What Impact Will Senate Bill 321 Have on Texas Employee Recruitment and Retention?

- SB 321 should be expected to have little impact on recruitment and retention—or perhaps even a positive impact.

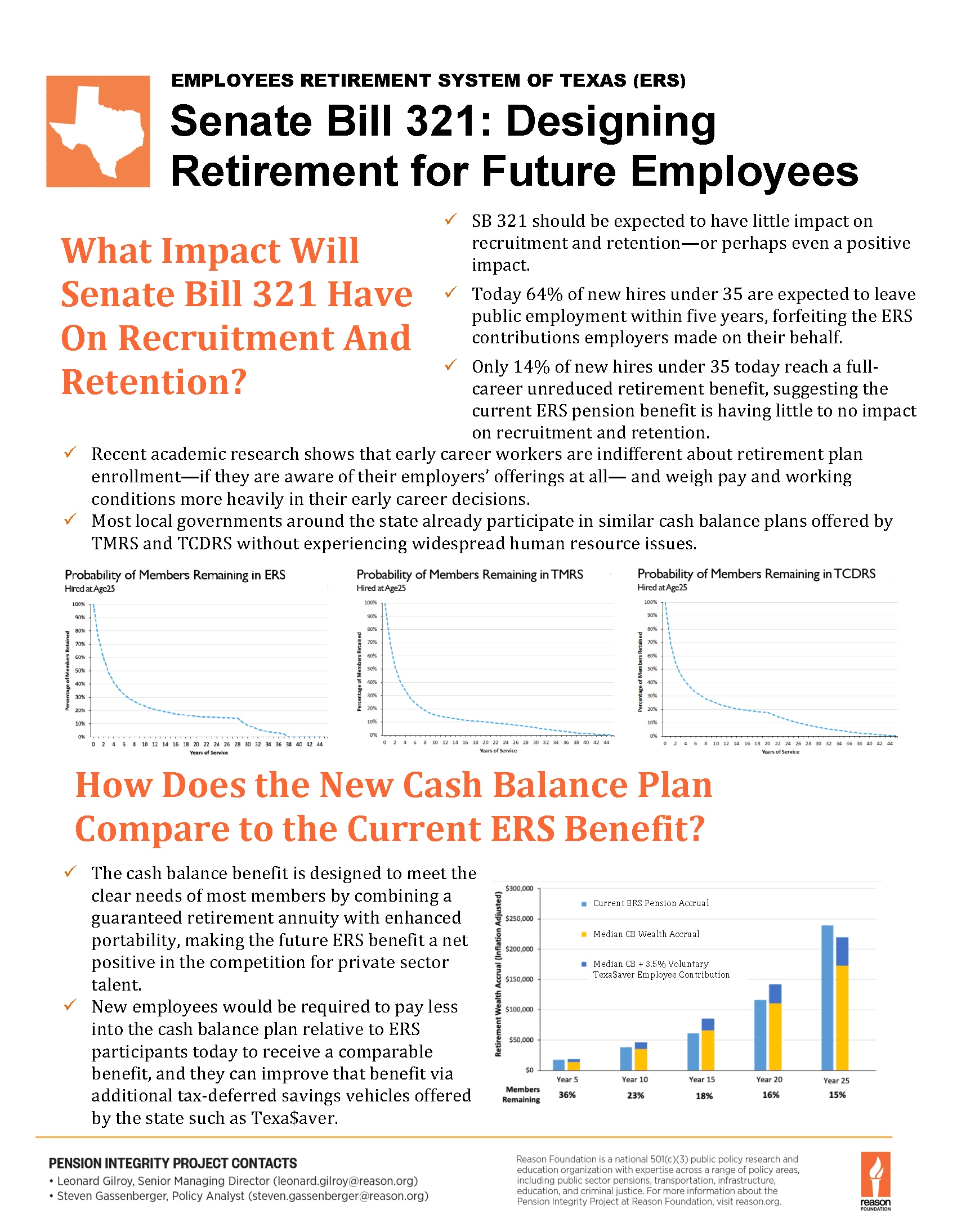

- Today 64% of new hires under 35 are expected to leave public employment within five years, forfeiting the employer’s ERS contributions made on their behalf.

- Only 14% of new hires under 35 today reach a full-career, un-reduced retirement benefit suggesting the current ERS pension benefit is having little to no impact on recruitment and retention.

- Recent academic research shows that early career workers are indifferent about retirement plan enrollment—if they are aware of their employers’ offerings at all—weighing pay and working conditions more heavily in their early career decisions.

- Most local governments around the state already participate in similar cash balance plans offered by TMRS and TCDRS without experiencing widespread human resource issues.

How Does the Cash Balance Plan Compare to the Current ERS Benefit?

- The cash balance benefit is designed to meet the clear needs of the vast majority of members by combining a guaranteed retirement annuity with enhanced portability, making the future ERS benefit a net positive in the competition for private sector talent.

- New employees would be required to pay less into the cash balance plan relative to ERS participants today to receive a comparable benefit, and they can improve that benefit via additional tax-deferred savings vehicles offered by the state such as Texa$aver.

Senate Bill 321: Designing Retirement for Future Employees

Stay in Touch with Our Pension Experts

Reason Foundation’s Pension Integrity Project has helped policymakers in states like Arizona, Colorado, Michigan, and Montana implement substantive pension reforms. Our monthly newsletter highlights the latest actuarial analysis and policy insights from our team.