In This Issue:

Articles, Research & Spotlights

- The Political Push for Connecticut’s Pensions to Invest in the WNBA

- San Diego Pension Debt Drives Taxes and Fees on Residents

- Pensions Contribute to $6 Trillion in State and Local Government Debt

News in Brief

Quotable Quotes on Pension Reform

Data Highlight

Reason Foundation in the News

Articles, Research & Spotlights

Connecticut’s Pensions Shouldn’t Make Political Investment in WNBA Team

Seeking to keep the state’s Women’s National Basketball Association team from moving to Boston, Connecticut Gov. Ned Lamont has promoted a plan to use state pension plan assets to buy a part of the team. In The Connecticut Mirror, Reason Foundation’s Marijana Trujillo explains the pitfalls of using public pension funds for anything beyond their intended purpose of generating investment returns to pay for retirement benefits promised to government workers. Connecticut’s public pensions remain severely underfunded, with $10,151 in per-capita pension debt, second-highest in the nation. Trying to use these public pension funds to keep a team in the state may be politically popular, but it would ultimately come with a cost borne by taxpayers.

San Diego’s Government Needs More Competition, Not More Taxes

Twenty years ago, financial mismanagement earned San Diego the label “Enron-by-the-Sea,” prompting taxpayers to demand a significant overhaul of the city’s procurement and retirement systems. However, as stability returned, the city moved away from competitive practices, and courts struck down the 2012 pension reform passed by popular vote. In a new San Diego Union-Tribune op-ed, Reason Foundation’s Leonard Gilroy and Marijana Trujillo assert that elected officials disregarded the voters’ intent and failed to pursue alternative reforms. Today, annual costs of the city’s retirement system are rising and contributing to a series of new taxes and fees. Instead of seeking additional funding from the city’s taxpayers, policymakers should consider competitive sourcing and cost-saving reform strategies that have worked in other cities.

Pensions Are a Major Contributor to State and Local Government Debt

The national debt, now over $38 trillion, rightfully receives significant attention, but taxpayers and policymakers should also be worried about the additional $6.1 trillion in debt owed by state and local governments. In an op-ed syndicated by Inside Sources, Reason Foundation’s Jordan Campbell and Mariana Trujillo explain that more than 40 percent of state and local debt stems from unfunded pension and health plan liabilities. These debts incur high interest costs, likely necessitate higher taxes, and divert crucial funding from other priorities such as schools and infrastructure. Without adequate reforms, public pension systems will consume a larger share of budgets and burden future generations of taxpayers with greater debt.

News in Brief

Higher Employee Contributions, Greater Risk Sharing in Public Pensions

A new issue brief from the National Association of State Retirement Administrators (NASRA) uses plan and national data to review how employee contributions have become a larger and more dynamic component of public pension financing. The report finds that since 2009, 41 states have raised employee contribution rates in at least one public pension plan, pushing median contribution rates to 6.2% of pay for workers covered by Social Security and 9.0% for those who are not. Despite this growth, employee contributions have remained a lesser revenue source for public pensions. From 1995 to 2024, employee contributions made up only 12% of total public pension revenue, compared with 30% from employers (state and local governments) and 59% from investment earnings. The brief outlines a recent growing shift toward risk-sharing designs, including variable contribution rates and hybrid plans that tie employee costs to funding levels or investment performance. Read the full brief here.

Quotable Pension Quotes

“Borrowing money from PERA is expensive. We’re similar to a fairly high interest rate credit card, and so delaying money owed today significantly increases what’s owed to the plan tomorrow.”

–Andrew Roth, Colorado Public Employee Retirement Association executive director, quoted in “As budget crisis grows, Colorado governor looks to cut PERA payments,” The Colorado Sun, Nov. 25, 2025.

“When they come up short, it becomes an obligation to the city to make it good.”

–Tom Van Overbeek, Chico, Calif., councilmember, on growing CalPERS costs, quoted in “Underfunded Chico city worker pensions take center stage for council,” Chico News & Review, Nov. 20, 2025.

“As more people retire, and we have fewer active duty officers than retired officers, what’s coming in isn’t offsetting what’s going out, you know. That’s part of the problem as well.”

–Linda Moore, mayor of Quincy, Ill., quoted in “Tax levy increase due to growing public safety pension demands, Quincy mayor says,” WGEM, Dec. 5, 2025.

Data Highlight

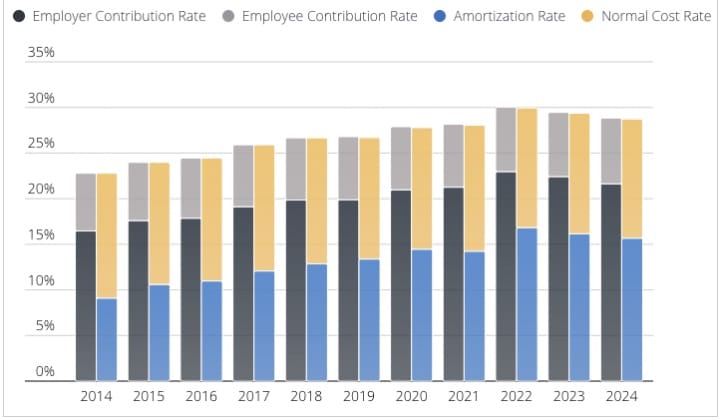

Reason Foundation’s Annual Pension Solvency and Performance Report includes an illustration of the last 10 years of growth in public pension costs. Since 2014, average annual contributions to public pensions have risen from 22.8% to 28.8%, primarily driven by rising debt-servicing costs. Most of the increased pension costs have been borne by government employers, i.e., taxpayers. Read the full analysis here.

Reason Foundation in the News

“This overestimation of returns has been slowly recognized and not even fully recognized yet,” Trujillo said. “That’s partly because if you just recognize it all at once, you’re going to have a really big hit on your balance sheet, and you’re going to have this big debt that used to be so much smaller. So, it makes some sense that local officials will try to delay that recognition.”

-Reason Foundation’s Mariana Trujillo, quoted in “What a $1.48 Trillion Pension Gap Means For Cities and States,” Smart Cities Dive, Dec. 15, 2025.