The Louisiana State Employees’ Retirement System reportedly gained an astounding 33.1 percent in investment returns from July 1, 2020, to May 31, 2021. Other states like California, Hawaii and New Jersey have also announced high quarterly and preliminary investment returns for their various public pension plans. While these investments returns are good news for pension plans that have racked up billions of debt in recent years, this year’s positive public pension investment returns alone won’t do a lot to improve the long-term solvency of the pension plans.

Still, the rebound in institutional returns is welcome after the economic dip and fears the world could be facing a long-term economic crisis when the COVID-19 pandemic hit last year. The S&P 500 index has gained a staggering 38 percent since July 2020, and all major indexes are on the upswing. This market performance will bolster the assets of most U.S. public pension systems and improve their funding in the short term.

The Center for Retirement Research at Boston College recently projected a two-basis point aggregate increase in the funded ratio for public pensions plans —from 72.8 percent funded in 2020 to 74.7 percent funded in 2021.

But retirees, taxpayers and policymakers should not get too excited yet.

Before the COVID-19 pandemic, the U.S. experienced its longest streak of economic growth in history, but during that time most public pension plans only made minor progress in improving their funding levels. In fact, many public pension plans’ funding got dramatically worse, which highlights one of the greatest challenges facing underfunded public pension plans—proper funding requires decades of hitting investment return goals, along with making sufficient pension contributions each year.

As many of these public pension plans struggle to significantly improve their funded ratios, it is becoming clear that they will not be able to simply invest their way out of their current shortfalls.

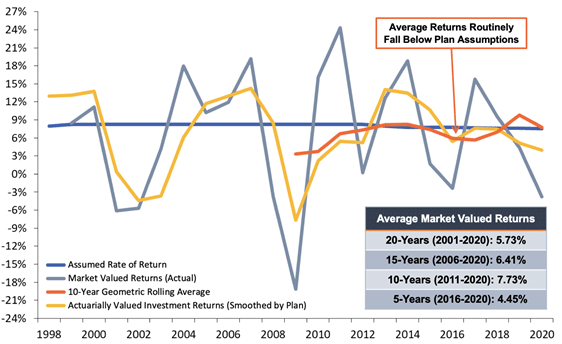

Take Louisiana’s pension plan for state employees for example. The Louisiana State Employees’ Retirement System (LASERS) had an average 7.7 percent return during the longest period of economic growth in US history between 2011 and 2020. But the return barely beat the plan’s assumed rate of return— 7.55 percent. In the longer term, the plan averaged just 5.7 percent over the last two decades, from 2001 to 2020. As a result of failing to meet overly optimistic investment return assumptions during that period, the pension system added around $3 billion in debt, bringing the plan’s total debt to $7.1 billion as of 2020. Investment shortfalls and overly optimistic assumed rates of return like this tend to be the largest culprits driving growing pension debt for state and local plans across the country.

Figure 1. Louisiana State Employees’ Retirement System: A History of Investment Returns (2001-2020)

Source: Pension Integrity Project analysis of plan’s valuation reports and comprehensive annual financial reports.

Although most public pension funds are seeing excellent investment returns this year, the economic prospects are less optimistic in the long run. As vaccinations increase and regions try to return to pre-pandemic activities, economies are facing a variety of risks, including rapid consumer price increases. Per the U.S. Bureau of Labor Statistics, for example, inflation in the United States increased by double digits in April and May. The Federal Reserve is also considering increasing interest rates by the end of 2023, which would likely slow real economic growth in the country.

Even before the COVID-19 crisis, financial experts were projecting a continuation of a lower-yield investment environment in the next 10-15 years. Revised economic expectations are even less optimistic right now. For example, J.P. Morgan’s recent Long-Term Capital Markets Assumptions report shows that they have lowered return expectations for U.S. stocks.

Simply put, public pension systems should view this year’s excellent investment returns as an outlier, not a norm. Once the current market rebound ends, most experts say the long-term funding prospects for state and local pension plans remain poor.

Public pension plans, on average, need to hit their return assumptions over a very long period to ensure the retirement benefits promised to teachers, law enforcement officers, and other public employees are fully funded and future taxpayers are not saddled with public pension debt. A single year of good investment returns, while quite welcome, is not a solid indicator that public plans that have struggled to improve their funding over the past two decades are now heading in the right long-term direction.

Stay in Touch with Our Pension Experts

Reason Foundation’s Pension Integrity Project has helped policymakers in states like Arizona, Colorado, Michigan, and Montana implement substantive pension reforms. Our monthly newsletter highlights the latest actuarial analysis and policy insights from our team.