state billions in interest payments.

- Review current plan options to improve retirement security. Consider offering additional retirement options that create a pathway to lifetime income for employees that do not stay in public service.

Full Employee Retirement System of Texas (ERS) Pension Solvency Analysis (March 2021)

Update 5/19/2021: This post previously stated that 66 percent of new ERS members leave before five years of service. Corrections to our employee attrition calculations now show that 64 percent of new ERS members will leave employment before five years of service.

Stay in Touch with Our Pension Experts

Reason Foundation’s Pension Integrity Project has helped policymakers in states like Arizona, Colorado, Michigan, and Montana implement substantive pension reforms. Our monthly newsletter highlights the latest actuarial analysis and policy insights from our team.