In 2002, the Arizona State Retirement System was $1 billion overfunded and on track to provide the retirement benefits that had been promised to state and municipal employees as well as educators. Just 20 years later, the Arizona State Retirement System has over $15.9 billion in unfunded pension liabilities and has fallen deeper into debt each year since 2014.

Our latest analysis of the Arizona State Retirement System (ASRS), updated December 2020, shows that costs for the system could potentially rise by almost $20 billion under some bad market scenarios. Additionally, the findings reveal how the past two decades of underperforming investment returns, interest on pension debt, and inaccurate actuarial assumptions have driven pension debt ever higher, resulting in diverting more and more funding away from Arizona classrooms and other public priorities each year.

One such finding is that overly optimistic investment return assumptions have been the biggest contributor to ASRS debt—adding over $10 billion in debt since 2002.

Not only does Reason Foundation’s latest solvency analysis examine the factors driving the growth of ASRS’ unfunded liabilities, but it also presents a stress-test analysis to measure the impacts that future market scenarios could have on unfunded liabilities and required employer contributions.

The findings show that ASRS has less than a 50 percent chance of meeting its set expected rate of return, and if it does not the system will fall even further behind. The growth of the public pension system’s debt can be seen in the chart below, which is pulled from the full solvency analysis.

With only 72.8 percent of needed assets on hand today, this underfunding not only puts taxpayers and public servants equally on the hook for servicing ballooning pension debt (the costs of which have increased massively since the early 2000s) but also undermines both the salary growth and retirement security needs of a significant portion of the workforce, particularly younger Arizona educators and state employees.

Challenges Facing ERS

- Deviations from Investment Return Assumptions have been the largest contributor to the unfunded liability, adding $10.7 billion to the unfunded liability since 2002. ASRS assets have consistently returned less than assumed, leading to growth in unfunded liabilities.

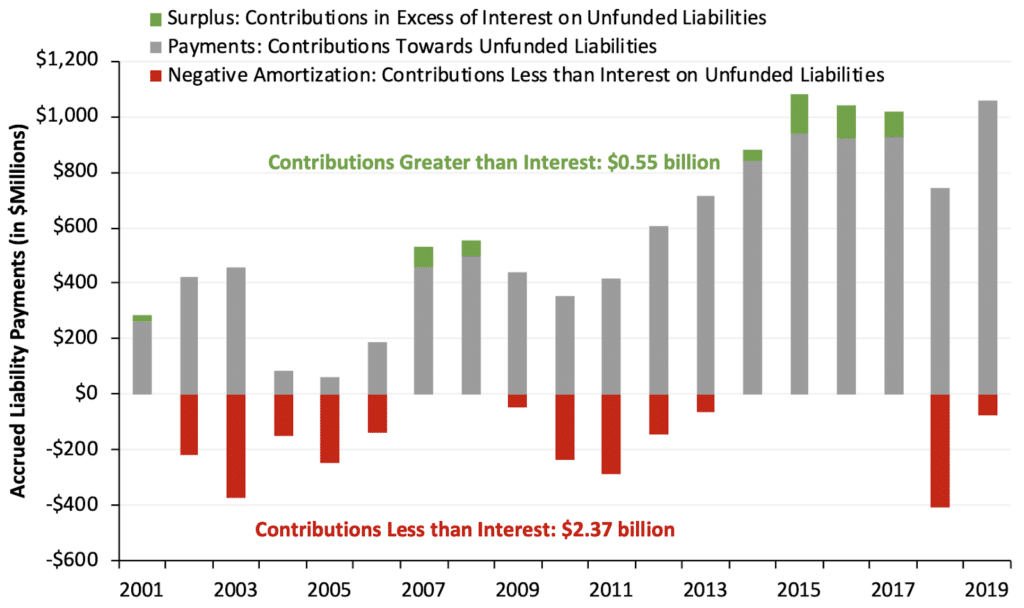

- Interest on Pension Debt has added $10.5 billion to the unfunded liability since 2002. • Accumulated interest on unfunded pension liabilities makes a pension more expensive. • Interest accrual on unfunded pension liabilities has frequently exceeded amortization payments, resulting in $1.2 billion in negative amortization (interest on the unfunded liability exceeding amortization payments).

- Changes in Methods and Assumptions have revealed roughly $4.1 billion to the unfunded liability since 2002.

- Undervaluing Debt through discounting methods has likely led to the tacit undercalculation of required contributions.

Challenge 1: Assumed Rate of Return

Unrealistic Expectations

The return assumption used by ASRS is exposing taxpayers to significant investment underperformance risk.

Underpricing Contributions

Using an overly optimistic investment return assumption leads to underpricing benefits and an undercalculated actuarially determined contribution rate.

Investment Returns Have Underperformed

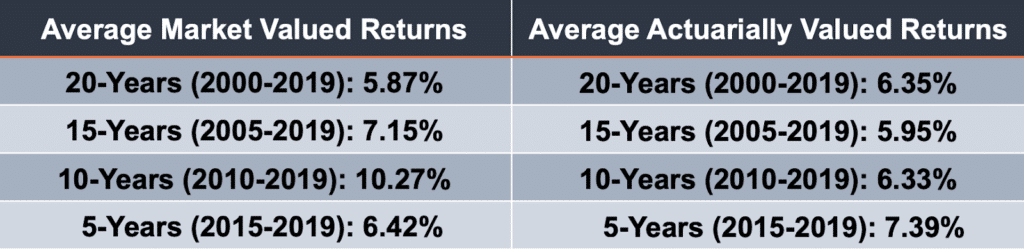

ASRS actuaries have historically used an 8% assumed rate of return to calculate benefit cost to members and employers despite significant market changes, only lowering the rate to 7.5% in 2018. • Average long-term portfolio returns have not matched long-term assumptions over different periods of time:

Note: past performance is not the best measure of future performance, but it does help provide some context to the problem created by having an excessively high assumed rate of return.

New Normal: The Market Has Changed

The “new normal” for institutional investing suggests that achieving even a 6% average rate of return in the future is optimistic.

- Over the past two decades there has been a steady change in the nature of institutional investment returns. 30-year Treasury yields have fallen from around 8% in the 1990s to consistently less than 4% today. New phenomenon: negative interest rates, designates a collapse in global bond yields. The U.S. experiences the longest economic recovery in history, yet average growth rates in GDP and inflation are below expectations.

- McKinsey & Co. forecast the returns on equities will be 20% to 50% lower over the next two decades compared to the previous three decades. Using their forecasts, the best-case scenario for a 70/30 portfolio of equities and bonds is likely to earn around 5% return.

- ASRS had yet to recover from the Great Recession, and now it will be dealing with high economic uncertainty and volatility in the wake of COVID-19.

Risk Assessment

Our risk assessment analysis shows that under likely market fluctuations, ASRS funding could decline significantly more.

If you assume ASRS will achieve an average six percent rate of investment return over the next 30 years plus experience one financial crisis in this time, analysis shows that the pension plans unfunded liability would equal $6.8 billion in the year 2050. Currently, the state assumes that the plan’s unfunded liabilities would be totally paid off by 2050.

This likely economic scenario would cost the state over $20 billion more in pension contributions than what they currently plan to spend on the plan.

Seeing as ASRS only averaged a 5.87 percent market valued investment return rate between 2000 – 2019, and that we have seen two major economic crises in the last 20 years, it is reasonable to assume the next 30 years will look somewhat similar.

An additional $20 billion in pension costs would put significant strain on the state budget.

Challenge 2: Amortization Methods

ASRS uses a 25-year, level-percentage amortization on a layered basis method to amortize newly accrued unfunded liability.

What is level percent of payroll amortization?

- Sets the amortization payment as a fixed share of total member payroll

- Often results in back-loaded pension debt payments, especially if payroll growth slows

What does amortizing unfunded liabilities using a layered-base approach mean?

- Any new ASRS unfunded liabilities in a given year are amortized over a 25-year period, meaning that there is no fixed-end date for the complete elimination of unfunded liabilities

What does a long amortization period mean?

- Professional actuaries generally recommend layering in periods 20 years or less in order to pay down unfunded liabilities faster, ensure sufficient contributions, and minimize the risk that pension debt is exposed to ongoing market risk

- Makes it more likely unfunded liabilities will never be paid off

- Often leaves debt payments each year short of the interest accrued on the debt (e.g. negative amortization)

Challenge 3: Uncovering Hidden Costs

Adjusting actuarial assumptions to reflect the changing demographics and new normal in investment markets exposes hidden pension cost by uncovering existing but unreported unfunded liabilities.

Here’s how actual experience has differed from actuarial assumptions:

↘️ New Member Rate Assumptions

ASRS new hire and rehire rates have differed from expectations resulting in a $543 million growth in unfunded liabilities from 2009-2014.

↘️ Withdrawal Rate Assumptions

ASRS assumptions on the rates of employer withdrawal have differed from expectations resulting in a $21 million growth in unfunded liabilities from 2009-2014.

↘️ Disability Rate Benefits

ASRS disability claims have been more than expected, resulting in a $14 million growth in unfunded liabilities from 2009-2014.

↘️ Active Mortality Rate Benefits

ASRS survivor claims for active members have been more than expected, resulting in a $13 million growth in unfunded liabilities from 2009-2014.

↘️ Age and Service Retirement

ASRS members have been retiring at younger than expected ages, resulting in a larger liability than expected and $7 million in growth in unfunded liabilities from 2009 to 2014.

↘️ Other Missed Assumptions

Other ASRS assumptions (not specified in financial documents) have differed from expectations resulting in a $285 million growth in unfunded liabilities from 2009-2014.

↗️ Inactive Mortality Rate Benefits

ASRS survivor claims for inactive members have been less than expected, resulting in a $154 million reduction in unfunded liabilities from 2009-2014.

↗️ Overestimated Payroll Growth

ASRS employers have not raised salaries as fast as expected, resulting in lower payrolls and thus lower earned pension benefits. This has meant a $2 billion reduction in unfunded liabilities from 2009-2014.

↘️ Overestimated Payroll Growth

However, overestimating payroll growth is creating a long-term problem for ASRS because of its combination with the level-percentage of payroll amortization method used by the plan.

This method backloads pension debt payments by assuming that future payrolls will be larger than today (a reasonable assumption). But when payroll does not grow as fast as expected, employer contributions must rise as a percentage of payroll. This means the amortization method combined with the inaccurate assumption is delaying debt payments.

Actual Change in Payroll v. Assumption

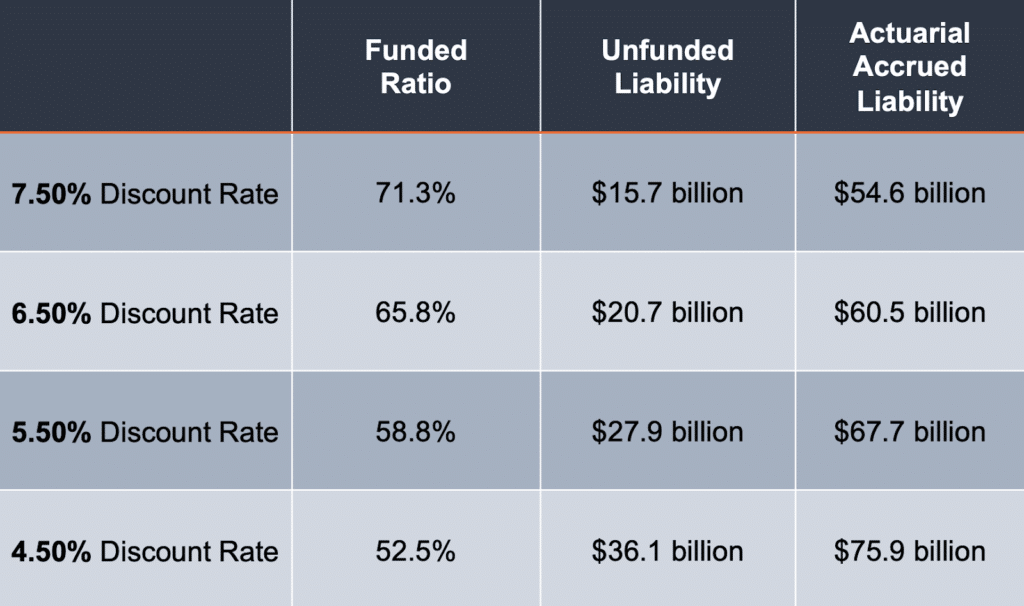

Challenge 4: Discount Rate & Undervaluing Debt

The ASRS discount rate methodology is undervaluing liabilities.

The “discount rate” for a public pension plan should reflect the risk inherent in the pension plan’s liabilities:

- Most public sector pension plans — including ASRS — use the assumed rate of return and discount rate interchangeably, even though each serve a different purpose.

- The Assumed Rate of Return (ARR) adopted by ASRS estimates what the plan will return on average in the long run and is used to calculate contributions needed each year to fund the plans.

- The Discount Rate (DR), on the other hand, is used to determine the net present value of all of the already promised pension benefits and supposed to reflect the risk of the plan sponsor not being able to pay the promised pensions.

Setting a discount rate too high will lead to undervaluing the amount of pension benefits actually promised:

- If a pension plan is choosing to target a high rate of return with its portfolio of assets, and that high assumed return is then used to calculate/discount the value of existing promised benefits, the result will likely be that the actuarially recognized amount of accrued liabilities is undervalued.

It is reasonable to conclude that there is almost no risk that Arizona would pay out less than 100% of promised retirement income benefits to members and retirees:

The discount rate used to account for this minimal risk should be appropriately low:

- The higher the discount rate used by a pension plan, the higher the implied assumption of risk for the pension obligations.

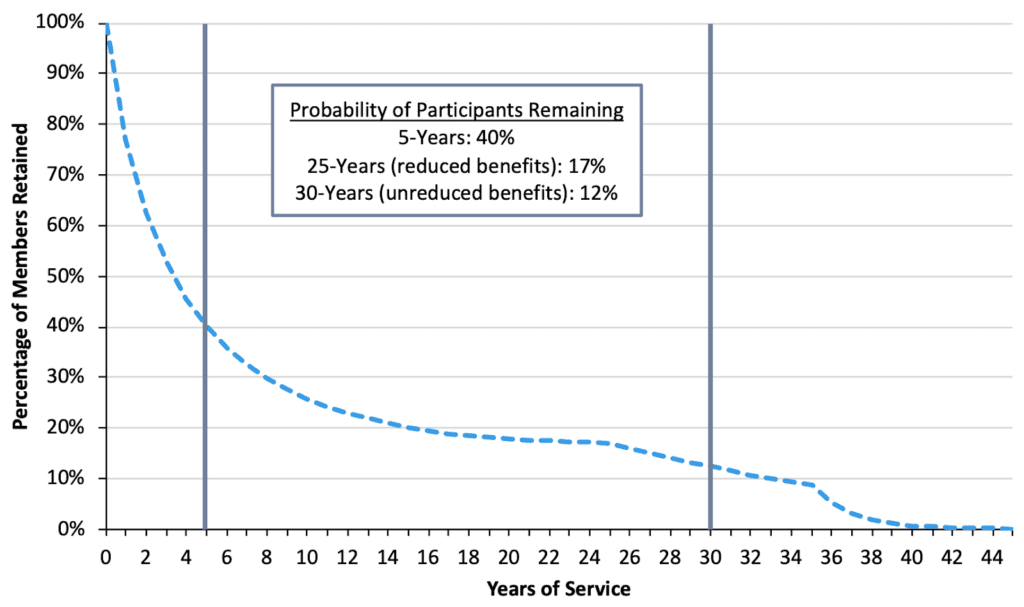

Challenge 5: The Existing Benefits Design Does Not Work for Everyone

High pre-retirement withdrawal rates signal challenges in recruiting and retaining new public employees:

- 60% of new workers leave before 5 years of service

- 74% of new workers leave before 10 years of service

- Just 17% of ASRS workers remain in the system from start to finish to receive partial benefits at age 50

- Under 12% of ASRS workers remain in the system from start to finish to receive full benefits at ages 55 to 65 (depending on their age at hiring)

A Framework for Policy Reform

Objectives

- Keeping Promises: Ensure the ability to pay 100% of the benefits earned and accrued by active workers and retirees

- Retirement Security: Provide retirement security for all current and future employees

- Predictability: Stabilize contribution rates for the long-term

- Risk Reduction: Reduce pension system exposure to financial risk and market volatility

- Affordability: Reduce long-term costs for employers/taxpayers and employees

- Attractive Benefits: Ensure the ability to recruit 21st Century employees

- Good Governance: Adopt best practices for board organization, investment management, and financial reporting

Pension Resiliency Strategies

- Adopt better funding policy, risk assessment, and actuarial assumptions. Lower the assumed rate of return to align with independent actuarial recommendations. These changes should aim at minimizing risk and contribution rate volatility for employers and employees.

- Establish a plan to pay off the unfunded liability as quickly as possible. The Society of Actuaries Blue Ribbon Panel recommends amortization schedules be no longer than 15 to 20 years. Reducing the amortization schedule would save the state billions in interest payments.

- Review current plan options to improve retirement security. Consider offering additional retirement options that create a pathway to lifetime income for employees that do not stay in public service.

Potential Solutions

1. Adopt Better Funding Policy, Risk Assessment, and Actuarial Assumptions

Risk Assessment and Actuarial Assumptions:

- Look to lower the assumed return such that it aligns with more realistic probability of success

- Work to reduce fees and costs of active management

- Consider adopting an even more conservative assumption for a new hire defined benefit plan

- Require stress testing for contribution rates, funded ratios, and cash flows with look-forward forecasts for a range of scenarios Arizona Pension Analysis: ASRS 59 December 4, 2020

2. Establish a Plan to Pay Off the Unfunded Liability as Quickly as Possible

Current amortization time horizons are too long:

- ASRS’ 30-year layered level percent of payroll amortization policy leaves unfunded liabilities significantly exposed to additional market risk and should be shortened similar to PSPRS’ policies.

- The Society of Actuaries Blue Ribbon Panel recommends amortization schedules be no longer than 15 to 20 years.

The legislature could put maximum amortization periods in place and/or require a gradual reduction in the funding period to target a lower number of years:

- Other states have phased in changes by reducing the amortization schedules one year at a time

- The legislature could require that ASRS be funded on a certain time period under specific scenarios, such as alternative assumptions and/or stress test scenarios Arizona Pension Analysis: ASRS 60 December 4, 2020

3. Create a Path to Retirement Security for All Participants of ASRS

ASRS is not providing a path for retirement income security to all Arizona public workers:

- For example, only 12% of public employees make it to the 30 years necessary for a full pension. This means the majority of members would be better served by having the choice of an alternative plan design built for portability and an increasingly mobile workforce, such as a Cash Balance, Hybrid or DC plan.

Employees should have a choice to select a retirement plan design that fits their career and lifestyle goals:

- Cash balance plans can be designed to provide a steady accrual rate, offer portability, and ensure a path to retirement security.

- Defined contribution plans can be designed to auto-enroll members into professionally managed accounts with low fees that target specified retirement income and access to annuities

Full Arizona State Retirement System Solvency Analysis

Stay in Touch with Our Pension Experts

Reason Foundation’s Pension Integrity Project has helped policymakers in states like Arizona, Colorado, Michigan, and Montana implement substantive pension reforms. Our monthly newsletter highlights the latest actuarial analysis and policy insights from our team.