Reason Foundation finds California has twice the total liabilities of any other state. California had $498 billion in total liabilities at the end of fiscal year 2022. That’s more than double the $247 billion in total liabilities in Illinois, $245 billion in New York, $225 billion in New Jersey, $221 billion in Texas, and $120 billion in total liabilities in Massachusetts.

On a per capita basis, Reason Foundation finds Connecticut’s total liabilities—$27,031 total liabilities per capita—were the worst in the nation at the end of the 2022 fiscal year, followed by New Jersey ($24.2k in total liabilities per capita), Hawaii ($19.4k per capita), Illinois ($19.4k per capita), and Wyoming ($18.6k per capita).

When looking at state public pension debt, Illinois has nearly double the pension liabilities of any other state. At the end of fiscal 2022, Illinois had $139.8 billion in public pension liabilities, New Jersey had $75.1 billion, California had $54.2 billion, Connecticut had $36.1 billion, Massachusetts had $34.8 billion, and Texas had $30.9 billion.

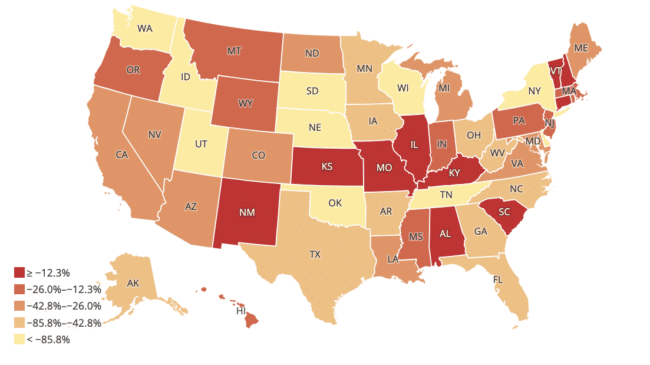

At the end of 2022, Illinois had $10,915 in pension liabilities per capita, followed by Connecticut ($10k per capita), New Jersey ($8.1k per capita), Kentucky ($5.6k per capita), Massachusetts ($5k per capita), and Hawaii ($4.3k per capita).

At the end of the 2022 fiscal year, the 50 states held $1.03 trillion in employee-related debt, including $502 billion in net public pension liabilities and $524 billion in net other post-employment benefit liabilities, such as promised medical benefits for retirees.

Ten states—Illinois, New Jersey, California, Texas, New York, Connecticut, Massachusetts, Pennsylvania, Kentucky, and Maryland—account for 84.7% of the total employee-related debt among all 50 states.

For detailed information about each state's debt and financial condition, please visit https://debttrends.transparencyproject.reason.org/state.

Overview of Government Financial Transparency Project: State and local debt trends 2020-2020

County debt: Los Angeles, Philadelphia, Denver, Miami-Dade and Cook counties among worst in nation