Issue No. 76 – January 2021

This newsletter from the Pension Integrity Project at Reason Foundation highlights articles, research, opinion and other information related to public pension challenges and reform efforts across the nation. You can find previous editions here.

In This Issue:

Articles, Research & Spotlights

- New Report Details the Extent of North Dakota’s Unfunded Pension Liabilities

- Montana’s Largest Pension Plan Has $2 Billion in Debt

- Examining Private Equity in Public Pension Investments

- Debt Grows as Pension Systems Post Low 2020 Investment Returns

- Contribution Increases Are Not a Comprehensive Solution for New Mexico’s Teacher Pension Plan

- Governor Raimondo, Biden’s Commerce Secretary Pick, is a Pioneer of Public Pension Reform

News in Brief

Quotable Quotes on Pension Reform

Data Highlight

Contact the Pension Reform Help Desk

Articles, Research & Spotlights

North Dakota Public Employees Retirement System Pension Solvency Analysis

In the last two decades, the North Dakota Public Employees Retirement System (NDPERS) has seen a significant increase in unfunded pension liabilities. From 2000 to 2020, the funded level of the pension plan serving the state’s employees fell from 115 percent funded to only 68 percent funded. To secure the retirement of North Dakota public servants, and to avoid ever-growing costs for taxpayers, state lawmakers need to examine the causes of the system’s current funding shortfall. A new report from the Pension Integrity Project at Reason Foundation identifies insufficient annual contributions to the pension plan as the largest factors leading to the growth in unfunded liabilities. The analysis also applies stress-testing to NDPERS to test how resilient the system will be in various market scenarios going forward. You can find official testimony from the Pension Integrity Project regarding policy changes the state is currently considering here.

Montana Public Employee Retirement System Pension Solvency Analysis

A new analysis by the Pension Integrity Project at Reason Foundation finds that the Montana Public Employee Retirement System is only 74 percent funded and has over $2 billion in debt. Despite being 120 percent funded in 2001, the plan continues to rapidly accrue unfunded liabilities. The new analysis finds that deviations from the plans’ investment return assumption have been the largest contributor to the unfunded liability, adding $1.3 billion in debt since 2001. The analysis also offers stress-testing to detail the plan’s potential future risks, which should be addressed by Montana policymakers.

Examining Private Equity in Public Pension Investments

As interest rates continue to be depressed, most public pension plans are finding it increasingly difficult to meet their investment return targets. Because of this, some pension system managers have increased their allocations to private equity and alternative asset classes like hedge funds and infrastructure investments, which often promise much higher rates of return. But there are reasons to be skeptical of public pension’s investment in private equity and pension systems should thoroughly evaluate the downsides of such investments before increasing their allocations to this asset class. In a new policy study, Reason’s Marc Joffe analyzes these downsides as well as the public policy alternatives to chasing the risky returns promised by private equity investments.

Pension Debt Grows as Public Pension Systems Post Low Investment Returns for 2020

A recent Pension Integrity Project analysis estimates that state-managed public pension systems collectively accrued an additional $200 billion in pension debt in 2020. While one bad year will not make or break a public plan’s ability to maintain long-term solvency, 2020’s investment performance continues the pattern of low returns that public pension plans have experienced for years. Insufficient investment returns compared to plan assumptions have been the largest factor contributing to pension debt in the last twenty years, and most signs indicate that this will continue to be an issue over the next twenty. Policymakers would be wise to take this moment to reassess the way their plans set investment return assumptions.

Contribution Increases Could Help New Mexico’s Teacher Pension Plan, But More Changes Are Necessary

Following reforms to New Mexico’s largest public pension system, the New Mexico Public Employees Retirement Association, the state legislature has turned its focus to the pension plan that serves the state’s teachers, the New Mexico Educational Retirement Board (ERB). New Mexico’s teacher plan currently has a funded status of just 60 percent and insufficient annual contributions are one of the main contributors to the plan’s growing unfunded liabilities. To address this issue, the state legislature is considering a proposal to gradually increase employer contributions. While this move would be a step in the right direction, the Pension Integrity Project warns that increasing pension contributions alone will not be enough to fully secure the teachers’ plan for future generations. Other major contributors to pension debt, like overly-optimistic return assumptions, also need to be addressed.

President Joe Biden’s nominee for commerce secretary, Governor Gina Raimondo of Rhode Island, should be a familiar name for those who follow pension reform news. Before she was elected governor, during her time as the state’s treasurer, Raimondo was largely responsible for major reforms to the state’s struggling pension plans. Reason’s Alix Ollivier examines the impact of her reforms and suggests that other state policymakers should look to the governor as inspiration to address their own public pension problems.

News in Brief

New Guidebook Explains Risk-Sharing to Policymakers

Defined-benefit pension plans place risks largely upon government budgets and taxpayers, while defined-contribution plans place risks largely upon employees. In a new Project on State and Local Government guidebook, Rockefeller College’s Donald J. Boyd, Gang Chen, and Yimeng Yin explain the benefit of risk-sharing policies – such as contingent cost-of-living adjustments, employee contributions, and hybrid plans to share risks among stakeholders and increase the long-term sustainability of public pensions. The guidebook is available here.

Report Examines Pension Costs as a Share of Total Spending

According to the National Association of State Retirement Administrators (NASRA), the percentage of all US state and local government spending on pension funds as a proportion of general budgets has more than doubled in the past 2 decades, accounting for over five percent of all spending in 2018. One notable example of this trend is California, which made a one-time $6 billion payment in 2018 to reduce unfunded liabilities. The report also identifies a link between urban areas and the level of spending on pension plans, meaning that states with more populous cities are more likely to experience high pension costs. The brief is available here.

Pew Explains Replacement Income as an Important Metric for Retirement Security

The Pew Charitable Trusts project on Public Sector Retirement Systems has three main retirement security metrics to evaluate how well plans prepare workers for their post-employment life, one of which is the replacement income ratio. In a new fact sheet, they describe the four steps needed to calculate this ratio. These include comparing benefits to final salaries, adjusting for inflation, adding Social Security, and comparing the benefit to take-home pay. The fact sheet is available here.

Quotable Quotes on Pension Reform

“The fundamental problem is governments have made promises for which they have not set aside enough money. They’re going to have to honor those promises, either because of law or politics or both.”

—Donald J. Boyd, co-director of the Project on State and Local Government Finance at SUNY’s Rockefeller College of Public Affairs and Policy, cited by Alan Greenblatt in “No Easy Wins in Pension Reform: Managing A Multi-Billion Dollar Problem,” Arnold Ventures, January 27, 2021

Data Highlight

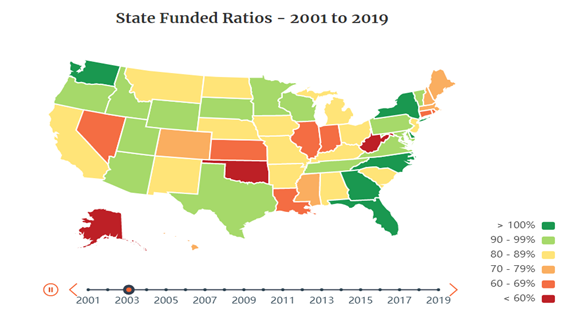

Each month we feature a pension-related chart or infographic of interest generated by one of our Pension Integrity Project analysts. This month, Quantitative Analyst Jordan Campbell visualizes the history of state pension plan’s funded ratios. Read more about the tool, and the rate at which pension debt is growing nationally, here.

Contact the Pension Reform Help Desk

Reason Foundation’s Pension Reform Help Desk provides information on Reason’s work on pension reform and resources for those wishing to pursue pension reform in their states, counties and cities. Feel free to contact the Reason Pension Reform Help Desk by e-mail at pensionhelpdesk@reason.org.

Follow the discussion on pensions and other governmental reforms at Reason Foundation’s website and on Twitter @ReasonPensions. As we continually strive to improve the publication, please feel free to send your questions, comments and suggestions to alix.ollivier@reason.org

Stay in Touch with Our Pension Experts

Reason Foundation’s Pension Integrity Project has helped policymakers in states like Arizona, Colorado, Michigan, and Montana implement substantive pension reforms. Our monthly newsletter highlights the latest actuarial analysis and policy insights from our team.