This newsletter from the Pension Integrity Project at Reason Foundation highlights articles, research, opinion, and other information related to public pension challenges and reform efforts across the nation. You can find previous editions here.

In This Issue:

Articles, Research & Spotlights

- Texas Teachers’ Plan Needs Pension Reform

- How to Improve the Florida Retirement System

- Are Public Pension Funding Concerns Exaggerated?

- One Year of Great Investment Returns Does Little to Improve Long-Term Funding

- Inflation Could Have High Costs for Pension Plans

News in Brief

Quotable Quotes on Pension Reform

Contact the Pension Reform Help Desk

Articles, Research & Spotlights

The Teacher Retirement System of Texas Is In Need of Serious Reform

In its recent regular legislative session, Texas made significant improvements to the long-term solvency of its retirement plan for public workers. Unfortunately, new bills under consideration during the state’s stalled special legislative session would do the opposite for the pension plan serving the state’s teachers. House Bill 85 and Senate Bill 7 would give retired members of the Teacher Retirement System a 13th check but do not address the long-term costs facing taxpayers, the state budget and retirees. Reason Foundation’s Leonard Gilroy and Steven Gassenberger discuss why the proposed legislation is not the optimal way to protect retiree benefits from inflation and outline how policymakers could better address the challenges facing TRS.

How to Reform Florida’s Retirement System

Despite several reform efforts in recent years, Florida’s public pension system is still in dire need of comprehensive changes to its funding and benefit policies. A new analysis projects the Florida Retirement System’s short- and long-term costs and evaluates how the most recent reform bill, which failed to pass, would have impacted FRS. Actuarial forecasts show that simply closing the state’s defined benefit plan will not relieve Florida of its funding issues, but a more comprehensive reform to contribution policy would significantly improve the system’s financial strength while still providing public workers the option of a guaranteed lifetime benefit.

Brookings Paper Says There Is No Imminent Public Pension Crisis

A newly updated report from Brookings Institute suggests there is no immediate need to reform public pensions because most state and local plans are likely to continue paying promised benefits without exhausting their assets over the next 20 years. Reason Foundation’s Marc Joffe examines the report and identifies some weaknesses to the idea that pensions need not achieve full funding to maintain long-term sustainability. Following Joffe’s analysis, the author of the Brookings report offers a rebuttal.

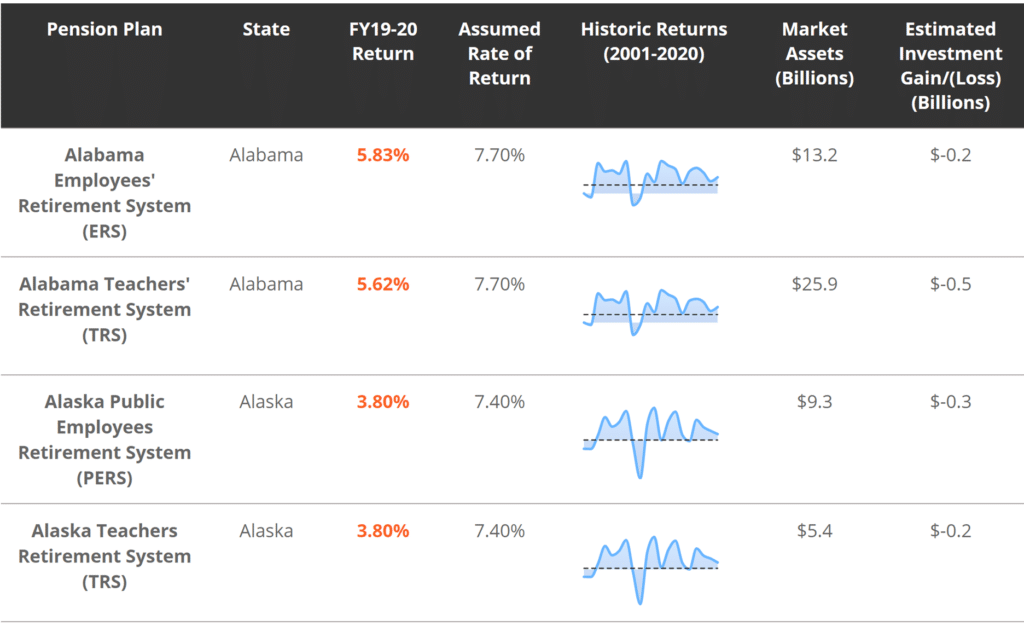

One Year of High Investment Returns Does Little to Improve Long-Term Public Pension Funding Levels

Many pension plans’ fiscal years end in June and as their investment results begin rolling in it is important to keep these positive returns in their broader financial perspective. While a good year of market returns is welcome and will improve public pension funding, Reason’s Anil Niraula details why it will take much more than one or two good years to significantly reduce unfunded liabilities. In the long-term, economists are still projecting lower market yields over the next decade and most public pension plans will not be able to invest their way out of their current pension funding shortfalls. In most cases, structural changes are needed to get pension plans on the right track.

Sustained inflation can threaten the value of retirement benefits promised to public workers, but benefits to reduce this effect – namely Cost of Living Adjustments (COLAs) – frequently come at a high cost with significant risk. There are steps public pension plans can take to reduce the negative impacts that inflation can have on retirees and pension funding. Reason’s Jordan Campbell summarizes the cost-of-living adjustment (COLA) policies used by states, recent reforms made to these policies, and how to build COLAs that would avoid adding more debt to pension systems.

News in Brief

New Report Outlines the Costs of New Orleans Backing out of Recent Reform

The Bureau of Governmental Research, a think tank that studies New Orleans public policy, released a new report that recounts the city’s 2020 decision to back out of a 2017 pension reform. The 2017 reform included many changes, the largest being a drastic decrease in the city plan’s multiplier. The report describes an opaque process that used poor justification to undo prudent cost-saving reforms from just three years earlier. As a result of the move, policymakers have added to the city’s long-term obligations by up to $115 million, which will ultimately be the responsibility of future taxpayers. The undoing of the 2017 reform means the city’s $300 million in unfunded liabilities are likely to grow, which will likely generate significant budget pressures and require New Orleans to shift funding away from other priorities. This and many more findings from the report are available here.

Quotable Quotes on Pension Reform

“This (policy) does generally mean a higher cost to employers and employees, but there’s a balance here … The risk mitigation policy exists to cut that risk in future years, to pocket your high returns and then seek to rebalance your portfolio in a way that doesn’t expose you to such significant drops that we saw in the Great Recession.”

—Chairman of Californians for Retirement Security Ted Toppin on the California Public Employees’ Retirement System’s policy to reduce its assumed rate of return in years of good returns in “Big year for CalPERS means higher pension costs for some public employees,” The Sacramento Bee, July 21, 2021

“This is real relief that will both spare future generations from a legacy of pension debt and give short-term budget relief to taxpayers…It was a big, difficult change, but now we’re seeing the reward of coming together to do hard things…There’s a lesson to be learned from that.”

—Connecticut Comptroller Kevin Lembo on the state making a $1.25 billion supplemental payment on its long-term pension debt in “Lembo: Extra pension payments mean big savings now — and down the road,” The Connecticut Mirror, July 15, 2021

“You’re going to increase the multiplier and the years of service, both together…When you add that to a sizable employee base, you could be adding billions to the unfunded liability.”

—Pioneer Institute Research Director and former Massachusetts Inspector General Greg Sullivan on a proposed bill to credit state employees with bonus years of service credit for work done outside of their homes in “Massachusetts pension boost for pandemic workers too costly, critics say”, The Bond Buyer, July 28, 2021

Data Highlight

Each month we feature a pension-related chart or infographic of interest generated by one of our Pension Integrity Project analysts. This month, policy analysts Anil Niraula and Jordan Campbell generated a tool displaying the latest investment returns for most state pensions. It also highlights plans’ investment returns going back two decades and shows the progression of unfunded pension liabilities over that same timeframe. Use the tool here.

Contact the Pension Reform Help Desk

Reason Foundation’s Pension Reform Help Desk provides information on Reason’s work on pension reform and resources for those wishing to pursue pension reform in their states, counties and cities. Feel free to contact the Reason Pension Reform Help Desk by e-mail at pensionhelpdesk@reason.org.

Follow the discussion on pensions and other governmental reforms at Reason Foundation’s website and on Twitter @ReasonPensions. As we continually strive to improve the publication, please feel free to send your questions, comments and suggestions to zachary.christensen@reason.org.