Executive Summary

In addition to their unfunded pension obligations, state and local governments have $1.2 trillion of net liabilities for other post-employment benefits (OPEBs), primarily health care commitments for retired public sector workers. This study computed this total, which amounts to 6 percent of U.S. Gross Domestic Product (GDP), by conducting an extensive review of state and local government audited financial statements.

This study is the most extensive effort yet undertaken to assess OPEB burdens on a national scale, comprising a review of over 30,000 recent audited financial statements for states, municipalities, school districts, and other units of government across the United States, capturing the vast majority of other post-employment benefit liabilities.

OPEB debt is highly concentrated, with just 15 governmental entities accounting for half the national total of $1.2 trillion. The debt is also geographically concentrated, with New York State having the highest debt burden by a considerable margin. New York State’s aggregate OPEB debt is driven by its largest public sector entities, including the City of New York, the Metropolitan Transportation Authority, and the State University of New York. But smaller entities across the state also have large volumes of OPEB debt relative to revenue. For example, this study identified seven New York school districts that have net OPEB liabilities amounting to over 350 percent of their annual total revenues.

By contrast, the state of South Dakota does not offer other post-employment benefits at all, while local government OPEB obligations across the state are limited. Other large public sector employers that do not provide OPEBs include Fresno County in California and Sound Transit in Washington State.

Other governments offer retiree health care but fully prefund this benefit. Indeed, this study found several governments that had substantially “overfunded” OPEB plans with assets equaling more than 110 percent of liabilities. Oakland County, Michigan, achieved this threshold by issuing OPEB obligation bonds, but Walworth County, Wisconsin, was able to pay down its OPEB debt without borrowing. Both counties closed their employer-paid OPEB plans to new members. The wide variance in OPEB liabilities reported across state and local governments is attributable to varying plan provisions, as well as differences in discount rate and health care cost trend rate assumptions.

Actions by the new Congress and presidential administration may impact OPEB liabilities. By expanding Medicare eligibility to individuals below 65, for example, the federal government would effectively take on a large portion of state and local OPEB obligations. But because these obligations are not evenly distributed across the country, federalizing OPEB debts could be seen as a transfer of wealth to New York State, New Jersey, Delaware, Connecticut, and the other states that have accumulated relatively large unfunded OPEB liabilities.

State and local governments can reduce their unfunded OPEB liabilities by making or exceeding actuarially determined OPEB contributions or by lowering future costs by, for example, increasing the number of years of service required to vest in retiree health benefits, phasing out benefits for higher-income retirees, and/or eliminating dependent coverage to provide health care for the retiree only.

Dimensions of the Unfunded OPEB Liability Problem

The impact of unfunded public pension liabilities on U.S. state and local government balance sheets has received substantial attention, but these liabilities are not the only burden faced by public sector entities. Unfunded other post-employment benefit (OPEB) liabilities—primarily for retiree health care—often approach or surpass pension liabilities on government ledgers.

This study, which is based on a review of over 30,000 recent audited financial statements, is the most extensive effort yet undertaken to assess OPEB burdens on a national scale.

This study, which is based on a review of over 30,000 recent audited financial statements, is the most extensive effort yet undertaken to assess OPEB burdens on a national scale. After describing the data collection process and estimating the total amount of U.S. state and local OPEB debt, this paper discusses how this debt breaks down geographically and identifies those governments that have the largest net OPEB liabilities.

Data Collection

This study’s research team gathered and reviewed over 30,000 audited financial statements produced by state and local governments. These statements are generically known as Comprehensive Annual Financial Reports, or CAFRs, even though some may not contain all the elements outlined by the Government Finance Officers Association as constituting a proper CAFR.1Government Finance Officers Association, Governmental Accounting, Auditing, and Financial Reporting Appendix D: Illustrative Comprehensive Annual Financial Report, 2020. https://www.gfoa.org/materials/ gaafr-appendix-d

This study obtained CAFRs from the Census Bureau’s single audit repository, which includes filings from any unit of government that expends more than $750,000 of federal funds in one year. This study also downloaded CAFRs from several state-level financial repositories and individual government websites.

When available by September 2020, a government’s 2019 CAFR was used. If not, the entity’s 2018 financial report was used. In the case of the nation’s largest subnational government, the state of California, its unaudited 2019 financial report was used, because it had not issued its audited 2019 CAFR in time for the compilation of this study’s data set. The set also does not include data from a few smaller local governments that had not issued 2018 or 2019 CAFRs by September 2020, but it is very unlikely that the amounts from those entities would have materially affected the totals.

Because the nation has over 90,000 local governments, this analysis’s sub-population includes only a minority of U.S. public sector entities. However, because the universe of CAFRs reviewed includes all 50 state governments along with the largest counties, cities, school districts and special districts, it accounts for the vast majority of government activity.

Some of the 30,000 governments whose statements this study reviewed did not implement Government Accounting Standards Board Statements (GASB) 74 and 75, which govern the calculation and reporting of OPEB liabilities. This was most common in states where local governments are not normally required to follow government accounting standards, including Arkansas, Iowa, and Nebraska. In these states, OPEB liabilities may be significantly underreported. New Jersey local governments also do not follow GASB reporting standards, but the state government shoulders most OPEB obligations incurred by local governments and reports them on its CAFR. It should be noted that all state governments follow GASB standards and account for the majority of OPEB liabilities.

Some of the 30,000 governments whose statements this study reviewed did not implement Government Accounting Standards Board Statements (GASB) 74 and 75, which govern the calculation and reporting of OPEB liabilities…. In these states, OPEB liabilities may be significantly underreported.

In some cases, governmental entities that are part of other governmental entities produce their own financial statements. For example, Arizona State University issues its own financial statements but its activities are also captured in the state of Arizona CAFR. This research endeavored to identify and back out cases of redundant reporting, but some instances of double counting likely remain in the data set. Any double counting is likely offset by unreported OPEB liabilities from governments whose financial statements were impossible to collect and from those that provide other post-employment benefits while not accounting for them using GASB standards.

Over $1.2 Trillion in OPEB Liabilities Nationally

State and local governments reported over $1.2 trillion of net other post-employment benefit (OPEB) liabilities nationally at the end of fiscal year 2019. This debt amounts to just under 6% of U.S. gross domestic product and is the third largest source of debt for U.S. subnational governments, behind municipal bonds outstanding and net pension liabilities, estimated at $3.1 trillion2“Financial Accounts of the United States – Z.1. L.107. Series FL213162005,” Federal Reserve System. 2019, https://www.federalreserve.gov/releases/z1/20200921/html/l107.htm (5 November 2020). and $1.2-$1.5 trillion3The $1.2 trillion estimate comes from US Census Bureau, Census Bureau Releases 2019 Annual Survey of Public Pensions, October 6, 2020. https://www.census.gov/newsroom/press-releases/2020/public- pensions.html (5 November 2020). This study’s review of government financial statements identified $1.5 trillion. The Federal Reserve System estimates pension liabilities at $4.2 trillion by applying a lower discount rate to future benefit payments., respectively.

This study’s estimate of aggregate net OPEB liability is higher than one published in 2016 by the Boston College Center for Retirement Research (CRR).4Alicia Munnell, et al. How Big a Burden are State and Local OPEB Benefits? (Boston: Center for Retirement Research, March 2016), https://crr.bc.edu/wp-content/uploads/2016/03/slp_48.pdf (5 November 2020). That study found $862 billion in aggregate net OPEB liabilities nationally. The difference between this report’s result and the one published by CRR is likely attributable to greater data coverage in this analysis rather than to any increase in OPEB obligations over time.

An American Legislative Exchange Council study estimated $1 trillion of net OPEB liabilities based on an analysis of state financial reports only and by applying a lower discount rate to future benefit payments.5Jonathan Williams, et al. Other Post-Employment Benefits: The Continuing Need for OPEB Reform, (Arlington, VA: American Legislative Exchange Council, 2020), https://www.alec.org/app/uploads/2020/01/OPEB- FEBRUARY-WEB.pdf (5 November 2020). In contrast to the ALEC analysis, this study uses as-reported net OPEB liabilities reported by both state and local governments.

Fifteen Governmental Entities Account for Over 50% of State and Local OPEB Debt

This report identified 15 governmental entities that each reported $10 billion or more in net OPEB liabilities. Collectively these governments accounted for more than $600 billion in OPEB debt, more than half the national total.

New York City reported the largest net OPEB liability of $108 billion, followed by California, New Jersey, Texas, New York, and Illinois. Other large OPEB obligors included Los Angeles County, Los Angeles Unified School District, the New York Metropolitan Transportation Authority, and public university systems in California and New York. Table 1 shows the 15 governments in this review that reported the highest net OPEB liabilities.

Table 1: Largest State and Local Net OPEB Liabilities, FY 2019

| State | OPEB Debt | Population | OPEB Per Capita |

|---|---|---|---|

| Alabama | $12,177,481,861 | 4,903,185 | $2,484 |

| Alaska | $1,293,880,851 | 731,545 | $1,769 |

| Arizona | $2,322,647,300 | 7,278,717 | $319 |

| Arkansas | $2,495,413,962 | 3,017,804 | $827 |

| California | $183,614,985,491 | 39,512,223 | $4,647 |

| Colorado | $2,584,825,548 | 5,758,736 | $449 |

| Connecticut | $28,336,538,083 | 3,565,287 | $7,948 |

| District of Columbia | $2,120,897,000 | 750,749 | $2,825 |

| Delaware | $8,657,258,594 | 973,764 | $8,891 |

| Florida | $22,837,941,233 | 21,477,737 | $1,063 |

| Georgia | $24,075,621,495 | 10,617,423 | $2,268 |

| Hawaii | $12,393,188,491 | 1,415,872 | $8,753 |

| Idaho | $254,923,323 | 1,787,065 | $143 |

| Illinois | $73,679,046,562 | 12,671,821 | $5,814 |

| Iowa | $1,379,321,377 | 3,155,070 | $437 |

| Kansas | $568,013,022 | 2,913,314 | $195 |

| Kentucky | $7,988,647,139 | 4,467,673 | $1,788 |

| Louisiana | $23,581,901,691 | 4,648,794 | $5,073 |

| Maine | $2,924,651,882 | 1,344,212 | $2,176 |

| Maryland | $38,942,487,377 | 6,045,680 | $6,441 |

| Massachusetts | $47,523,075,688 | 6,892,503 | $6,895 |

| Michigan | $30,953,054,436 | 9,986,857 | $3,099 |

| Minnesota | $2,742,244,233 | 5,639,632 | $486 |

| Mississippi | $789,643,944 | 2,976,149 | $265 |

| Missouri | $5,044,035,010 | 6,137,428 | $822 |

| Montana | $280,486,910 | 1,068,778 | $262 |

| Nebraska | $889,275,137 | 1,934,408 | $460 |

| Nevada | $3,497,420,356 | 3,080,156 | $1,135 |

| New Hampshire | $2,973,172,943 | 1,359,711 | $2,187 |

| New Jersey | $101,478,261,992 | 8,882,190 | $11,425 |

| New York | $313,920,086,646 | 19,453,561 | $16,137 |

| North Carolina | $41,342,789,101 | 10,488,084 | $3,942 |

| North Dakota | $62,375,435 | 762,062 | $82 |

| Ohio | $11,592,626,048 | 11,689,100 | $992 |

| Oklahoma | $2,199,836,311 | 3,956,971 | $556 |

| Oregon | $2,144,405,865 | 4,217,737 | $508 |

| Pennsylvania | $38,539,986,433 | 12,801,989 | $3,010 |

| Rhode Island | $3,370,956,915 | 1,059,361 | $3,182 |

| South Carolina | $15,792,680,769 | 5,148,714 | $3,067 |

| South Dakota | $75,933,081 | 884,659 | $86 |

| Tennessee | $10,172,688,062 | 6,829,174 | $1,490 |

| Texas | $110,800,605,210 | 28,995,881 | $3,821 |

| Utah | $375,298,520 | 3,205,958 | $117 |

| Vermont | $2,868,911,672 | 623,989 | $4,598 |

| Virginia | $5,716,050,225 | 8,535,519 | $670 |

| Washington | $6,799,221,754 | 7,614,893 | $893 |

| West Virginia | $2,670,376,857 | 1,792,147 | $1,490 |

| Wisconsin | $7,122,825,062 | 5,822,434 | $1,223 |

| Wyoming | $1,137,947,859 | 578,759 | $1,966 |

| Overseas Territories | $2,481,542,035 | 3,754,600 | $661 |

| Totals | $1,233,332,651,931 | 332,039,123 | $3,714 |

Most Liabilities are Concentrated in a Few States

State and local OPEB liabilities are concentrated in a relatively small number of states. This research identified four states that had aggregate state and local net OPEB liabilities greater than $100 billion (well above the state median of $5 billion). These are (in declining order by aggregate net OPEB liability): New York, California, Texas, and New Jersey. Three of these states are also among the nation’s highest population states, but, Florida, another high population state has much less OPEB debt.

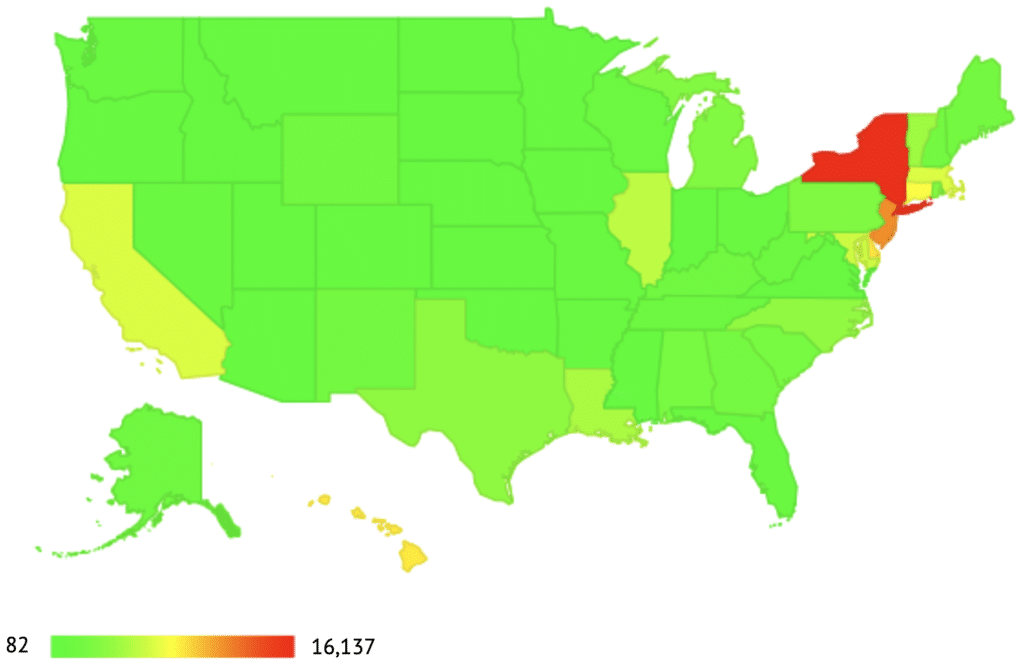

Another way to evaluate geographic concentrations of OPEB debt is to consider net OPEB liabilities per capita. Viewed from this perspective, OPEB liabilities are heavily concentrated in urbanized northeastern states. With aggregate net OPEB debt of $314 billion—or over $16,000 per capita—New York State is the clear outlier. After New York State, the highest OPEB liabilities per capita (in declining order) are in New Jersey, Delaware, Hawaii, Connecticut, Massachusetts, and Maryland.

By contrast, several states have aggregate net OPEB liabilities per capita of less than $200. These include North Dakota, South Dakota, Utah, and Idaho. This study also identified net OPEB liabilities per capita of less than $200 in Indiana and Kansas, but aggregate OPEB liabilities may be understated due to limited implementation of GASB standards by local governments in those states.

Table 2 shows aggregate net OPEB liabilities by state. Figure 1 shows aggregate net OPEB liabilities per capita by state in a color-shaded map.

Table 2: Total State and Local OPEB Debt by State

| State | OPEB Debt | Population | OPEB Per Capita |

|---|---|---|---|

| California | $183,492,566,331 | 39,512,223 | $4,644 |

| Illinois | $73,679,046,562 | 12,671,821 | $5,814 |

| Massachusetts | $47,523,075,688 | 6,892,503 | $6,895 |

| New Jersey | $101,478,261,992 | 8,882,190 | $11,425 |

| New York | $316,210,238,646 | 19,453,561 | $16,255 |

| Texas | $110,797,246,407 | 28,995,881 | $3,821 |

Figure 1: Net State and Local Government OPEB Liabilities Per Capita by State

Comparison of Net OPEB Liabilities and Net Pension Liabilities

In addition to $1.2 trillion in net OPEB liabilities, this review of state and local CAFRs found over $1.5 trillion in net pension liabilities. This pension debt estimate is higher than the one recently published by the U.S. Census Bureau referenced in section 1.2. The difference is most likely due to the inclusion of more entities in this study, which, unlike the Census survey, did not rely on voluntary compliance by pension systems. This report’s analysis is based on a review of documents that state and local governments are required to file to meet federal grantmaking and municipal bond market standards.

Although net OPEB liabilities are a large fraction of net pension liabilities, OPEBs have more-limited cashflow implications for most U.S. governments than pensions. Many U.S. governments provide no retiree health coverage or relatively small monthly stipends. Those governments that provide retirees (and even their dependents) with full premium coverage without prefunding typically discount future benefit payments at much lower discount rates than they apply to their future pension payment obligations. Given these two considerations, most state and local governments face smaller future annual payments to meet unfunded OPEB liabilities than to meet unfunded pension liabilities.

Discussion of OPEB Plan Provisions and Actuarial Assumptions

OPEB liabilities vary greatly across state and local governments. Aside from the number of active and retired employees participating in the OPEB plan, plan provisions and actuarial assumptions also determine total liabilities. A government’s net OPEB liability also depends on the amount of assets it has set aside to prefund benefits.

OPEB Plan Provisions

State and local OPEB programs have varying vesting provisions. In some cases, employees fully vest after a few years of service, while in others employees must provide 20 or more years of service before earning retiree health benefits. In some cases, vesting is gradual, with employees earning some percentage of the full OPEB over a number of service anniversaries.

Plans also vary in providing coverage for a retiree’s dependents. In certain cases, like the Los Angeles Unified School District, retirees receive the same benefit terms as active employees: health care coverage is provided to retirees’ spouses and dependent children. Other systems limit coverage to the retired employee only.

Finally, the benefit amount varies greatly among plans. Some pay the full cost of a private health care plan, while others provide a limited, fixed stipend that the employee can apply to premiums charged for his or her chosen health insurance plan.

For plans that pay premiums on behalf of retired employees, coverage is much more expensive for retirees below the age of 65. At age 65, individuals typically become eligible for Medicare. The retiree health benefit for these older retirees typically takes the form of a Medicare supplement plan that fills coverage gaps in the federal program. The cost of a Medicare supplement plan is typically much lower than that for private health insurance policies available to individuals younger than 65.

Health Care Cost Trend Rate Assumptions

If OPEB plans cover all or a percentage of the participant’s insurance premiums, medical cost trends greatly influence future benefit costs. In recognition of this fact, government accounting standards require governments to disclose the assumed health care trend rate. GASB defines the health care trend rate as “the rates of change in per capita health claims costs over time as a result of factors such as medical inflation, utilization of healthcare services, plan design, and technological developments.”6“Statement Number 75 – Accounting and Financial Reporting for Postemployment Benefits Other Than Pensions,” Governmental Accounting Standards Board, June 2015, https://www.gasb.org/jsp/GASB/ Document_C/DocumentPage?cid=1176166144750&acceptedDisclaimer=true GASB requires financial statement filers to not only disclose the rate assumed for calculation of its reported net OPEB liability, but also what the liability would have been if a rate 1% lower or 1% higher had been used. This type of sensitivity analysis was initially required for pension plan discount rates under GASB 68.

In recent decades, health care cost inflation has usually exceeded the rise in consumer prices. Between 1945 and 2019, health care costs rose an average of 5.2% annually while overall prices rose 3.7% on average. But for individual years, there has been substantial variance around this 1.5% annual differential.7“Database, Tables and Calculators by Subject,” U.S. Bureau of Labor Statistics, https://www.bls.gov/data/ (5 November 2020). Author’s analysis of data retrieved for series CUUR0000SA0 and CUUR0000SAM. Further, policy changes and technological innovations could cause future inflation differentials to vary from those observed in the past.

This report’s data set does not include health care trend rate assumptions due to the complexity of collecting them. Therefore, this is left as a topic for future research.

Discount Rate Assumptions

Once an actuary has estimated future annual OPEB costs, he or she must represent this annuity as a single number in present value terms. This is accomplished by discounting projected future benefit costs. The rate used to discount these cashflows has a large impact on the reported net OPEB liability.

Most OPEB plans have little or no prefunding.

Most OPEB plans have little or no prefunding. In these situations, GASB standards require the government entity to discount its future benefit payments by “a tax-exempt, high- quality municipal bond rate.”8GASB Statement. 75.

A rate that meets this definition is The Bond Buyer 20 index, which is the average yield for 20 general obligation municipal bonds with an average rating of AA from Standard & Poor’s and/or Aa2 from Moody’s.9James Chen, “Definition of Bond Buyer 20,” Investopedia. June 25, 2019. https://www.investopedia.com/ As of June 30, 2019, this Bond Buyer 20 index stood at 3.50%,10The Bond Buyer, Market Statistics Archive, 2020. https://www.bondbuyer.com/broker/bond-buyer-data. A graph showing historical rates for multiple municipal bond indices from 2013 to 2020 is available from Bartel Associates LLC, “Select GASB 67/68 Discount Rate Indices,” http://bartel-associates.com/resources/ select-gasb-67-68-discount-rate-indices (5 November 2020) and this is used as a discount rate in some 2019 CAFRs.

To the extent that governments prefund their OPEB plans or have policies in place to do so, they can discount some or all their liabilities by the assumed rate of return on assets. Governments using this provision may apply discount rates similar to those used for their pension plans, which average 7.2%.11National Association of State Retirement Administrators, “Public Pension Plan Investment Return Assumptions,” February 2020, https://www.nasra.org/files/Issue%20Briefs/NASRAInvReturnAssumpt Brief.pdf (5 November 2020)

Analyzing OPEB Liabilities for Selected Governments

This part reviews some extreme cases this study’s analysis identified. This list includes the governments that have the highest OPEB debt burdens, governments that have substantial net OPEB assets (meaning that funds they have accumulated to pay OPEB obligations exceed expected benefit payments in present value terms), and large entities that do not offer other post-employment benefits.

Entities with Large Net OPEB Liabilities Relative to Total Revenue

Section 1.3 listed the 15 governments that had the highest net OPEB liabilities in absolute dollars. Since governments vary widely in size, the absolute amount of an entity’s OPEB debt is not a good indication of whether retiree health care benefits may be a source of future fiscal distress.

In contrast, this section considers governments that have the highest ratios of net OPEB liabilities to total revenue. Table 3 lists entities with net OPEB liability more than 3.5 times total revenue as of the end of its 2019 fiscal year (or, if 2019 reports were not available, their 2018 fiscal year).

Table 3: Highest Net OPEB Liability to Revenue Ratios

| State | Entity Name | Fiscal Year | NET OPEB Liabilities | Total Revenues | OPEB/Revenue Ratio |

|---|---|---|---|---|---|

| OH | Wings Academy 2 | 2019 | $69,841 | $1,992 | 3506.07% |

| OH | Randall Park High School | 2019 | $62,940 | $2,820 | 2231.91% |

| LA | Vermilion Parish Assessor | 2019 | $4,587,676 | $878,876 | 521.99% |

| NY | Red Hook Central School District | 2019 | $221,150,322 | $53,868,340 | 410.54% |

| MI | Garden City | 2019 | $135,604,252 | $33,629,258 | 403.23% |

| NY | Cobleskill-Richmondville Central School District | 2019 | $170,988,882 | $42,967,798 | 397.95% |

| NY | Town of Tonawanda | 2019 | $398,361,315 | $100,513,776 | 396.33% |

| NY | Arlington Central School District | 2019 | $857,327,808 | $217,920,030 | 393.41% |

| CT | Poquonnock Bridge Fire District | 2019 | $19,216,091 | $5,070,308 | 378.99% |

| NY | Poughkeepsie City School District | 2019 | $407,605,117 | $109,505,267 | 372.22% |

| NY | Massena | 2019 | $59,562,325 | $16,126,760 | 369.34% |

| NY | Niagara Falls | 2018 | $360,760,270 | $98,719,641 | 365.44% |

| NY | Canton Central School District | 2019 | $109,981,112 | $30,543,332 | 360.08% |

| NY | Plattsburgh City School District | 2019 | $167,089,711 | $46,849,927 | 356.65% |

| LA | East Baton Rouge Parish Assessor | 2019 | $23,940,868 | $6,733,248 | 355.56% |

| NY | New Hartford Central School District | 2019 | $191,858,310 | $54,143,847 | 354.35% |

| NY | Norwood-Norfolk Central School District | 2019 | $88,973,596 | $25,119,585 | 354.20% |

The two highest ratios belong to public high schools directly overseen by the state of Ohio. Wings Academy 2 and Randall Park High School did not operate during the 2018-2019 school year but continued to employ staff who accrued retirement benefits. Consequently, these schools reported OPEB liabilities without receiving significant revenue.

Seven governments on the list are small and medium-sized school districts in New York State. The largest of these districts, Arlington Central, reported enrollment of 7,990 students in the 2018-2019 school year, down from 9,041 five years earlier.12“New York State Department of Education Data Portal,” https://data.nysed.gov/profile.php?instid= 800000053261 and https://data.nysed.gov/enrollment.php?year=2014&instid=800000053261 (5 November 2020) Because state aid for school districts is typically apportioned by the number of students, falling enrollment is often associated with stagnant or even declining revenues. On the other hand, lower enrollment does not affect the number of retired school district employees. The number of active employees who may become eligible for OPEBs upon retirement often falls more slowly than student enrollment. Given these factors, shrinking school districts like Arlington Central face increasing OPEB cost pressures. Retiree health care benefit payments of $12.7 million represented more than 5% of district expenditures in 2018-2019.13Unless specific references are cited, data provided in this section come from Audited Financial Statements of the governments discussed.

Retiree health care benefit payments of $12.7 million represented more than 5% of district expenditures in 2018-2019.

Arlington Central School District’s net OPEB liability of $857 million also results from relatively conservative actuarial assumptions. Future benefits were discounted at a rate of 3.10%, while health care costs were assumed to increase 8% in 2020, 7.5% in 2021 and 7.0% in 2022. The rate of cost growth was projected to continue slowing by 0.5% annually until reaching an ultimate trend rate of 5.0% in 2026. The district’s benefit package includes dental and vision as well as dependent coverage, but some classes of retirees must contribute to benefit costs. Arlington Central is in Duchess County as are two other school districts listed among the highest OPEB debt/revenue entities: Red Hook Central and Poughkeepsie City School District.

Of the general-purpose governments on the list, Garden City, Michigan has the highest OPEB/revenue ratio at 403%. This suburb of Detroit has faced declining population and stagnant revenues. Fiscal year 2019 revenues of $33.6 million changed little from 2013 levels. The city’s OPEB plan covered 219 retirees and beneficiaries as opposed to only 53 active employees who are not yet receiving benefits. As with Arlington School District, the city’s large OPEB debt was partially attributable to conservative assumptions: a 3.1% discount rate and a health care cost trend rate starting at 9% and gradually falling to 5%.

The list also contains two Louisiana parish assessor’s offices. In Louisiana, parishes serve essentially the same functions as do counties in other U.S. states, but their tax assessors’ offices produce standalone financial statements. East Baton Rouge Parish Assessor’s Office, the larger of the two included here, provides full health coverage to retirees 55 years and older who have at least 12 years of service. The assessor uses a relatively low discount rate of 2.74% but also assumes relatively low health care cost inflation: 4.30% initially, trending down to 3.80%.

Entities with Significant Net OPEB Assets Relative to Total Revenue

In addition to identifying governments with large OPEB debt burdens this analysis found several that had set aside sufficient assets to more than fully fund their future OPEB obligations—at least from a financial reporting standpoint. Table 4 shows governments with net OPEB assets greater than 10% of total revenue (assets are shown as negative liabilities for consistency with other tables in this study).

Oakland County, Michigan in Detroit’s northwestern suburbs has the largest net OPEB asset both in absolute terms and as a percentage of revenue of any U.S. state or local government. The county has adjusted benefits on numerous occasions. Employees hired before 1985 could retire with full benefits—including dependents—with eight years of service at age 60. Vesting periods were then extended in 1985 and again in 1996. For employees hired after 2006, defined retiree health benefits were replaced by a retiree health savings account.14“Health Care Schedule,” Oakland County Michigan website, https://www.oakgov.com/hr/retirement/retirement-benefits/Pages/Eligible.aspx (5 November 2020).

Table 4: Lowest Net OPEB Liability to Revenue Ratios

| State | Entity Name | Fiscal Year | Net OPEB Liabilities | Total Revenues | OPEB/Revenue Ratio |

|---|---|---|---|---|---|

| MI | Oakland County | 2019 | -$382,116,263 | $848,575,313 | -45.03% |

| MI | Spring Lake District Library | 2019 | -$691,474 | $2,001,843 | -34.54% |

| MI | Northville District Library | 2019 | -$1,032,726 | $3,043,006 | -33.94% |

| MI | Lenawee County Road Commission | 2019 | -$5,565,265 | $19,482,194 | -28.57% |

| MN | Independent School District No. 2711 | 2018 | -$3,965,207 | $15,849,248 | -25.02% |

| MI | Huron Charter Township | 2019 | -$2,681,752 | $15,639,498 | -17.15% |

| IN | Indiana State University | 2019 | -$44,961,000 | $266,456,000 | -16.87% |

| MN | ISD 182 – Crosby | 2018 | -$2,685,185 | $16,322,180 | -16.45% |

| MI | Clinton County | 2019 | -$4,661,339 | $33,009,551 | -14.12% |

| WI | Walworth County | 2019 | -$17,034,324 | $124,105,458 | -13.73% |

| MI | Bay-Arenac Behavioral Health | 2019 | -$7,120,627 | $52,271,304 | -13.62% |

| MN | Eagan | 2019 | -$11,581,775 | $86,622,217 | -13.37% |

| MI | Orion Township Public Library | 2019 | -$340,149 | $2,589,793 | -13.13% |

| MI | Lansing City Board of Water & Light | 2019 | -$46,608,898 | $362,348,959 | -12.86% |

| WI | School District of Whitefish Bay | 2019 | -$5,188,513 | $40,687,955 | -12.75% |

| WI | Waukesha County Area Technical College | 2019 | -$12,147,106 | $96,002,317 | -12.65% |

| MI | Groveland Township | 2019 | -$341,168 | $2,725,672 | -12.52% |

| WI | Whitefish Bay School District | 2018 | -$4,773,034 | $39,954,421 | -11.95% |

| MN | Independent School District No. 624 | 2019 | -$15,144,573 | $132,980,757 | -11.39% |

| MI | Wixom | 2019 | -$2,933,290 | $26,374,391 | -11.12% |

| WI | Blackhawk Technical College | 2018 | -$4,535,877 | $41,432,322 | -10.95% |

Although Oakland County had historically prefunded OPEBs, it had a large unfunded liability as late as 2007. In that year, the county issued $557 million of bonds, technically known as Certificates of Participation, for the purpose of paying off its OPEB liability.15“Official Statement: Taxable Certificates of Participation,” County of Oakland, July 6, 2007, https://emma.msrb.org/MS261641-MS236949-MD462300.pdf (5 November 2020). The county later refinanced the bonds with a private placement, lowering its interest rate from 6.23% to 3.80%. Now that the county’s OPEB plan is significantly overfunded, actuarially determined OPEB contributions have fallen to zero as income on OPEB assets has exceeded benefit costs.

Another general-purpose government with a net OPEB asset is Walworth County, Wisconsin. The county had a $14 million net OPEB liability in 2005, but eliminated it by 2012 and accumulated a net OPEB asset position of $17 million by 2019. Unlike Wayne County, Walworth County’s Board resolved its OPEB debt without issuing OPEB obligation bonds. Instead, the county began accumulating OPEB assets by contributing more than the amount necessary to cover annual benefits. It also closed its OPEB plan to new employees, negotiating with its public employee unions to instead make a one-time payment to an IRS Section 501(c)(9) Post Employment Health Plan on their behalf.16A portion of this discussion is based on Walworth County’s 2008 CAFR. IRS Section 501(c)(9) governs voluntary employees’ benefit associations (VEBAs), which are mutual associations of employees providing certain specified benefits to their members or their designated beneficiaries. See “Selected Problems of Voluntary Employees’ Benefit Associations (VEBAs),” Internal Revenue Service, 1984, https://www.irs.gov/pub/irs-tege/eotopicf84.pdf (5 November 2020).

Large Entities with No OPEB Obligations

Most of the 30,000 entities this study reviewed did not report net OPEB liabilities or assets. While these entities are predominantly smaller governments, several reported over $1 billion in total revenue. Those governments are listed in Table 5.

Most of the entities on this list are publicly owned health care providers. These entities may feel less need to offer retiree health care benefits because their private sector counterparts rarely do so. According to recent Kaiser Family Foundation survey, only 16% of large health care organizations offered retiree health benefits compared to 29% of large employers generally.17Gary Claxton, et al., “Employer Health Benefits: 2020 Annual Survey,” October 8, 2020. Kaiser Family Foundation. http://files.kff.org/attachment/Report-Employer-Health-Benefits-2020-Annual-Survey.pdf (5 November 2020)

Two large general-purpose governments that do not provide OPEBs are the state of South Dakota and Fresno County, California.

Table 5: Highest Revenue Entities Not Offering Other Post-Employment Benefits

| State | Entity Name | Fiscal Year | Total Revenues |

|---|---|---|---|

| NC | The Charlotte-Mecklenburg Hospital Authority | 2019 | $8,384,443,000 |

| MD | University System of Maryland | 2019 | $5,456,473,620 |

| NJ | Rutgers, The State University of New Jersey | 2019 | $4,431,373,000 |

| SD | State of South Dakota | 2019 | $4,349,322,000 |

| TX | Parkland Health and Hospital System | 2019 | $2,319,653,000 |

| CO | University of Colorado Hospital Authority | 2019 | $2,319,396,000 |

| NE | University of Nebraska | 2019 | $2,260,640,000 |

| FL | South Broward Hospital District | 2019 | $2,187,371,000 |

| WA | Central Puget Sound Regional Transit Authority | 2019 | $2,156,167,000 |

| MD | Baltimore City Public School System | 2019 | $1,695,454,000 |

| CA | Fresno County | 2019 | $1,670,594,000 |

| SC | Spartanburg Regional Health Services District Inc | 2019 | $1,394,287,000 |

| NJ | Newark Public Schools | 2019 | $1,307,984,534 |

| NM | New Mexico Department of Transportation | 2019 | $1,266,498,136 |

| CA | Calviva Health | 2018 | $1,186,268,882 |

| SC | Lexington County Health Services District | 2019 | $1,180,179,000 |

| WA | Seattle School District No.1 | 2019 | $1,144,451,044 |

| WA | Harborview Medical Center | 2019 | $1,076,535,000 |

Two large general-purpose governments that do not provide OPEBs

Dakota and Fresno County, California. In its CAFR, South Dakota cites its lack of other post- employment benefits as one aspect of its conservative fiscal management strategy that has led the three top rating agencies to assign the state top AAA/Aaa ratings. Although South Dakota does not face substantial competition from other large public sector employers in its region, the same cannot be said of Fresno County. Its principal city, Fresno, and neighboring Tulare County both offer OPEBs.

Although most large transit agencies offer retiree health benefits, Central Puget Sound Regional Transit Authority, more commonly known as Sound Transit, does not. This agency also does not offer a defined benefit pension plan, although it does provide two defined contribution plans.18A. Pennucci, J. Bauer, S. Lee, and A. DeShazo, “Retiree benefits in public pension plans (Document No. 12- 12-4101r),” (Olympia, WA: Washington State Institute for Public Policy, 2012), https://www.wsipp.wa.gov/ ReportFile/1116/Wsipp_Retiree-Benefits-in-Public-Pension-Systems_Full-Report.pdf (5 November 2020).

Finally, although most of the largest governments provide OPEBs, this is not necessarily the case for smaller public sector employers. The majority of entities in this analysis did not report a net OPEB asset or liability. In some cases, this absence of OPEB data is due to the benefit being covered by another government entity or non-implementation of GASB reporting standards, but many governments appear to simply exclude OPEBs from their benefit packages.

Policy Considerations for Entities with Large OPEB Obligations

If the Biden administration and Congress make the kinds of health care reforms that Democrats have promised in the past, state, and local governments with large OPEB debts may see significant relief as these obligations are transferred to federal taxpayers. Regardless of whether the federal government intervenes, several policy options are available for public entities that wish to improve their financial sustainability by shrinking unfunded OPEB liabilities.

Federal Policy: Ideas for Medicare Expansion

Federal legislation that affects medical cost inflation and health insurance premiums for individuals over age 50 impacts state and local OPEB liabilities. The most consequential changes currently proposed by congressional Democrats involve expanding Medicare eligibility.

As a candidate, Joseph Biden proposed expanding Medicare eligibility to those between ages 60 and 64.19“Fact Sheet: How Joe Biden Would Help You Get Health Insurance Coverage During The Coronavirus Crisis,” Biden/Harris Campaign website, https://joebiden.com/fact-sheet-how-joe-biden-would-help-you- get-health-insurance-coverage-during-the-coronavirus-crisis/ (November 5, 2020). He also proposed measures to reduce prescription drug costs for Medicare beneficiaries and adding vision and dental coverage to program benefits.20Sarah O’Brien, “Medicare coverage could expand under a Biden presidency,” CNBC, August 22, 2020. https://www.cnbc.com/2020/08/22/why-medicare-coverage-could-expand-under-a-biden- presidency.html (5 November 2020). To the extent that the federal government funds Medicare expansions, they would in turn reduce future state and local OPEB expenditures, and thus net OPEB liabilities reported in forthcoming financial statements by shifting these obligations to federal taxpayers.

Biden’s proposed expansion is more modest than those favored by other Democrats. In 2019, Senator Tammy Baldwin (D-IL) proposed the Medicare at 50 Act, S. 470, gathering support from 20 Democratic cosponsors.21“S.470 – Medicare at 50 Act,” Congress.gov, February 13, 2019, https://www.congress.gov/bill/116th-congress/senate-bill/470/text (5 November 2020) While the legislation could not advance in the Republican- controlled Senate, a similar bill may reemerge in 2021. Although this legislation would make the vast majority of state and local retirees eligible for Medicare, its benefits would be limited because younger retirees would be required to “buy into” the program. Premiums would be set at a level necessary to cover benefits for the new class of members so that the legislation is deficit-neutral. However, because Medicare is generally less expensive than private coverage due to the program’s lower provider reimbursement rates,22Eric Lopez, et al., “How Much More Than Medicare Do Private Insurers Pay? A Review of the Literature.” Kaiser Family Foundation, April 15, 2020, https://www.kff.org/medicare/issue-brief/how-much-more-than- medicare-do-private-insurers-pay-a-review-of-the-literature/ (5 November 2020). the Medicare at 50 Act may be expected to significantly reduce state and local OPEB liabilities.

Although some OPEB liabilities arise from life insurance coverage and other retiree benefits, health coverage accounts for the lion’s share of the aggregate net OPEB liability nationwide.

Single payer health care, a policy advocated by many progressive Democrats, would eliminate state and local liabilities related to retiree health care. Although some OPEB liabilities arise from life insurance coverage and other retiree benefits, health coverage accounts for the lion’s share of the aggregate net OPEB liability nationwide. Consequently, the implementation of single payer health care would virtually eliminate the problem of unfunded state and local OPEB liabilities.

In the last Congress, Senator Bernie Sanders proposed S.1129, the Medicare for All Act of 2019, which would implement a single payer health care system in the United States. The bill was co-sponsored by 14 Senate Democrats, including now-Vice President Kamala Harris, but did not advance in the Republican-controlled Senate. The legislation adds dental and vision coverage to existing Medicare benefits and expands eligibility to all U.S. residents.23“S.1129 – The Medicare for All Act of 2019,” Congress.gov, April 10, 2019, https://www.congress.gov/bill/

Such proposals bring moral hazards. While congressional proposals have taken various forms, Medicare expansions would reduce or eliminate state and local OPEB liabilities primarily by transferring the burden to the federal government. Without new revenues, such a transfer would add to an already large unfunded federal-level health care liability. In its most recent financial statements, the federal government reported unfunded Medicare liabilities of $34 trillion.24“Financial Statements of the United States Government for the Year Ended September 30, 2019,” Department of the Treasury, February 27, 2020, https://fiscal.treasury.gov/files/reports- statements/financial-report/2019/FR-02272020(Final).pdf (5 November 2020).

In its most recent financial statements, the federal government reported unfunded Medicare liabilities of $34 trillion.

Unless the remaining federal liability is offset by charging insurance premiums or increased taxes, a Medicare expansion would add to federal Medicare liabilities. Since the Medicare at 50 legislation discussed above requires anyone buying into the system to pay premiums intended to cover their cost of participation, its implementation may not increase the federal government’s unfunded Medicare liability—if actuaries agree that the cost of buying into the program does, in fact, fully offset the budgetary cost of their participation.

By contrast, Senator Sanders’ Medicare for All proposal does not include a comprehensive funding mechanism. Although new beneficiaries would pay premiums, these would not necessarily cover the cost of care, and lower income participants would receive large premium subsidies. Although the Sanders bill was not scored by the Congressional Budget Office, the Penn-Wharton Budget Model estimated that, absent financing through payroll taxes or additional premiums, the legislation would increase the national debt by 92% in 2060.25Felix Reichling and Ken Smetters, “Senator Sanders’ Medicare for All (S.1129): An Integrated Analysis,” Penn-Wharton Budget Model, January 30, 2020, https://budgetmodel.wharton.upenn.edu/issues/2020/1/30/ sanders-medicare-for-all (5 November 2020). While additional payroll taxes could reduce or prevent additional debt accumulation, they increase the expense of employing workers and thus reduce employment.

From an OPEB perspective, future Medicare expansion could be seen as a transfer of wealth from states with low per capita liabilities to governments in states with higher liabilities, such as New York. While state and local governments with low liabilities would see limited balance sheet relief, the balance sheet improvement in high benefit states would be substantial. This could be seen as an inequitable subsidy to New York and other states that have taken on retiree health care obligations without putting in place a mechanism for effectively funding them. Also, with the federal government now incurring record deficits and facing other spending demands amid the change in administrations, this may not be a propitious time for Congress to assume state and local obligations.

Federal Policies That Reduce Health Care Costs

Because actuaries use estimates of medical cost inflation to project future OPEB costs, federal policies that slow the rise of health care costs can reduce OPEB liabilities. Policy changes that increase competition among providers or impose price controls will have similar effects on reported OPEB debt regardless of their relative impacts on the quality and availability of health care. As noted above, a federal policy of obliging health care providers to accept lower Medicare reimbursement rates would reduce OPEB liabilities.

This is true irrespective of whether providers respond by retiring, reducing their hours, or becoming less attentive to their patients. As a result, the cost of reducing health care liabilities could be a lower quality of medical care.

Because actuaries use estimates of medical cost inflation to project future OPEB costs, federal policies that slow the rise of health care costs can reduce OPEB liabilities.

Recent policy attention has focused on limiting prescription drug costs. However, the impact of these policies on OPEB liabilities will be limited by the fact that prescription drugs account for only 9% of health care expenditures.26“National Health Expenditures 2018 Highlights,” Centers for Medicare and Medicaid Services, December 7, 2019, https://www.cms.gov/files/document/highlights.pdf (5 November 2020).

One recent federal policy change that is affecting OPEB liabilities for certain employers was the repeal of the so-called “Cadillac Tax” provision of the Affordable Care Act. This tax would have been imposed on employer-sponsored health care plans costing more than $10,200 annually for an individual and over $27,500 for a family. Although intended to deter the use of high cost insurance plans, the tax would have increased retiree health care payments for those governmental employers offering such plans.27Ryan Golden, “Cadillac tax, granting ‘relief’ for employers,” HR Dive, December 23, 2019, https://www.hrdive.com/news/trump-signs-bill-repealing-aca-cadillac-tax-granting-relief-for-employer/569551/ (5 November 2020).

The repeal measure should reduce OPEB liabilities reported by employers who offer extensive benefits in high cost areas in fiscal year 2020 or 2021, once new actuarial analyses have been completed. A recent actuarial valuation for Los Angeles County showed a 3% reduction in net OPEB liability largely due to the new law.28“Los Angeles County Other Postemployment Benefits Program Actuarial Valuation,” July 1, 2020, https://www.lacera.com/investments/actuarial_reports/2019_opeb_valuation.pdf (5 November 2020).

State and Local Reforms

Although future federal action could sharply reduce or eliminate OPEB liabilities, the near- term policy landscape is uncertain. The new Congress will have a lot on its plate including coronavirus relief, infrastructure, and climate change policies, among many other challenges.

Rather than seeking relief from the federal government, state and local governments can take their own steps to lower OPEB burdens. Policy options include measures that would reduce OPEB liabilities, increase assets, or both.

Rather than seeking relief from the federal government, state and local governments can take their own steps to lower OPEB burdens.

As discussed in section 3.4, many governments do not offer OPEB benefits like retiree health care, dental, and life insurance. This suggests that providing retiree health coverage in addition to a primary retirement plan may not be necessary to attract and retain employees. Unlike pension benefits, OPEBs generally lack the same degree of benefit alteration legal protections and can thus be modified at the discretion of elected officials for unrepresented employees or as part of the collective bargaining process with public employee unions. Given the growing trend toward non-career public service—short-tenured employment, as opposed to full career—at least some employees may prefer additional cash compensation in lieu of an added retirement benefit they may never vest in.

Short of eliminating retiree health coverage altogether, government employers can take incremental steps to lowering their OPEB liabilities. These include:

- Closing unsustainable OPEB plans to new employees.

- Phasing out benefits for higher income retirees.

- Increasingly sharing future health insurance premium costs with retirees by capping monthly benefits at some level below the premium charged by the plan’s insurance provider and limiting annual increases to a fixed percentage.

- Limiting coverage to employees only rather than also covering spouses and dependents.

- Requiring plan participants to use managed care plans such as Health Maintenance Organizations (HMOs) or Preferred Provider Organizations (PPOs) and then negotiating benefits and costs with plan providers.

- Requiring pre-Medicare retirees to purchase coverage on the state’s Affordable Care Act exchange.

On the asset side, the strategies available are similar to those employed to reduce pension liabilities. Rather than operate OPEB plans on a pay-as-you-go basis, employers should consider making their actuarially determined contributions each year. They may also consider making additional contributions to more rapidly reduce their liabilities.

Transitioning from pay-as-you-go to pre-funding of OPEBs has an important balance sheet benefit to state and local governments: the ability to apply a higher discount rate to future benefit payments. According to Government Accounting Standards Board Statement Number 75:

Projected benefit payments are required to be discounted to their actuarial present value using the single rate that reflects (1) a long-term expected rate of return on OPEB plan investments to the extent that the OPEB plan’s fiduciary net position is projected to be sufficient to make projected benefit payments and OPEB plan assets are expected to be invested using a strategy to achieve that return and (2) a tax-exempt, high-quality municipal bond rate to the extent that the conditions for use of the long-term expected rate of return are not met.29“Summary – Statement Number 75,” Government Accounting Standards Board, June 2015, https://www.gasb.org/cs/ContentServer?c=Pronouncement_C&cid=1176166370763&d=&pagename=GA SB%2FPronouncement_C%2FGASBSummaryPage (5 November 2020).

This implies that OPEB liabilities being serviced on a pay-as-you-go basis must be discounted at a rate of less than 3% in 2020.30The Bond Buyer 20 Index was at 2.21% as of June 30, 2020. This index is available to subscribers at https://www.bondbuyer.com/broker/bond-buyer-data. But if the government has a funding plan in place to cover all benefit payments with system assets, it may discount the payments at a rate similar to the one it uses for pension payments, which is typically around 7%. This change could reduce reported OPEB liabilities by upwards of 50%.

The state of North Carolina is an example of a government employer that approaches OPEB debt reduction from both the asset and liability sides of the balance sheet. An actuarial valuation report released in October 2020, showed a $3 billion reduction in state and school district net OPEB liabilities. Part of the reduction was achieved through prefunding, while the state also reduced future benefit payments for its Medicare-eligible employees by renegotiating the terms of its Medicare Advantage contract.31“Summary of Draft GASB 74 OPEB Valuation As of December 31, 2019/Measured June 30, 2020,” State of North Carolina, Committee on Actuarial Valuation of Retired Employees’ Health Benefits (OPEB Committee), August 28, 2020, https://files.nc.gov/ncosbm/documents/files/OPEB_Presentation_2020-08- 28.pdf (5 November 2020).

Conclusion

Unfunded other post-employment benefit obligations are a major source of fiscal stress for some U.S. state and local governments, but OPEB liabilities are concentrated in a relatively small number of governments in a few states.

Unfunded other post-employment benefit obligations are a major source of fiscal stress for some U.S. state and local governments, but OPEB liabilities are concentrated in a relatively small number of governments in a few states.

New York State has the most serious challenge with unfunded OPEBs. If the state continues to experience low population growth, declining public school enrollment, and high rates of health care cost inflation, its OPEB burden could worsen. On the other hand, a federal Medicare expansion could significantly reduce its state and local debt by shifting these obligations to the federal level.

Piecing together the OPEB liability puzzle is quite challenging because necessary data are scattered across thousands of audited financial reports. Gathering these reports and extracting key data points from them should provide a better understanding of the situation. But more work will be necessary. It’s important to learn more about OPEB obligations incurred by governments that do not follow GASB reporting standards. It would also be helpful to systematically collect assumptions used to compute OPEB liabilities, including discount rates and health care trend rates.

The thousands of governments that have either avoided incurring large OPEB obligations or have fully funded them offer lessons to those grappling with large volumes of OPEB debt. Strategies these governments should consider include tightening eligibility requirements, modifying benefit designs, and making actuarially determined contributions. Rather than waiting for federal support, highly indebted state and local governments should begin investigating these options.