Steve Vu is a quantitative analyst at Reason Foundation.

At Reason, Vu delivers data solutions to evaluate the operation and financial performance of public pension funds.

Prior to joining Reason, worked in emerging financial markets where he led an economic team to advise top asset management firms on investment strategies and portfolio constructions.

Vu graduated with a Master’s degree in Behavioral and Computational Economics at the Economic Science Institute, hosted by Dr. Vernon Smith, a Nobel prize winner.

Vu is based in the Los Angeles Metropolitan Area.

-

Florida must stay the course to pay for promised pension benefits

Florida’s retirement system for public workers is estimated to be 17 years away from eliminating expensive pension debt.

-

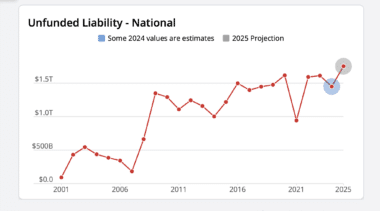

Report: State and local pension plans have $1.48 trillion in debt

State pension systems have $1.29 trillion in unfunded liabilities, and local governments have $187 billion.

-

How government workforce reductions can impact public pension debt

Public pension plans need to lower their payroll growth assumptions or transition to a method that is less sensitive to payroll fluctuations.

-

With additional plans reporting, total unfunded public pension liabilities in the U.S. grow to $1.61 trillion

Information added to the Annual Pension Solvency and Performance Report finds the median funded ratio across public pension plans decreased marginally to 75.8%.

-

Public pension plans should capitalize on strong investment returns to build long-term stability

In 2024, most public pension plans reported investment returns above their long-term assumed rates of return.

-

States should use budget surpluses to pay down public pension debt

States with budget surpluses should reduce expensive, long-standing debts, including unfunded public pension obligations.

-

Annual pension solvency and performance report

At the end of the 2023 fiscal year, the nation's public pension systems had $1.59 trillion in total unfunded liabilities.

-

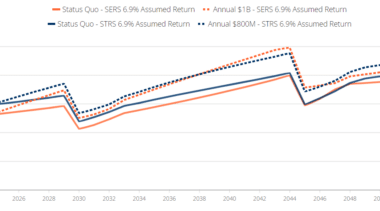

How Connecticut pensions can save $7 billion in interest costs over the next 30 years

The Connecticut Pensions Dashboard explores various economic scenarios that could impact the state's public pension debt.

-

The case for Connecticut’s fiscal guardrails

The “fiscal guardrails” have saved Connecticut more than $170 million and could save $7 billion over the next 25 years.

-

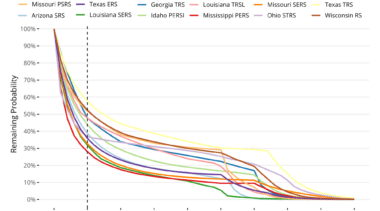

Most public employees leave jobs before they vest in pension systems

An examination of 12 public pension plans finds 62% of public workers leave before vesting in their pensions.

-

Public pension funds should avoid local economically targeted investments

While some politicians may be tempted by calls for public pensions to invest in local economies, a pension board's duty is to maximize investment returns to fully fund plan members’ benefits.

-

For most workers, the value of Alaska’s defined contribution plan surpasses that of a traditional pension

The following tool created by the Pension Integrity Project displays the year-by-year accrual of retirement benefits for a wide variety of Alaska workers in different fields and starting at different ages.

-

The risky political push to force public pensions to divest from China

The worrying trend of using public pension funds as a tool to exercise political leverage.

-

Public pension costs continue to drive up Milwaukee taxes

Milwaukee needs to urgently tackle the mounting public pension costs burdening the city's budget.

-

The costs of proposals to add or restore cost-of-living adjustments for public retirees

Between 2010 and 2013, 17 states reduced, suspended, or eliminated COLAs for current workers and retirees to help address public pension debt and costs.

-

The 2022 fiscal year investment results for state pension plans

Overall, the median investment return result for state pension systems in 2022 is -5.2%.

-

In search of higher returns, public pension systems dive deeper into alternative investments

Taxpayers, policymakers and public pension fund managers should be aware of risky and volatile investments.