-

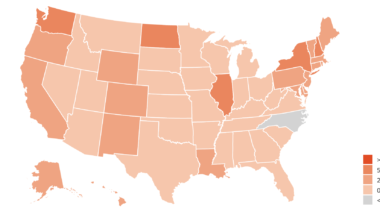

K-12 Education Spending Spotlight: An in-depth look at school finance data and trends

Reason Foundation’s new K-12 Education Spending Spotlight provides critical insight into key school finance trends across the country.

-

Best practices for cost-of-living adjustment designs in public pension systems

Striking the proper balance between cost, risk, and benefits in a way that works for both employees and employers.

-

Frequently asked questions on student-centered funding

Student-centered funding puts student needs as the focus of education funding decisions.

-

Converting high occupancy vehicle lanes to high occupancy toll lanes or express toll lanes

This brief examines why and how high-occupancy vehicle lanes are converted, how much the conversions cost, and how high-occupancy toll and express toll lanes have performed.

-

How to improve transit service for today’s workers and commuters

U.S. metro areas need a new transit approach that is tailored to serving the needs of today’s workers.

-

How Washington state can transition from the gas tax to road usage charges

This brief suggests a policy framework for developing a road usage charge program in Washington and an implementation order that builds on systems already in place on the state’s major highways.

-

Examining the Teachers Retirement System of Texas after the pension reforms of 2019

Senate Bill 12 of 2019 made reforms, but TRS contributions will likely be insufficient because the pension plan is using outdated economic assumptions.

-

Replacing Michigan’s gas tax with mileage-based user fees

A transition from per-gallon fuel taxes to a mileage-based user fee system should be considered as a strategy to ensure adequate road funding for Michigan’s future.

-

What is a revenue-risk public-private partnership?

And when is revenue risk the better financing choice for the state and taxpayers?

-

The impact of California’s cannabis taxes on participation within the legal market

This analysis develops an empirical model to estimate the degree to which California’s tax regime affects participation within its commercial cannabis market, and how participation may change through different approaches to taxation.

-

Why paying down New Hampshire pension debt faster would be a win for taxpayers

A “catch-up” payment toward the New Hampshire Retirement System's unfunded liabilities would reduce pension debt and yield long-term cost savings.

-

Frequently asked questions about the FDA’s ban on menthol cigarettes

Here are some of the common questions about banning menthol cigarettes, the supposed evidence in support of a menthol cigarette ban, and a ban's possible consequences on public health and minority communities.

-

Evaluating the potential impacts of Louisiana Senate Bill 438

The proposed hybrid plan is more expensive than the current pension under all scenarios.

-

Paying down PSPRS debt faster is a win for taxpayers

Unfunded PSPRS and ASRS liabilities make those pension systems more costly, pressuring government budgets. Paying down pension debt as fast as possible avoids interest costs and saves taxpayers money.

-

House Bill 2486 threatens Oklahoma’s pension progress

Public pension changes of the magnitude being proposed should receive rigorous actuarial and risk analyses that ensure future generations’ interests are protected.

-

Actuary highlights House Bill 55’s costs and risks to the Alaska Public Employees’ Retirement System

Changes of the magnitude being proposed in Alaska House BIll 55 should receive rigorous actuarial and risk analyses that have not yet been conducted.

-

Understanding the recent nationwide increase in crime

Violent crime has decreased dramatically since its peak in the 1990s. In 2020, the violent crime rate remained near the record lows achieved throughout the 2000s.

-

Pennsylvania House Bill 2272: Making the state’s distilled spirits monopoly illegal

Pennsylvania HB 2272 would end the state-run liquor monopoly, but stops short of establishing a competitive, private market replacement.