-

The costs and risks of proposed public retirement changes in Alaska

Examining several pieces of proposed legislation impacted public pensions in Alaska.

-

Examining an Alaska pension reform counterfactual

A look at what would have happened to the Public Employee Retirement System and Teacher Retirement System if proposed pension reforms from 2021 had been enacted.

-

Senate Bill 88 would expose Alaska to potentially higher pension costs

Senate Bill 88 would likely cost Alaska more than $8 billion in the coming decades.

-

House Bill 22 and Senate Bill 35 threaten Alaska’s budgets

HB 22 and SB 35 would likely cost Alaska upwards of $800 million in the coming decades.

-

Social equity programs in marijuana legalization laws aren’t achieving goals of helping victims of the drug war

State efforts to promote social equity within legal cannabis markets have unintentionally created new versions of the war on drugs.

-

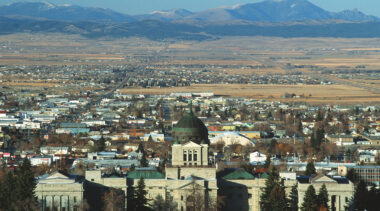

Montana’s default retirement benefit option should best serve most public workers

Montana House Bill 226 would better align the default retirement benefit option with what would best most workers need.

-

Updated Arizona K-12 education finance model with latest school finance and transportation data

The model allows users to test changes to Arizona’s funding formula, see how changes to local property taxes impact funding, and see how potential changes affect the funding of individual school districts and charter schools.

-

Airline deregulation: Past experience and future reforms

The U.S. experience with airline deregulation shows that eliminating government barriers to competition can generate enormous benefits for consumers.

-

Preserving and expanding the benefits of airline deregulation

Three reforms Congress could make to expand the benefits of airline deregulation.

-

Automated vehicle policy recommendations for the 118th Congress

The future of automated driving systems and how to refocus federal policymaking on productive near-term activities.

-

Why New Mexico House Bill 547’s tax increases undermine public health

The taxes in the bill would hurt efforts to reduce the smoking of traditional cigarettes and disproportionately harm low-income families.

-

Montana reform would improve pension funding and retirement savings for public employees

Montana House Bill 226 would adopt actuarially determined employer contributions funding to guarantee benefits are fully funded within a specified timeframe.

-

Tolling value proposition for trucking and state departments of transportation

The question addressed in this paper is whether toll-financed interstate highway modernization could overcome the long-standing objections of the trucking industry, as well as concerns of state DOTs about the coming decline in fuel tax revenues.

-

The current status of Texas Central’s proposed high-speed rail line linking Dallas and Houston

The high-speed rail vision Texas Central outlined in 2013 of easy land acquisition, quick construction, minimal opposition, and low costs is vastly different from the grim reality that caused the company to abandon its project in 2022.

-

Clearing up definitions of backpack funding

Without strong funding portability mechanisms, school districts have weak financial incentives to welcome transfer students.

-

Modeling methodology and approach to analysis of public retirement systems

The Pension Integrity Project uses custom-built actuarial and employee benefit models that are tailored to reflect each unique retirement system.